This is the first full day of Mises U 2017 and it’s reserved for these 7 essential lectures. Recorded versions of these lectures from past Mises events are probably available on YouTube. (note: I was unable to view Peter Klein’s lecture as I work from home and had a customer appointment):

Lecture 1 – The Birth of the Austrian School by Joe Salerno

Lecture 2 – Subjective Value and Market Prices by Jeff Herbener

Lecture 3 – Praxeology: The Method of Economics by David Gordon

Lecture 4 – The Division of Labor and Social Order by Carmen Elena Dorobat

Lecture 5 – Money by Lucas Engelhardt

Lecture 6 – Austrian Capital Theory by Roger Garrison

Lecture 7 – Entrepreneurship by Peter Klein

This is what amounts to a crash course in the basics of Austrian economics. In this post, I’ve tried to capture the key ideas of each lecture in an easily digestible format. Some speakers are, of course, easier to follow than others, and some had visual aids where others did not. The arguments here aren’t fully developed, but I hope that I did each speaker justice.

Lecture 1 – The Birth of the Austrian School by Joe Salerno

The Austrian School was founded in the late 1800s, during the Marginal Revolution, when 3 economists working in different countries simultaneously developed the principle of marginal utility. The economist associated with the Austrian School was Carl Menger. The other two were William Stanley Jevons and William Walras. Differences: Jevons and Walras viewed utility as a measurable quantity of satisfaction, Menger viewed utility as a kind of satisfaction, but not a quantity of satisfaction. In other words, there’s no such thing as a “util.”

Menger’s view of economics was centered on the idea that human beings act to satisfy wants and that all value is subjective. Menger’s accomplishments were celebrated by Joseph Schumpeter, Ludwig von Mises, F. A. Hayek. No doubt about it, the Austrian School began with Carl Menger.

Some Notes on the Classical School – the Ruling Economic Paradigm Before Carl Menger

The Accurate Observations of the Classical School:

→ Prices are not arbitrary – firms don’t just set prices willy-nilly. Prices are set by supply and demand.

→ Businesses uses prices to calculate profits and losses.

→ Entrepreneurs uses prices to determine what goods to produce.

The Errors of the Classical School:

→ Cost of production determines value.

→ The Classical School viewed goods in terms of “classes.” So “water” is more important than “diamonds” because water sustains life and diamonds are a luxury. Why then are diamonds so much more expensive than diamonds? The paradox of value. They never solved it and instead latched on to a cost of production fallacy – “diamonds are more expensive than bread because it costs more to produce them.”

→ The Classical School lost sight of the consumer in focusing on the cost of production as determining market price.

Menger’s Corrections and Big Ideas

Menger searched for the causes of real prices, wages and rents that are actually paid on markets at a given time.

Some quotes:

“Man himself is the beginning and end of every economy.”

“Our science is the theory of a human being’s ability to deal with his wants.”

“All things are subject to the law of cause and effect.”

According to Menger, things have value because people put them to use in service of satisfying an end. Menger replaced homoeconomicus (the business man of the Classical School) with homoeconomizer (the consumer who strives to satisfy wants). These are Menger’s trinities of causation, read left to right, which help to visualize his ideas about the consumer, value, and means and ends:

ends → means → realization

man → external world → subsistence

wants → goods → satisfaction

How The Law of Marginal Utility Solves the Paradox of Value

The value of a good is determined by its “marginal utility,” that is, the satisfaction from the least important or lowest ranked end served by the available supply of the good. Therefore the value of any given good decreases as supply increases.

An Example: Crusoe’s Value Scale for Sacks of Wheat

1st to sustain life

2nd to sustain vitality and energy

3rd seed for next harvest

4th feed for goats (milk, cheese, meat, etc.)

5th to make whiskey

6th feed for pet parrot

If a rodent breaks into Crusoe’s storehouse and eats a bag, which end will Crusoe forgo? According to Menger, you’d give up the lowest valued end and each remaining bags becomes a little more precious. However, if a rodent were to eat 5 bags, the last remaining bag would be of the utmost value, as that bag is now set aside for Crusoe’s most important end – sustenance. The utility here is choice-based and established by ever-changing subjective values. This resolves the paradox of value. In a normal situation, a diamond has a higher marginal utility than a loaf of bread because bread is so abundant. However, if a person is stranded in the dessert and dying of thirst, they would trade a diamond for a gallon of water. Marginal utility explains why this is.

What This Means for Understanding Prices – Menger’s Law of Imputation

The value of the means reflect the value of the ends or wants they serve. Value is imputed backwards – from consumer value judgments all the way down the structure of production. Consumers – not the cost of production – determine price. Menger’s theoretical work was largely concerned with unpacking this process. Example: if we all took on the values of the Amish, what would happen to the value of diamonds as jewelry? They would fall to zero. What happens to the highly paid jewelers? Their wages fall to zero. What happens to the diamond mines? Their value falls to zero. Demand drives/causes supply.

This sheds light on the economics of exchange, as well. Contrary to Adam Smith, exchange isn’t a result of the “propensity to truck, barter, and exchange.” Nor does exchange occur because two goods are of some objective equal value. Rather, exchange occurs when there’s a “double inequality,” that is, two actors place different valuations on goods.

Lecture 2 – Subjective Value and Market Prices by Jeff Herbener

This was a very complex, technical, and detailed lecture. I was able to capture about half of what Herbener had to say. The main task is to show the relationship between subjective valuations and prices in the market.

A Brief Exposition on the Logical Structure of Economics

Human action is purposeful behavior to attain an end. Having an end does not constitute action. We must act with the use of means. We must perceive the objects in the world, discover their cause and effect connection in action to attain our ends. It involves organizing the elements of the external world. There is, of course, a scarcity of means. We are finite creatures living on a finite planet. The central organizing principle of human action: economizing. All human action is economizing. Means are scarce, ends are unlimited, and ends can be achieved through a variety of different combinations of means. We must choose between ends which we value more highly and ends which we value less highly. We must evaluate in our own minds the satisfaction we expect to receive from alternative ends. We have a preference, or a value ranking. We know preferences based on action. This is called demonstrated preference. Value is a judgement of the human mind and therefore has no extensive property. We can’t define a unit of subjective value. We can’t make interpersonal comparisons of our subjective valuations. We can’t say, scientifically, that one person values X more than another values Y. This presents a problem. How do we determine, as it relates to social organization, what to produce?

Note: our subjective valuations are not constant. There’s no fixed relationship between means and ends. They’re in flux. The implication is that we can’t make a mathematical formula

Value Imputation

Objects have value to individuals. Where does that value come from? Value is given to consumer goods by the actor and this imputation travels down the chain of production to capital goods which are very far from the consumer. I value my iPhone subjectively because I get satisfaction from employing it to serve my ends. The is a part of the cause and effect relationship of the structure of economic thinking.

mind → consumer goods → producer goods.

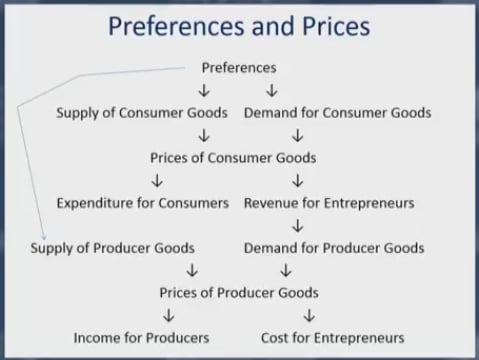

A more detailed look at imputation:

This graphic depicts the relationship between consumer preferences, the prices of consumer goods, the prices of producer goods, and finally, the income and costs for producers and entrepreneurs.

Lecture 3 – Praxeology: The Method of Economics by David Gordon

Praxeology is the science of human action. Ludwig von Mises and Murray Rothbard believed that economics was part of a larger science, the science of human of action, of which economics is the most developed branch. The method used in praxeology differs from the method used in mainstream economics.

Praxeology begins from the concept of human action, or more precisely, from the axiom that man acts. From the proposition that man acts, the rest of praxeology is deduced. This is deduction is material, not formal. You have to understand the meaning of each step.

An example of praxeological reasoning, or a praxeological claim, is the following: action involves the use of a means to achieve an end. The means, of course, is subjective. A sick person who consults a witch doctor may not get better, but the sick person nevertheless believes it will help and is using a means to achieve an end. When Mises says “all action is rational,” he has a weak notion of rationality. Not much is required. All that’s needed is that someone think a particular means will help them achieve a particular end. The fact that people make mistakes or commit fallacies in their thinking makes no difference to Mises’s point.

Praxeology isn’t a normative discipline. It’s not interested in what you should or shouldn’t do. Praxeology investigates means and ends. Praxeology could say that a particular means is inadequate to achieving a particular end, but as it regards ultimate ends, it is silent. Note: ethical relativism or subjectivism or emotivism are not necessarily connected to praxeology. Praxeological economic statements are non-quantitative and true by deduction from the concept of action. The distinction here involves the form of an action versus the particular historical details about an action.

A key principle in praxeology is the principle of methodological individualism. Only individuals act. Nations and classes and such exist, but they can act only through individuals. This principle might sound obvious, but at the time Mises was writing Human Action the idea that groups had a separate consciousness and existence and acted apart from individuals was not uncommon. Some thinkers, in fact, held that individuals were abstractions from the group.

Most economists today follow a method like that which is used in the physical sciences. The Austrians argue that economics isn’t like the physical sciences. In the physical sciences, you deal with non-rational physical objects. In economics, you deal with acting and purposeful man, using means to achieve ends, mapping his subjective valuations onto the world.

They key question: how do we know that the principles of praxeology are true? Gordon considers praxeological principles to be “obviously true,” Moorean facts, he called them, named after the philosopher G. E. Moore. Further, Gordon argues that these principles cannot be overturned. They are immune to refutation. Suppose that you claim, “I do not exist.” This claim presupposes that you do exist, otherwise you wouldn’t be able to say it. Likewise, performing an experiment to demonstrate that human beings don’t act would be self-refuting. Economic principles are of this kind. The Austrians disagree with Popper’s falsification principle and with Quine’s empiricism.

I wish Gordon had dealt with this last question in more detail. He spent some time on it, but it’s important.

Lecture 4 – The Division of Labor and Social Order by Carmen Elena Dorobat

Dorobat’s lecture included all the standard points about comparative and absolute advantage and how the division of labor materially enriches all nations, both in terms of internal production and international trade. It doesn’t matter if a city X sits on a barren island of volcanic rock and city Y has fertile fields, clean rivers, and warm weather. Both cities will benefit from trade. The benefits of the division of labor: human labor within the division of labor is more productive than among individuals in isolation. The division of labor isn’t “teamwork” so much as it is separating tasks according to efficiency.

→The division of labor began to be studied in the 13th and 14th centuries by Catholic scholastics, though this involved a number of moral and philosophical questions.

→In the 18th century, the discussion became more “economic” in tone with Adam Smith’s Wealth of Nations.

→In the 19th century, the French Liberal School of Turgot, Say, and Bastiat embraced Smith’s analysis, expanded, and corrected it.

→In Human Action, Mises called the division of labor (and its counterpart, human cooperation) the “fundamental social phenomenon” and the “essence of society.” The basic lesson of the division of labor and of Ricardo’s ideas on absolute and comparative advantage is, as Mises writes, that the “collaboration of the more talented, more able, and more industrious with the less talented, less able, and less industrious results in benefits for both.”

Specialization of this kind is important, but it must be complemented by free trade and market signals. These additional conditions are necessary for the members of society to enjoy the fruits of the division of labor – free trade so that people can have access to the results of specialized production and money prices which provide signals and incentives for individuals to choose their most efficient task. This is vital, as it is precisely these signals which ensure that the division of labor serves human ends. This applies to households, communities, national economies, and the global market.

Lecture 5 – Money by Lucas Engelhardt

Lucas Engelhardt is a gifted and extemporaneous speaker, which made him enjoyable to listen to and learn from but difficult to take notes on.

The Barter System

The double coincidence of wants. “In order for me to trade, someone else has to have what I want and I have to have what someone else wants.” Unfortunately for Engelhardt, he’s only got economics knowledge to offer, and if he wants food, he’d have to find a farmer that wants to learn economics. That’s the barter system. Money solves this problem. Engelhardt doesn’t have to search for a farmer who’s looking for an economics lecture. He can pay for food in a commonly accepted medium of exchange, which the farmer can then in turn buy something other than a course in economics.

The Characteristics of Money

→ Store of value – it keeps its value reasonably well

→ Unit of account – we use money to calculate profit and loss

→ Portability – this means having a high value for its weight and bulk

→ Divisible – a cat would make a very poor medium of exchange

→ Fungibility – the individual money units are capable of substitution – an ounce of gold is equal to any other ounce of gold

Big Idea: Money Isn’t Different From Other Goods

→ The value of money is determined by supply and demand. Increasing the supply of money will lower the value. Decreasing the supply of money will increase its value. Basic supply and demand reasoning is useful in understanding money.

→ Money emerged on the market not simply because people were willing to accept it in exhange but because it had a use value which others found desirable. In other words, gold has an outside use other than as a medium of exchange. Paper money lacks this characteristic.

→ Increasing the general supply of money in an economy does not benefit the economy as a whole. This creates additional demand, inflated prices, and erodes savings. However, increasing the amount of money in an economy does benefit the institutions at the entry point of that new money over and against everyone else.

Lecture 6 – Austrian Capital Theory by Roger Garrison

Roger Garrison’s lectures on capital theory and the Austrian Business Cycle are second to none – they’re also deeply dependent on his PowerPoint graphics. If you want to understand the Austrian-Hayekian critique of Keynes’s macroeconomics, there’s no one better than Garrison and his brilliant PowerPoints. Here’s a post from last year about Garrison and his “capital-based macro,” complete with a link to one of his presentations. It’s especially helpful in understanding what causes economic booms and busts like the Roaring 20s and the Crash of 1929. Today’s lecture, however, wasn’t quite what I expected. He was critical of Frank Knight and Milton Friedman and their writings on capital theory, but he didn’t get into the Austrian theory until about half-way through the session. I did get a chuckle at how Garrison took Knight to task on his incessant use of quotation marks around words like “permanent” and “only,” which Garrison interpreted as, “I’m going to go ahead and say this and I hope you’ll let me get away with it.”

The Hayekian Triangle

→These are the bare bones essentials to Austrian Capital Theory.

→ Consumable output is produced by a sequence of stages of production over time. Of course, the actual economy is infinitely more complex than this.

→ The shape of the structure of production is determined by the rate of savings.

→ More savings means less consumer consumption and more resources committed to the left side of the triangle which brings production plans into alignment with consumer preferences.

→ Less savings means more consumer consumption and more resources committed to the right side of the triangle, which means fewer resources for long-term production plans. This brings production plans into alignment with consumer preferences. Garrison illustrates this in an wonderfully animated display, which is available in the link above.