Elizabeth Warren has introduced a new bill called the “Accountable Capitalism Act.” Writing at Vox, Matthew Yglesias calls it “a plan to save capitalism” and says that it

would redistribute trillions of dollars from rich executives and shareholders to the middle class — without costing a dime.

Kevin Williamson, writing at National Review, calls it a plan

to nationalize every major business in the United States of America

and writes that

Senator Warren’s proposal entails the wholesale expropriation of private enterprise in the United States, and nothing less. It is unconstitutional, unethical, immoral, irresponsible, and — not to put too fine a point on it — utterly bonkers.

It is also cynical. Senator Warren is many things: a crass opportunist, intellectually bankrupt, personally vapid, a peddler of witless self-help books, etc. But she is not stupid. She knows that this is a go-nowhere proposition, that she will be spared by the Republican legislative majority from the ignominy that would ensue from the wholehearted pursuit of this daft program. It is in reality only a means of staking out for purely strategic reasons the most radical corner for her 2020 run at the Democratic presidential nomination.

While I won’t profess to know whether Warren’s motivation is sincere or cynical, I will absolutely endorse Williamson’s assessment of the plan as “bonkers.” Here’s why:

There are two fundamental components to Warren’s plan (full text here), which applies to all American corporations and limited liability companies with revenues of over $1 billion (not indexed for inflation). The first is the requirement that’s getting the most attention, that

Not less than 2⁄5 of the directors of a United States corporation shall be elected by the employees of the United States corporation.

The second is far more expansive. Removing the numeration and simplifying the punctuation/legalese, the text states:

A United States corporation shall have the purpose of creating a general public benefit . . . .

In discharging the duties of their respective positions, and in considering the best interests of a United States corporation, the board of directors, committees of the board of directors, and individual directors of a United States corporation shall manage or direct the business and affairs of the United States corporation in a manner that seeks to create a general public benefit; and balances the pecuniary interests of the shareholders of the United States corporation with the best interests of persons that are materially affected by the conduct of the United States corporation; and shall consider the effects of any action or inaction on the shareholders of the United States corporation; the employees and workforce of the United States corporation; the subsidiaries of the United States corporation; and the suppliers of the United States corporation; the interests of customers and subsidiaries of the United States corporation as beneficiaries of the general public benefit purpose of the United States corporation; community and societal factors, including those of each community in which offices or facilities of the United States corporation, subsidiaries of the United States corporation, or suppliers of the United States corporation are located; the local and global environment; the short-term and long term interests of the United States corporation, including benefits that may accrue to the United States corporation from the long-term plans of the United States corporation; and the possibility that those interests may be best served by the continued independence of the United States corporation; and the ability of the United States corporation to accomplish the general public benefit purpose of the United States corporation; may consider other pertinent factors; or the interests of any other group that are identified in the articles of incorporation in the State in which the United States corporation is incorporated, if applicable; and shall not be required to give priority to a particular interest or factor described in clause (i) or (ii) over any other interest or factor.

That’s a lot of interests the directors are required to “balance” — but, on the other hand, there is no real enforcement mechanism for any government agency or private entity to penalize a corporation which fails in these demands, except insofar as a particular state may provide for stockholders to sue. Williamson writes that

The federal government would then dictate to these businesses the composition of their boards, the details of internal corporate governance, compensation practices, personnel policies, and much more.

And, to be fair, I don’t see anything that gives the government this power — it’s purely symbolic.

Which means the real objective of the law is the employee representation requirement. Yglesias defends this by pointing to the fact that such “codetermination” requirements are fairly routine in such countries as Germany, and he’s not wrong, but even a simple check of Wikipedia shows that the country has had a long history of Works Councils and similar structures, so that the existence of such requirements in Germany really says nothing about the appropriateness of such a brand-new requirement in the United States. Even though, in practice, no individual shareholder has any means of impacting corporate decisions by voting for one particular board member or another, they do represent the interests of shareholders because it is shareholders who own the company. If 40% of board members no longer represent the shareholders, than this is, in effect, taking away from shareholders the ownership of 40% of the company.

And, in fact, Yglesias estimates that stock prices would tumble by 25%, writing

For the vast majority of people who earn the majority of their income by working for wages, cheaper stock would be offset by higher pay and more rights at work. . . .

Indeed, it seems likely that literally trillions of dollars of paper stock market wealth could be eliminated by weakening shareholder hegemony in this way.

And, again, this is fine for Yglesias because, he claims, it’s only the ultra-rich who own stock: the richest 10% own 81.4% of the stock market, and the top 1% own 38% of the stock market wealth. But the study he derives these figures from focuses exclusively on household wealth based on a government survey, the Survey of Consumer Finances, so it excludes from its calculations “wealth” owned by individuals in the form of promised future pension benefits (and backed by pension funds), and take no interest in the amount of stock market wealth owned by nonprofits or other institutions. Take a look at the estimates from Pensions & Investments: 80% of stock market equity is held by institutions: that means, mutual funds, pension funds, 401(k)s, and the like. In particular, 37% of stock is owned by retirement accounts.

Warren and Yglesias and other supporters of her bill may be dreaming of playing Robin Hood by taking away stock market value to the benefit of rank-and-file workers. But let’s please remember that Robin Hood was fiction.

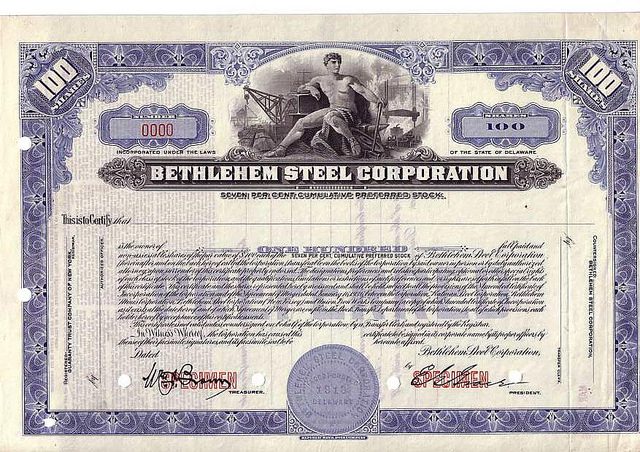

Image: https://commons.wikimedia.org/wiki/File:Bethlehem_Steel_Corporation_1936_Specimen_Stock_Certificate.jpg; By Downingsf [CC BY-SA 3.0 (https://creativecommons.org/licenses/by-sa/3.0)], from Wikimedia Commons