The US economy mess canbe gigantic if not checked! The savings rates are low and more and more people are addicted to spending beyond their means! Gurumurthy writes how the USD 3.8 trillion that the rest of the world has invested in the US treasury notes and US Dollar itself may see their interests depreciating!

S. Gurumurthy is a renowned Chartered Accountant and a top Corporate Advisor to many big companies and CEOs in India. Here is how the story line goes in the article…..

Interest rates Go down…

By repeated interest cuts, from 20 per cent to just 1 per cent in 20 years from 1981 to 2001, the US Fed got US households addicted to buying regardless of needs. At rates of 1 per cent interest, US households saw no meaning in saving. No wonder they felt justified in spending beyond their income.

Savings Rates do down…

The US savings rate to GDP, which was 18 per cent in 1970s, first came down to 9 per cent in 1990, then to an average of 2.8 per cent in 10 years from 1996 to 2005 and finally to a negative figure of 0.6 per cent in 2006. This drift directly led to households getting addicted to borrow and to spend.

And the population addicted to spending and enjoying itself spends thoughtlessly on the credit cards…

The US household dues on credit cards rose from $338 billion in 1990, when the Fed rates were around 8 per cent, to $1.5 trillion in 2003, when the Fed rate became 1 per cent. Today the dues on credit cards are over $2.46 trillion and the number of credit cards in use is 1.2 billion.

The credit obligations of a US household have increased tremendously…

An average American is addicted to 13 credit obligations, nine credit cards and four instalment loans! It is difficult to de-addict them today. The result, in just 15 years, US households have handed over all their money to the corporates and become indebted, like Indian farmers have.

The stock market has also expanded.. but that has also seen a rise in borrowing against stocks and house equity…

In 1981, when Fed rate was 20 per cent, some 5.7 per cent US households had held stocks.

When, in 1990, the interest rate was cut to 8 per cent and less, some 25 per cent households frequented Wall Street, a five-fold increase in 10 years. When, in the year 2001, Fed rates were 1 per cent, some 52 per cent of the US households became obsessed with Wall Street, a ten-fold increase in 20 years.

So, American current account deficit balloons – sparked by the domestic consumption. So Americans consume while the Asians save for them! Gurumurthy says that it is the US domestic imbalance that is unbalancing the WORLD! I had said almost a year back. I had said:

I have very strongly believed that when the dust of the modern economic excesses is settled, the main culprits that will emerge will be the Credit Card companies and that culture they spawn. That in my view is most responsible for the spiralling deficit that US has incurred over the years.. where its citizens have become accustomed to consuming more than they earn and so forcing the trade to be lopsided! Americans are spending their kids out of prosperity!

…. and Gurumurthy says..

Experts describe, even dismiss, the US current account deficit, to manage which US borrows almost three-fourths of all global savings – two-thirds of which is generated in Asia – as just ‘global imbalance’. On a closer look, it is American domestic imbalance that is unbalancing the world.

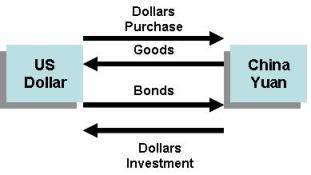

Now remember that illustration of how the entire trade and imbalance works between US and China? THAT is how the entire mess being generated! Now, see the Bottom-most arrow from Right to Left.. that is the one that shrinks in value when the dollar goes down.. because the arrow (Left to Right) just above it has no meaning any more as the Fed keeps printing money without any back-up value.. US Dollar has depreciated close to 300% against Gold value! (“….less than $275 could get an ounce of gold in 2002; today $800 cannot. So, the dollar, rated with gold, has depreciated by over 290 per cent”. says Gurumurthy!)

Now remember that illustration of how the entire trade and imbalance works between US and China? THAT is how the entire mess being generated! Now, see the Bottom-most arrow from Right to Left.. that is the one that shrinks in value when the dollar goes down.. because the arrow (Left to Right) just above it has no meaning any more as the Fed keeps printing money without any back-up value.. US Dollar has depreciated close to 300% against Gold value! (“….less than $275 could get an ounce of gold in 2002; today $800 cannot. So, the dollar, rated with gold, has depreciated by over 290 per cent”. says Gurumurthy!)

So the USD 3.8 Trillion worth of US currency held by the rest of the world… is falling as we speak. At some point the folly of this investment will be obvious to the world investing blindly. THAT is when the World Economy will reach the “tipping point”!

After all, in the end, the $3.8 trillion securities held by other countries are merely pro-notes of the US. So all that those who exported goods or securities to the US have on hand are the accumulated pro-notes for $3.8 trillion. Are they not just unpaid vendors? The pro-notes held by them are losing value by the day and hour against the euro, gold, oil and also against the rupee.