Is Medi-Share the Solution to Your Health Insurance Needs?

We get a lot of questions about it, and that’s what I’d like to discuss in this Medi-share Review.

Unless you have a good employer-sponsored health insurance plan, or you’re on Medicare, you’re probably concerned about your health insurance. A major reason is the cost of premiums. They can easily be over $1,000 per month for a family, or even for a couple. And that’s even if you have a high deductible.

My wife, Linda, and I feel like we found a solution, or at least one that works for us. It’s a Christian health sharing ministry, called Medi-Share. We’ve had it for our family since 2009, and it’s been working well for the past nine years.

It’s a bit unconventional. As I said, it’s a Christian health sharing ministry, which means it is basically Christian health insurance, but not technically. It fills the same role, and in our experience, it does it at only a fraction of the cost. And just as important, it’s a service that’s consistent with our faith values.

Our Medi-Share Review (April 2018)

What is a Christian Health Sharing Ministry?

As a Christian health sharing ministry, Medi-Share is based on the faith community values and practices of the early Church. It was given within the community that each member would share one another’s burdens.

In that way, members of Medi-Share share one another’s medical burdens. They do that by contributing to the program through monthly contributions, called “shares”. The contributions go into a pool, where it’s available to pay for the medical costs of members in need.

In addition to payment of a member’s medical costs, the community also support each other in prayer, and sometimes with personal support.

Medi-Share is a nonprofit organization, and conducts the program along biblical principles.

What We Like About Medi-Share

Whenever the topic of Medi-Share comes up, the first question we usually get it what do you like about it?

The short answer is that it provides the same benefit as health insurance, but at a much lower cost.

They actually do have a network of participating doctors, and if you use one the process is smooth, since the doctors know how it works.

We generally use doctors from outside the network. That can be a bit of an issue, because a lot of doctors don’t know how Medi-Share works. But we prefer going to doctors that we feel comfortable with, so we’ll make the extra effort.

But even out-of-network, we simply explain Medi-Share to the doctor, they do a little bit of digging, and then bill Medi-Share. That will give us a discount on the services, and we’ll pay the difference out of pocket.

Now for us, out of pocket is common, because we use the highest deductible plan Medi-Share offers. Much as is the case with traditional health insurance, we do this to keep the monthly contributions as low as possible.

This isn’t a major problem in our family, because we mostly go for routine checkups. There’s only been one or two times where we had to go back for something a little bit more complicated. Just like traditional health insurance, the high deductible works well when you don’t go to the doctor that often.

How Much Does Medi-Share Cost?

This is obviously a typical question, and the answer is that it’s a lot cheaper than traditional health insurance.

When we switched from health insurance to Medi-Share, our monthly contributions fell to only about 50% of our previous health insurance premiums. And that’s with our family of four. Now I said we have taken the highest annual deductible to minimize the monthly contribution.

Our deductible is $10,000 per year, which means Medi-Share doesn’t begin paying our costs until we cross that threshold.

But as a result, our monthly contribution is about $230. It’s based on the age of the oldest member of the household, and that’s the contribution we’re paying with me at 37 years old.

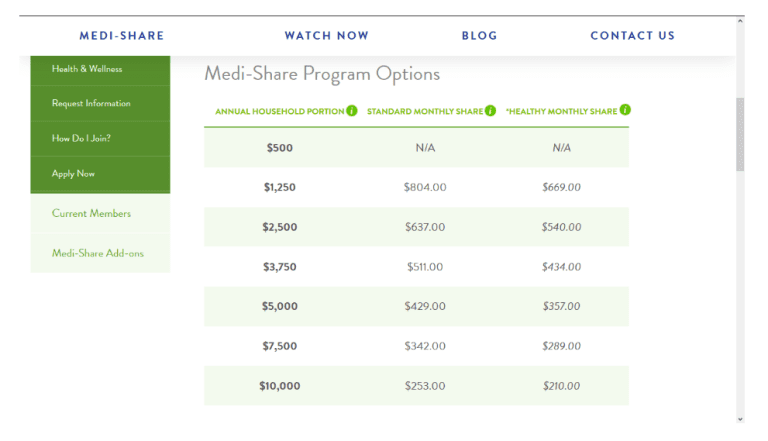

The screenshot table below will give you a basic idea what the monthly contributions are with

varying deductibles (referred to as the “annual household portion”). It’s based on a family of

four, in which the oldest member is 40. Notice that there are seven deductibles, ranging from

$500-$10,000.

On the far right side of the table, you’ll see a heading, Healthy Monthly Share. Medi-Share will give you a contribution discount of up to 20% if you meet certain health standards. These have to do with very specific metrics for blood pressure, abdominal circumference and body mass index. So if you’re super healthy, your monthly contribution will be lower still.

There is also a one time, nonrefundable $50 application fee, plus a $120-member fee paid with your first monthly contribution.

What About the Affordable Care Act Mandate?

You’re probably aware that if you don’t have qualifying insurance, you’ll be subject to a tax penalty under the ACA health insurance mandate. There’s good news here. Christian health sharing ministries qualify as exempt for the purposes of the mandate.

What Are the Qualifications for Medi-Share?

One of the most fundamental requirements of Medi-Share is that you must adhere to a biblical lifestyle to join. For instance, they won’t cover abortions. Nor will you be covered if you’re injured in a drunk driving accident. You must also abstain from use of tobacco or illegal drugs. You need to know these limitations, but you should be good to go as long as you adhere to a biblical lifestyle.

Does Medi-Share Cover Pregnancy and Adoptions?

We get this question a lot, and it’s a good one. The good news is that you don’t need to wait a year, but you do need to be a member at the time you become pregnant. Your pregnancy related expenses will be covered as long as you’re making your monthly contributions.

We haven’t been through the pregnancy experience, but we have been through two adoptions with them. They do cover certain expenses there as well. Adoptions can be very expensive, and we got about $4,000 back on our first one four years ago. On our second adoption we only got back $1,500, but by then we had opted for the higher deductible.

And while we’re not certain of this, we believe there are also some benefits paid for funeral expenses.

What About Customer Service?

When we first started working with Medi-Share, the wait times to get customer service would run 40 minutes to an hour. They’ve improved on this quite a bit since and now we almost always get someone on the line immediately when we call. And what we have found is that they’re consistently helpful anytime we speak with them.

We also typically find that they pray with us at the end of the conversation. As Christians, we find this comforting.

What About that High Deductible?

This is really a personal thing. As I said earlier, we set the deductible high to keep the monthly contributions low. And since we’re a pretty healthy family, it’s been working well so far. A lot of people are doing that now with traditional health insurance as well.

We work around the high deductible by budgeting a certain amount each month for out-of-pocket medical expenses. It’s kind of like an informal health emergency fund, ready if we need it. You pretty much have to do that if you have a high deductible with any program. In a way, it’s a bit like self-insuring, at least for the first $10,000. But it’s comforting to know that Medi-Share will pay 100% of medical costs above that deductible.

Final Thoughts on Medi-Share

Linda and I are both very comfortable with Medi-Share. More than anything else, it’s mostly a matter of getting comfortable with something different. And if you think about it, you’ll have to do that anytime you change traditional insurance policies anyway.

We’ve been with Medi-Share for nine years now, and we have no intention of changing. Feel free to ask any more questions you have about the plan. But if you’re serious about learning more, it’s best to go directly to their website to find out how much money you can save here.