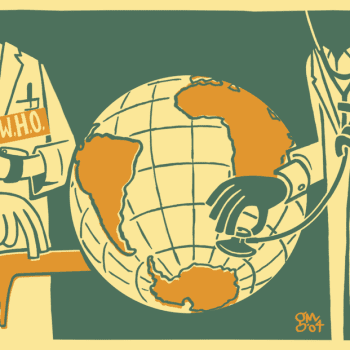

Milton Friedman, among other Cassandras, explained why [a common currency would not unify and bring harmony to Europe] nearly two decades ago in an essay detailing the best (the United States) and worst (Europe) conditions under which to create a currency union. In Europe, where countries are divided by language, customs, regulatory regimes and fiscal policies, a common currency would inevitably prove disastrous, he wrote. Shocks hitting one country would heave themselves across the continent if individual countries could not easily adjust prices through their exchange rates.

Rather than promoting political unity, Friedman argued, “the adoption of the Euro would have the opposite effect. It would exacerbate political tensions by converting divergent shocks that could have been readily accommodated by exchange rate changes into divisive political issues.”

Friedman’s predictions look prescient now, though they didn’t at first. When Greece adopted the euro in 2001, it benefited enormously by suddenly being able to borrow far more than it should have ever been allowed to. But this wild, boom-time overborrowing left it destitute when credit and demand dried up during the financial crisis. Thanks to the currency union, Greece no longer had the means — currency devaluation — to inflate away its debts and export its way out of a deepening recession. Instead, its euro-zone family members — particularly Germany, the effective patriarch — insisted on keeping inflation in the shared currency ultra-low, which was precisely the opposite of what Greece needed.

Furthermore, the other euro-zone members insisted that Greece institute severe austerity measures in exchange for the emergency lending it needed to avoid tumbling headlong into default and depression. This demand was made in the spirit of tough love between family members, but it had the effect of pushing Greece into default and depression anyway, just by a different route.

As Friedman predicted, Europe’s attempts to achieve lovey-dovey political harmony through economic unity led to neither. In recent years, according to the European Commission’s “Eurobarometer” polls, Europeans, and in particular those in the troubled countries on the European Union’s periphery, have become substantially less likely to say they feel “attached” to Europe (67 percent in 2007 vs. 56 percent last fall).

And who can blame them? The continent may have seen little in the way of violent conflict since the advent of a common currency, but European countries’ history of mutual resentments seems to have been sublimated into punitive economic policies that have caused a different form of suffering. Thanks to the austerity plans imposed by creditors, a quarter of Greece’s workers cannot find jobs; the economy has shrunk by 25 percent since 2010; and the country is not a whit closer to being able to pay back its debts.