THE QUESTION:

Should 21st Century Christians still give 10% of their income to the church?

THE RELIGION GUY’S ANSWER:

A bad pun says that the week of a church’s annual budget pledge drive the pastor preaches the Sermon on the Amount. Many churches are fretting about amounts these days, hoping attendance and offering-plate receipts will recover from the COVID crisis.

How much should modern-day Christians donate to support their churches? The oft-cited standard is the “tithe,” a biblical term for 10% of income. But Keith Giles, a “progressive Christian” blogger at patheos.com, argued that there are “very good reasons to stop tithing your 10% every week.”

Definitions: Should that be 10% of wealth and accumulated assets or only income? Should all 10% go to the church only with any other giving counted beyond the 10%, or does the tithe cover all religious and charitable donations? Also, of course, the very different biblical situation involved gifts of agricultural produce, not money.

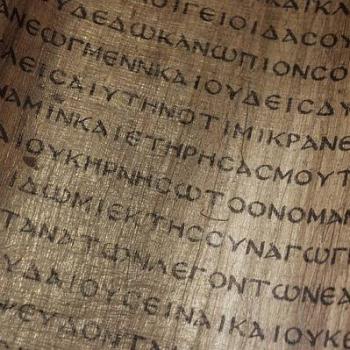

Speaking of the ancient context, Giles’s main theme is that tithing was part of a bypassed Old Testament system that provided upkeep for the Jerusalem Temple and the priests working there who had no other livelihood. The Romans destroyed the Temple in A.D. 70 so there’s no Temple or priesthood that need support.

However, that argument ignores that today’s clergy similarly live off believers’ financial support in order to carry out religious work. In fact, clergy typically get lower pay than other professionals with comparable years of training. Also, your local church building may be no Temple but it needs to be maintained and utility bills must be paid.

Giles makes the broader claim that the Old Testament laws no longer bind Christians, using as a proof text Hebrews 8:13: “In speaking of ‘a new covenant,’ he (God) has made the first one obsolete. And what is obsolete and growing old will soon disappear.” (We will sidestep the hot church debate about which moral tenets in the Old and New Testaments still apply today.)

Then there’s the historical approach. Giles says the New Testament does not command that anyone give 10% “and the church didn’t formally institute the tithe until 777 A.D. under Charlemagne. For over 700 years, no one who followed Christ tithed anything to the church.” Regarding the early Christian practice, he cites this interesting quote from the pioneer 2nd Century theologian Tertullian: “Every man once a month brings some modest contribution — or whatever he wishes, and only if he does wish, and if he can; for nobody is compelled; it is a voluntary offering.” These donations were designated to help people in need. “We, who are united in mind and soul, have no hesitation about sharing property. All is common among us — except our wives.”

Understand that Giles himself is part of a “house church” in Orange County, California, that presumably has no staff pastor to pay and no church building to maintain, a context that shapes his outlook. His group, as with Tertullian’s depiction, uses all its offerings to help the poor. But most Christians are part of churches that need operating funds.

Not that Giles wants to let Christians off the hook financially. In fact, he argues that “the New Covenant standard is not 10%, but 100%. God owns everything and we are commanded to surrender everything to Christ.” The Guy assumes he and his church friends do not literally donate 100%. While rejecting any percentage formula, Giles upholds the New Testament attitude of “give freely because you have freely received” (Matthew 10:8) and “God loves a cheerful giver” (2 Corinthians 9:7).

The full Old Testament procedures with multiple tithes are too complex to summarize here. Readers interested in that are referred to the “Jewish Encyclopedia” treatment at https://jewishencyclopedia.com/articles/14408-tithe/. Some ancient rabbis taught that tithing only applied in the Holy Land, not to Jews living elsewhere. “The Jewish Religion” by Rabbi Louis Jacobs says “many observant Jews today do donate a tenth of their annual income to charity” in the practice known as the “money tithe” or “wealth tax.”

Two faiths born in 19th Century America famously emphasize tithing. The Seventh-day Adventist Church states that followers “recognize that God claims 10% of our income as His own and so we faithfully return His tithe to the ‘storehouse,’ ” referring to Malachi 3:10, a text often quoted in stewardship appeals. In the Adventist understanding, the tithe funds only pastoral ministry and evangelism while members’ “offerings” beyond the 10% cover needs like church and school maintenance.

The Church of Jesus Christ of Latter-day Saints (LDS) teaches that believers in biblical times observed “the law of tithing” and “through modern prophets, God restored this law once again to bless His children.” LDS scripture declares that “I, the Lord, require the hearts of the children of men. Behold, now it is called today until the coming of the Son of Man, and verily it is a day of sacrifice, and a day for the tithing of my people, for he that is tithed shall not be burned at his coming” (Doctrine and Covenants 64:22-23).

Tithes go directly to church headquarters in Salt Lake City where all spending decisions are centralized. The LDS church adds a remarkable system to encourage compliance. Members hold an annual “settlement” conference with the lay leader (“bishop”) of the congregation (“ward”) to review donations. (Income reports are on the honor system without reviewing tax records.) If no such meeting occurs or 10% is not donated, an LDS member cannot obtain the bishop’s “recommend” to participate in the central rites conducted in LDS temples or hold church office. The result is legendary LDS church wealth.

The Guy adds this thought: If 10% was a cherished rule for ancient people who lived off of subsistence agriculture, it is surely a modest expectation for people enjoying the affluence of modern economies.