Last week, Michael Sean Winters wrote a detailed and trenchant view of a book by the Acton Institute’s Sam Gregg, called Becoming Europe. Let me confess that I have not read the book, and am relying solely on Michael Sean’s review. But Gregg’s thesis seems to fit with a recurring American libertarian talking point: the United States risks sliding on the path toward Europe by moving away from free market policies.

Michael Sean does an excellent exposing how this approach is totally at odds with the last 120 years of Catholic Social Teaching. I would like to add to this by pointing out that the economics of this argument – the argument based on the superiority of the US economic system over its European counterpart – are fundamentally flawed and not borne out by the facts. Indeed, I would argue that countries that attempt to model their economies on the basis on Catholic Social Teaching tend to do better.

Europe and Catholic Social Teaching

Let me start with the European social model and how it relates to Catholic Social Teaching. Of course, there is no single European social model. Ireland and the UK lean in the Anglo-Saxon direction, and in many important dimensions are closer to the US than to their peers in Europe. Scandinavia puts a high emphasis on solidarity and cohesion, and veers in a more statist dimension. The system in southern Europe is incoherent and suffers from major governance problems – quite frankly, it doesn’t work so well. But I believe that the philosophy that still underpins the mainstream continental social model – especially in countries like Germany – remains heavily influenced by Catholic Social Teaching.

This model, as developed by Christian Democrats in the postwar period, is known as the social market model. It combines the competitive free market with strong bonds and solidarity and fraternity, twined with appropriate degrees of subsidiarity. It also believes that stability is the glue that makes the social market work effectively.

On solidarity, the model adopts the idea from Catholic Social Teaching that there are certain rights that stem from the innate dignity of very person: rights such as life, bodily integrity, food, clothing, shelter, medical care, rest, necessary social services; and also the right to be looked after in old age, disability, or unemployment (Pacem in Terris). These rights typically cannot be guaranteed by the free market. And on the specific issue of medical care, the issue where the US lags the most, the Church has taught that health care expenses should be “cheap or even free of charge” (Laborem Exercens)

Clearly, the state has a key role to play here. This goes all the way back to Leo XIII, who argued that the state should protect the poor and the wage earner, and not favor the interests of the rich (Rerum Novarum). But it is also imbued with subsidiarity, as social programs in continental Europe are often administered by subsidiary associations including unions and Church groups. The state directs, but responsibility for administering the system is shared.

Subsidiarity is also supported by a strong tradition of social partnership, whereby key economic decisions – on issues like wages, employments, and benefits – reflect consultations between government, unions, and employer organizations. In other words, the European model recognizes the legitimacy of mediating institutions that stand between the individual and the state. You don’t see too much of this in the US.

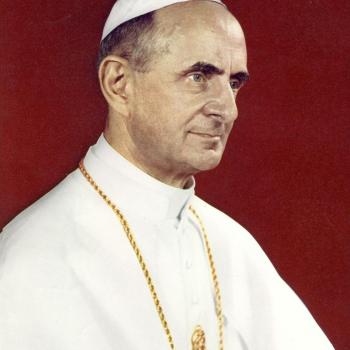

Stability is also important. This goes back to a foundational principle of Catholic Social Teaching that while the free market is compatible with the common good, it cannot be left to its own devices. As Pius XI put it, “the right ordering of economic life cannot be left to a free competition of forces… from this source, as from a poisoned spring, have originated and spread all the errors of individualist economic teaching” (Quadragesimo Anno). Paul VI condemned “profit as the chief spur to economic progress, free competition as the guiding norm of economics, and private ownership of the means of production as an absolute right.” (Populorum Progressio) And John Paul II argued that the market should be “appropriately controlled by the forces of society and by the State, so as to guarantee that the basic needs of the whole of society are satisfied” (Centesimus Annus)

This means we need proper regulation in economic life. This is especially important in the financial sector, which tends to be the major source of dysfunction and instability in our modern economic system. This was a lesson that was forgotten in too many places, although continental Europe never embraced unfettered financial markets to the same extent as the Anglo-Saxon countries.

As we look back on the crisis, the results are in: Catholic Social Teaching 1, Libertarianism 0. And yet, libertarians don’t seem to have internalized this lesson, criticizing even mild attempts to tighten regulatory oversight.

Just last week, Pope Francis reiterated this constant theme in Catholic Social Teaching, condemning “ideologies which uphold the absolute autonomy of markets and financial speculation, and thus deny the right of control to States, which are themselves charged with providing for the common good”.

So in sum, I believe that the mainstream European social model is far more aligned with Catholic Social Teaching that its libertarian counterparts. It adopts a free market economy, yes, but subjects economic forces to the appropriate degree of regulation, and strives to ensure that people’s basic needs are met.

Living standards

But what about criticisms of the European economic model? Do they have a point? Well, yes and no. We cannot deny that Europe faces grave economic problems today. But for the most part, they are not the problems singled out by American libertarians.

Let me start with the basics, GDP per capita, the most standard estimate of living standards. If you look at the numbers, you will see European GDP per capita is about three-quarters the level of the United States – higher in the north, lower in the south, but worse everywhere. Does this prove the superiority of the US model? Not at all. To understand why, we need to break down this GDP per capita into its constituent parts. Bear with me, this will get a bit wonkish, but this is necessary for the argument.

GDP per capita is really product of the following terms:

(GDP/population) = (GDP/ hours worked) * (hours worked/ employment) * (employment/population)

In other words, income per capita is the product of hourly productivity, average hours worked, and the employment rate. Let’s take each in turn.

First, productivity. While there is a gap between US and European productivity, this is really coming from southern European countries like Italy and Spain. If you look at core Europe like France and Germany, then productivity is essentially at US levels. So there are specific structural problems in the lagging south, but this is not an indictment of the continental social model.

Second, hours worked by the average worker. Here, Europe is far behind the US. But this is a positive, not a negative, sign! It means that Europeans deliberately forego income to spend more quality time with family and friends, especially through mandated leave (which the US does not have). It is the true legacy of the days when there were about 50 religious feast days throughout the year on which no work was done. A pro-family pre-Calvinist legacy!

Third, employment rates. Again, as with productivity, the evidence is nuanced. If you look at prime-age males, the cohort traditionally charged with earning a living wage or a family wage, employment rates are as high (or even higher) than in the US. But rates for the young, the old, and (in some countries) women are lower. This is especially an issue in southern Europe, where labor market institutions too often privilege insiders over outsiders. So yes, there are specific problems with specific groups, but there is no generalized evidence that continental European labor markets are worse than their Anglo-Saxon counterparts.

Let’s dig a little deeper into unemployment. Last year, the unemployment rate in the US was 8 percent. In the EU, it was 10.5 percent. But this hides huge differences. The unemployment rate in Spain, for example, was a staggering 25 percent, while in Germany it was an enviable 5.5 percent.

Remember, Catholic Social Teaching has never accepted the legitimacy of unfettered labor markets. True, European labor markets do not go far enough to guarantee a living wage and prioritize employment over other economic aims, but they still score higher than their Anglo-Saxon counterparts. Labor markets work pretty well in northern Europe. In these countries, social partnership looms large and unions have a key role – and unions put a lot of weight on overall employment. This works because the level of trust is high, which is not the case in the south, making the system hard to replicate.

Government also has a role to play, by funding what are known as “active labor market policies” – options for the unemployed that include education and training programs and wage subsidies to encourage take-up of low-paying jobs. In many places, receipt of unemployment benefits is conditional on participating in these programs. Again, this is fully aligned with Catholic Social Teaching, meeting the needs of workers while avoiding any violations of dignity that come with the “social assistance state”.

It is worthwhile singling out the German labor market, because it proved remarkably successful during the crisis. Even though (as in other countries) GDP fell sharply, unemployment did not rise. Germany introduced a system called Kurzarbeit, which meant that employers, unions, and the government came to an agreement – workers would cut back their hours, firms would hold onto workers, and government would provide subsidies. This was a far more effective and humane system that filling up the unemployment rolls. And it worked.

Let’s not forget – the system of codetermination is deeply ingrained in German labor relations. Again, this comes directly from Catholic Social Teaching and means that workers have a say in managing an enterprise. This kind of system, influenced by Church teaching, has the capacity to work far better than a US-style system of free and unfettered labor markets.

Going beyond GDP

So far, I have just talked about GDP per capita. This is still the way we measure standards of living, but it is patently inadequate. Its conception is overly materialistic, and it does not come close to measuring human development or, more importantly, human flourishing.

We will never be able to apply statistics to these issues. But we can certainly do better than GDP per capita. For example, ex-French President Sarkozy set up the Stiglitz-Sen-Fitoussi Commission to look into broader measurement of economic, environmental, and social sustainability.

This is a promising area, but it is for the future. Right now, though, we can look at well-established indicators of human development. And here, unfortunately for libertarians, the US comes across much worse than Europe.

Let’s look at some numbers from the OECD, which includes both the US and the EU countries.

The US infant mortality rate is 6.7. The OECD average is 4.6. In Germany, it is 3.5, and in Sweden it is 2.5.

Life expectancy tells the same tale. In the US, it is 77.9 years, against an OECD average of 79.3 years. It is 80 years in Germany, and 81.4 years in Sweden.

So even though the US spends more than double the amount of the EU on healthcare per person, it achieves worse outcomes – mainly by excluding millions from adequate healthcare. Add to that a dominant gun culture that cheapens life in the US.

We can look at other indicators. The poverty rate in the US is 17.3 percent, against an OECD average of 11.1 percent. In Germany, it is 8.9 percent.

The numbers for inequality (measured by the Gini coefficient) tell a similar story. Among the OECD countries, the US sits at the bottom of the pack, with only Turkey, Mexico, and Chile looking worse.

In the past, economists have tended to discount inequality, arguing that we should not worry about distributional issues. But recent research is actually catching up to Catholic Social Teaching, showing that excessive inequality is indeed harmful to countries. It can erode trust and social cohesion, the bedrock of economic and social progress. It makes economic growth less likely to be sustained, and it makes countries more susceptible to volatile economic and financial crises. We have hard evidence for all of this.

Just look at Latin America, one of the world’s most unequal regions. This inequitable division of wealth – plus the governance problems associated with it – goes a long way toward explaining the longstanding economic challenges of the region, including the waves of economic volatility twinned with political instability.

And looking at the OECD, is it any surprise that the countries most affected by crisis are the most unequal countries? This group includes Anglo-Saxon countries like the US, the UK, and Ireland, countries that cheerleaded a financial sector based on “casino capitalism”. It also includes crisis countries like Greece, Portugal, and Italy. Just as in Latin America, inequality comes with governance problems and a lack of trust in basic institutions. The more equal countries in the North are among the strongest and most stable. If you had studied Catholic Social Teaching instead of classical economics, this would not come as a surprise!

So what is the problem with Europe?

So far, I have talked about longer-term issues and the structural differences between European and US economic models. But what about the short term, where Europe is still mired in economic crisis?

Americans of a libertarian bent like to blame this crisis on the growth of government, especially the welfare state.

This story is far from the truth. The real story of the European crisis has little to do with its social model. It comes instead from the imbalances that arose with the introduction of the euro, when people got a bit carried away. They assumed that Greek debt, for example, now bore the same risk as German debt. So there was a huge lending boom to southern Europe, and the good times rolled. But when the crisis came, people panicked and pulled back lending. So we had a classic balance of payments problem with countries having difficulty paying their debts, both public and private. But there was a catch – as countries were tied to the euro, they could not follow the traditional route of letting the currency devalue and restoring competitiveness.

In such circumstances, options were few and painful, involving lower wages and prices relative to core Europe. But this can prove economically and socially ruinous in the short term. It can make the problem worse, creating a vicious circle of weak banks, weak growth, and weak public finances. This is the real story of the European crisis.

Let me be clear on one point – as in most other countries, high public debt was a consequence, not a cause, of the crisis. Deficits rose because of deep recession, or because governments were forced to assume the debt of collapsing banks.

The one possible exception to this point was Greece, but even here, a key problem was the refusal of the well-off to pay their taxes aided by a weak system of tax administration. It was not due to the welfare state. Look at OECD data again. Social spending in Greece is 23 percent of GDP. As a point of comparison, it is 19.4 percent of GDP in the US. On the other side, it is 26.3 percent of GDP in Germany; 28.2 percent of GDP in Sweden, and 32.1 percent of GDP in France. I find very little correlation between size of social spending and depth of economic problems. This is an ideologically-motivated red herring.

There are plenty of other data points that disprove the simplistic American narrative of Europe. Look at Ireland, which was a bastion of liberal economic policies before the crisis, embracing the American path of deregulation and low taxes. It too suffered from severe crisis, yet again because a badly regulated and poorly supervised banking sector. As the banking sector collapsed, Irish public rose by over 100 percent of GDP, a staggering addition to the public sector purse caused by bad private sector decisions. The lesson here, of course, is that we need more regulation and better supervision, and that includes across countries.

At some fundamental level, the European crisis results less from a problem with the system itself, and more from a big change to the system that was improperly managed. People got too carried away with the historic process of monetary union, and failed to look at its structural flaws.

Everyone now agrees that incomplete economic integration was at fault. Europe had a single market and a single monetary policy, but fiscal policy and financial regulation were still national responsibilities.

Let’s conduct a simple thought experiment. Imagine if Florida had been an independent country and not integrated into the federal tax and spending system. What would have happened during its housing bust? I think we know the answer, and it has nothing to do with Florida’s welfare state! The same is true with banking problems in places like Ireland that overwhelmed the ability of a single government to handle them. Integration came with too little solidarity across counties.

So Europe needs to fix the problem of incomplete integration. This is why banking union and fiscal union are high on the agenda.

One more point. The American libertarians also loathe “Keynesian” policy, which simply means countercyclical policy – looser monetary and fiscal policy in bad times, tighter monetary and fiscal policy in good times. As I mentioned at the outset, the European social model has always emphasized stability alongside solidarity, and this stability – especially in Germany – has always included a strong emphasis on low inflation and fiscal discipline.

Ironically, this has led to more skepticism of Keynesian intervention in Europe than in the US, especially in Germany. This is why Germany today is the leading voice behind the call for “austerity”, which most people believe to be misguided in current circumstances. But stability is deeply embedded in the German, and indeed the broader European, psyche. It is the Americans have that always been more interventionist on the macroeconomic front. Just compare the record of the Fed and the Bundesbank when it comes to monetary policy. This is just another example of how American libertarians do not really understand Europe.

To conclude…

Yes, there are many economic problems with Europe that need urgent attention today – problems of incomplete integration, deep-rooted structural problems in the southern countries. The economic crisis is far from over.

To get beyond these problems, I believe that Europe needs the light of Catholic Social Teaching, urgently. But so does the US, which is even further away from that light.

For the evidence teaches us that the Catholic approach to economics is not just naïve wishful thinking. It can lead to better economic outcomes than its free market alternative. Thus libertarian economics is both morally and practically flawed. It is time for Catholics across the spectrum to start pushing back against the ruinous libertarian agenda and reclaim our full heritage.