Credit cards suck the financial life out of Americans today. But debit cards are the perfect teacher for our teens to learn about wise spending.

Last week I shared how our family handled two foundational areas that we developed early on in our kids: financial savvy and a strong work ethic. You can read it here. That post, written when my oldest was 7, has undergone 6 years of testing and tweaking.

Chores and Finances

When our boys were still toddlers, we began introducing them to the concept of chores and finances. Here’s why we started so young.

- Grocery store checkout lines. You’re a parent, I know you broke into a sweat just reading those words!

- Up until age 5 or so, kids love to be helpers. Capitalize on that; get buy-in on doing chores before they realize its actual work.

- Praise is all a child needs when you start them out young.

- Once a schedule of chores is established, adding on to increase responsibility is a sign to our kids that they’re growing up. Big parenting win.

To summarize last week’s post:

- The Biblical concept we leaned into was based on II Thessalonians 3:10 – you don’t work, you don’t eat.

- Begin introducing age-appropriate chores as early as possible. We started at age 2.

- Use a visually appealing chore chart. We laminated little pictures of each kid to paste beside their weekly chore. Kids love seeing pictures of themselves.

- Once chores are running smoothly, begin introducing the paycheck idea. Similar to an allowance but we wanted a real-world example to follow rather than the ‘allowance’ idea.

- Have a day (or days) in the month that your child knows they’ll receive their paycheck. We started out with bi-weekly and I put a Paycheck Friday sticker on the calendar. Kids are visual. Make it look good.

- Paychecks were handed out in cash and coins and 3 wallets were used: Saving, Giving, Spending. One coin or bill needed to go into each wallet each paycheck, but the amount is their choice.

- What happens when kids don’t want to do their chores? Same thing as in the real-world. Their paycheck gets docked. We started by docking 10 cents and went up from there as they got older.

- Work —> Get Paid —> Buy Candy or Toys

Curbing the “Can I have?”

What was our biggest success with this? The grocery line checkout.

What was our biggest success with this? The grocery line checkout.

This is our little guy when we were well into our finance training. He’s checking out the hot wheel prices and decided he needed to do a bit more saving up. Big win!

We get a lot of stares from store patrons as they watch our boys check out the toys and candy, but don’t ask us for anything. This, sweet friend, is what Intentional Parenting produces. It takes diligence and patience and reminding, but once it clicks you’ll be blown away by your own kids.

Older Kids Need a Different Strategy

As the kids got older it became more cumbersome to carry multiple wallets every time we left home. I hesitated to introduce the evil plastic cards to our kids at such a young age, but carrying plastic would be so much easier than fumbling with coins or forgetting wallets at home. The solution we found came in the form of a debit card designed for kids and teens.

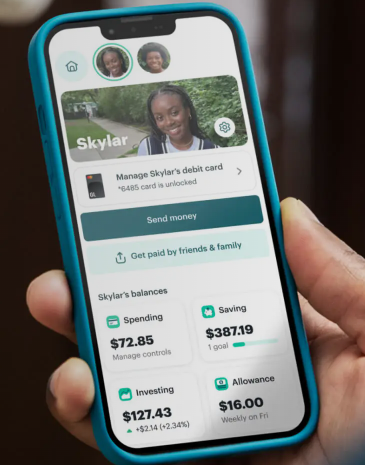

We selected Greenlight* as our debit card of choice. It has a great app that is user friendly, allows for connection to the parent’s bank account to transfer money to children, and can be personalized (if you have girls they will love this!).

Each Greenlight parent account connects to multiple children who are all displayed on the parent dashboard.

Each Greenlight parent account connects to multiple children who are all displayed on the parent dashboard.

Each child has their own dashboard (seen to the left) with ‘wallets’ for spending, saving, investing and more.

Money is transferred from the parent’s bank account to the parent wallet in Greenlight, then transferred to each child with a few simple clicks. It can be divided into various ‘wallets’.

Chores can be set up with kids getting paid upon chore completion. This is different from the bi-weekly paychecks we have issued, but great when transitioning from early adolescents to teenagers who may need a little extra incentive to get chores done.

Direct deposit can be set up so payments automatically hit the cards on a schedule you set.

And the best teaching tool of all?

Plastic does not equal free money.

Our children are learning that money has to be in their account

before they can buy anything.

This is not a credit card, but a fantastic pre-cursor to one. When our kids learn early on that they need money to be able to use their card, it becomes a habit ingrained that will serve them well into their adult years. Why does this matter? I could have a whole Ted Talk, but I’ll summarize!

Credit Card Debt in America

According to a recent Forbes Study, in 2023 Americans were up to their eyeballs in credit card debt, to the tune of 1.08 TRILLION dollars. How did we get here? Oh wait….I promised a summary.

Credit card mailings target our teens long before they get jobs that could pay the bills. This means that our kids are at high risk of living in debt. Lets curb those odds, shall we?

Debit vs Credit Cards

A constant refrain when we jump in the car and head to a store goes a little something like this:

“Mom, can I check the app on your phone to see how much is in my Greenlight?”

What if we checked our bank accounts as diligently as my boys check theirs? What if we made sure there was enough money set aside in our accounts to cover the Target, Walmart and [insert store] purchases we’re about to make?

Teach your kids now, mama. Store clerks stand amazed as they watch our kids head to the checkout, know how to use their card, put in their pin number and pay for their own purchases. Once in awhile that purchase is denied because they didn’t figure in tax, or they misread the price tag. It is so hard as a mom to let them feel the pain of putting a wanted purchase back on the shelf. But I’ve learned that life is a much better teacher than my words can be. So I don’t hand over the extra dollar they need (well, not often anyway!).

So there you have it. The Rodriguez Finance Lesson 101. Does this resonate with you? Have you tried something different that has had great success? Let my readers know by adding a comment below!

Until next week my financially savvy friend.

*This post contains an affiliate link that will benefit me if you sign up.