Sennett summarizes a study from the early 1990s done by the American Management Association, which found that “repeated downsizings produce ‘lower profits and declining worker productivity.’” The study found “less than half the companies achieved their experience reduction goals; fewer than one-third increased profitability” and only one-quarter increased productivity. The reason, according to Sennett is clear: “the morale and motivation of workers dropped sharply in the various squeeze plays of downsizing. Surviving workers waited for the next blow of the ax rather than exulting in competitive victory over those who were fired.”

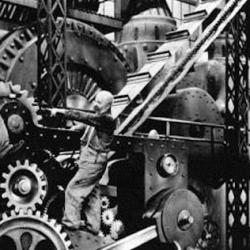

In this respect, flexible capitalism assumes the same abstract and mechanistic notion of work and workers as earlier forms of capitalism often did. The reasoning is pure iron cage: If we cut personnel costs, and give the remaining employees more powerful machines, we’ll get more stuff made. It would all work smoothly, if the employees were not people but cogs.

Why then downsize? Sennett offers this cynical but plausible answer: Disruptive change shows the markets that the company is serious about shaking things up, and stock prices rise. Hence, “In the operation of modern markets, disruption of organizations has become profitable. While disruption may not be justifiable in terms of productivity, the short-term rewards to stockholders provide a strong incentive to the powers of chaos disguised by that seemingly reassuring word ‘reengineering.’ Perfectly viable businesses are gutted or abandoned, capable employees are set adrift rather than rewarded, simply because the organization must prove to the market that it is capable of change.”