The Economy no longer works for average people. I’ll give you three guesses as to why, but you’re only going to need one: The rich are stealing all the money.

The Economy no longer works for average people. I’ll give you three guesses as to why, but you’re only going to need one: The rich are stealing all the money.

Before you think I’ve lost it, allow me to introduce you to a podcast called The Weeds, and the reporting of Ezra Klein. The Weeds is not everybody’s cup of tea. It’s a detailed policy discussion led by the latest research.

Government agencies and the academy are constantly putting out these policy studies and directives that are sometimes called white papers. These are authoritative, research based guides to complicated issues of public policy (basically the polar opposite of a blog post). Once a week or so, the nerds from The Weeds emerge from their nerdery and explain a white paper to us mortals.

On August 23rd they reviewed two interesting white papers. Here are the highlights of what the data show:

Paper #1

The bottom 50% of all income earners (by distribution) in our society have been completely shut off from economic growth since the 1980s.

That means that if you are in the bottom half of the economy, when adjusted for inflation, you basically haven’t seen a bump in earned income since the 1980s. However, if you are in the top 1%, your income went up by 205% (not a typo… 205 percent). If you are in the top .oo1 % it went up 630%.

Now, when you look at adjusted income and factor in things like tax credits and government assistance, the story is a little better. The lower half has grown around 20%, but much less than the national average (60%). Most of that gain is not cash. It’s medicaid and medicare assistance. So it’s not money you can buy your kids some sneakers with. It’s just government assistance to get access to healthcare, or food, or medical help.

By comparison, in a place like France the bottom rate grew by 30%, essentially the same as the national average. (Plus the average person basically gets 2 months off per year in France… so there’s that).

What does that mean? It means that our economy is set up to transfer all of the gains to the top 1%, and even more so to the top .001%.

Let me give it to you another way. For every dollar made in America the bottom 20% used to get 20 cents. In 2014 they got 12.5 cents and falling. The top 1 percent used to get 10.2 cents, now they get over 20 cents.

Translation: Our economy is growing, even growing faster than other countries. But, that growth is being entirely co-opted by the rich. The rich have rigged the system so that they get all the gains. They are stealing all the money.

Paper #2

This one is a study of market concentration and market power. It finds that companies across a wide swath of the U.S. economy are charging more for goods, even though the price to produce those goods has basically stayed the same. That means higher profits, which should be good for the average person. But all of those profits are not finding their way to you and me. They are finding their way into the pockets of the top .oo1%.

Klein explains what this means:

“What we are seeing painted here is a picture of an economy that, on the one hand, all of the income gains are being pulled in by the rich, and the rich are able to increase their markup between what they produce and how much money they get for it. On the business side, the power is being held by big corporations and they are able to increase the amount that they take home. In both cases it does not seem to be doing the economy much good.”

Translation: Corporations have way more power over labor than they did in the 1980s. They have found a way to rig the system so that any of the substantial gains in the economy go to themselves, and not to their employees. The rich are stealing all the money and the average person is powerless to change the system.

This is not an isolated study

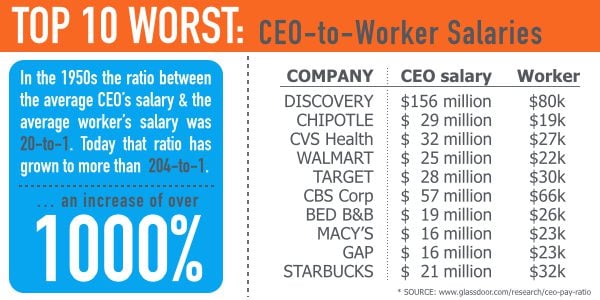

- CEO pay has grown 90 times faster than typical worker pay since 1980.

- The world’s 8 richest men hold more wealth than half the world’s population put together.

- In America the top 1 out of 1000 households holds about 90% of the wealth.

- 70% of the households in 25 advanced economies saw their earnings drop in the past decade… not the top .001%.

The reason the economy no longer works for average people is that the rules of the market economy favor the rich. The free-market v. big government argument is a big scam! The richest .001% are playing us. They are stealing all the money and trying to act like nothing’s going on. The politicians are on the dole (See Citizen’s United).

What did the average person decide to do about this problem? We elected a billionaire president. What is that billionaire president’s solution? Tax cuts for the top .001% and for corporations.

Raise your hand if you think that’s going to help the average person.