Lecture 1 – The Austrian Theory of the Business Cycle by Roger Garrison

Lecture 2 – Environmental and Resource Economics by Tim Terrell

Lecture 3 – The Opioid Epidemic by Mark Thornton

Lecture 4 – Fake Economic News by Walter Block

Lecture 5 – Hayek and Keynes: Head to Head by Roger Garrison

Lecture 6 – Minimum Wage by Mark Thornton

Lecture 1 – The Austrian Theory of the Business Cycle by Roger Garrison

Here we go! I’ve seen this lecture in person and it’s one of my favorites. I became interested in economic-history as a young high school student precisely because I didn’t buy the story my textbook gave me about the Great Depression. The Austrian Theory of the Business Cycle, for me, was crucial, and despite all of the ideological and religious changes I’ve been through over the years, this economic point of view has always remained persuasive. This lecture is heavily dependent on Garrison’s infamous PowerPoint slides, so I’ll do my best to share his big ideas without getting too detailed.

Garrison calls the broader application of the Austrian Business Cycle Theory “capital-based macro-economics.”

“Before we can ask how things might go wrong we must explain how they could ever go right.” – F. A. Hayek

Consumption and investment

Garrison immediately notes a difference between the Keynesian and the Austrians in that the Austrians separate consumption and investment. There is no C+I. The basic insight here is that in a national economy, as in a household, there is a tradeoff between consumption and investment. When people consume less, they increase their savings. When people consume more, they reduce their savings. This is how things work in a market economy.

Market for loanable funds and the function of interest rates

When people save more, that money becomes available in the form of loanable funds, subject to a variety of interest rates, which is borrowed by the business community and put into investment. This is all dependent on consumer time-preference. When people become more future-oriented, they save more, interest rates drop, and entrepreneurs take on longer-term investment projects. When people become more present-oriented, they spend more, interest rates rise, and entrepreneurs take on shorter-term investment projects. This is how interest rates coordinate consumption and production over time. The interest rate is a vital signal for economic coordination. The interest rate discriminates against particular kinds of investment projects. This is the Mises-Hayek view. Keynes’s misstep here is the belief that a reduction in consumer spending is a destructive phenomenon, however, lower interest rates can themselves perform a natural stimulating effect in the stages of production further away from present consumption.

This is a simplified view of the structure of production for automobiles. All consumer goods move through a structure of production. Garrison’s slides are brilliant in demonstrating how the tradeoff between consumption and investment and the increase or reduction in consumer saving/spending dovetails with the shape structure of production. High present-consumption/low savings will via a higher interest rate direct resources away from the early stages of production. Low present-consumption/high savings will via a lower market interest rate direct resources away from later stages of production. After all, people save now to spend later; the interest rate is a signal which guides entrepreneurs and investors in their use of scarce resources, including labor. That’s the economizing function. This is how an economy can work without central bank guidance/manipulation. In my reading, this is a fatal argument to the idea that it’s a lack of consumer spending which causes economy-wide panics and depressions, since it demonstrates the role of market interest rates in coordinating economic activity in just such a case.

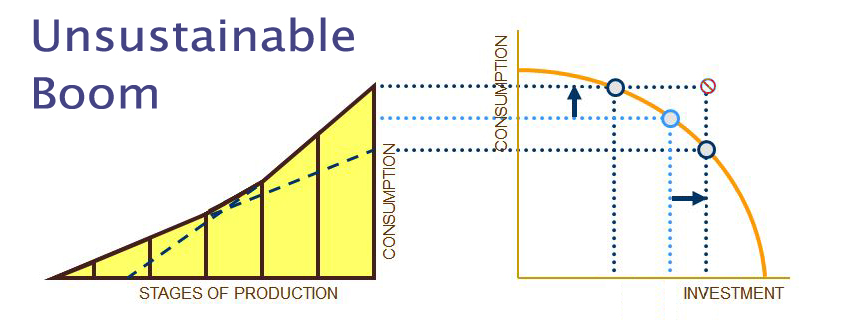

In the picture below, you can see visually what this tug-of-war looks like. Artificial credit expansion pushes the economy is competing directions, re-shaping and stretching the structure of production. If you recall, in the Austrian view, economies face a tradeoff between consumption and investment. Central bank credit expansion papers over this reality, simultaneously expanding the economy in two opposing directions which under normal, free-market circumstances could not be possible. This is the boom, and for a time it looks like real prosperity. When it’s finally understood that there aren’t enough physical resources to go around, an enormous, systemic correction follows – the bust. The thrust of Austrian theory: the boom-bust business cycle is a result not of the free-market, but of government intervention in the economy via central banking and inflationary credit expansion. This is the theoretical framework of what caused both the Roaring 20s/Panic of 1929 and the 2000s Housing Boom/Financial Panic of 2008.

Credit expansion

Credit expansion

What happens when central banks lend money into existence? This new money looks like real savings and interest rates will reflect this but in fact consumer preferences and spending patterns have not changed. The availability of real resources is not reflected in interest rates pushed down due to credit expansion. Entrepreneurs nevertheless take advantage of lower interest rates by taking out longer-term loans and embarking in investment projects a greater distance from final consumption products. This pulls the economy in two opposing directions. Where in a market economy there is a tradeoff between consumption and investment, credit expansion creates overconsumption and malinvestment; people haven’t reduced present consumption, but entrepreneurs mislead by the artificially low interest rate nevertheless behave as though they have and begin investment in long-term projects. In a Greenspan-Bernanke economy, consumers and investors enter into a tug of war over the same resources where in a Mises-Hayek economy the market rate of interest would coordinate their activity.

These are the broad strokes of the Austrian Theory of the Business Cycle.

Lecture 2 – Environmental and Resource Economics by Tim Terrell

Terrell notes that this is his primary area of expertise and that there are two primary issues involved in this subject: resource use (trees, animals, fuel economy, etc.) and externalities and spillover effects (cigarette smoke, pollution, etc.).

Three basic approaches to dealing with externalities

→ Taxing negative externalities and subsidizing positive externalities.

→ Regulating and setting particular quotas on the amount of pollution let loose – sometimes called the command and control approach.

→ Property rights: before the EPA and before command and control, it was not an unrestrained environment. Firms were held accountable for demonstrated harm in courts.

Austrian perspective → efficiency is attained when legal institutions allow individuals to pursue their ends. Conflicts may arise, but Austrians do not believe in engaging in “interpersonal utility comparisons” because, according to Terrell, costs are subjective and cannot be measured (this is covered to some degree in the notes from Monday). Marginal private benefit and marginal social costs cannot be measured. This is a basic insight of praxeology – you can’t make interpersonal utility comparisons. For example, how do you measure the impact of a bad odor from a paper mill on a community? This is one of the troubles with taxing negative externalities and command and control. Finding the “right amount” of emissions to allow runs into a calculation problem that is without a solution absent prices emerging from voluntary interactions in a market. Beyond that, political policies tend to be static and unresponsive to social and economic changes and dependent on erratic political calculations. Ideal pollution targets are subject to less-than-honest politically motivated changes which cater to the needs of special voting blocs and special corporate interests which put pressure on environmental policy. History demonstrates that politicians are willing to sacrifice the environment to win elections and satisfy the needs of local factories and industries which employ communities/voters.

Pollution is not about harming the environment but about human conflict over the use of physical resources.

In the second half of his Terrell takes aim at the idea that courts should render decisions based on monetary costs. This would be a bit tedious to recount here.

“We can’t decide on public policy, tort low, rights or liabilities on the basis of efficiencies or the minimizing of cost.” – Murray Rothbard

From what I understand of Terrell, the Austrian economic perspective on environmental regulation is closely connected to its basic, praxeological insights about subjective value, exchange, and economic calculation. In fact, it flows from those insights. It’s easy to cast Austrians free-market, anti-government ideologues, but their insistence on the failure of government intervention makes a lot more sense if you understand how their view of economics as a branch of the science and logic of human action informs their thought process.

Lecture 3 – The Opioid Epidemic by Mark Thornton

Thornton began by establishing that indeed there is an opioid problem in the US. Far more than 30,000 Americans die each year. The numbers have increased dramatically and the effect is widespread. 116 million Americans suffer from chronic paid. About 50% of adults. This is, of course, directly connected to the incredible amount of opioid prescriptions. Takeaway: a lot of pain, a lot of opioids, and a lot of overdoses.

The face of heroine has changed

1960s and 70s – the inner-city junkie/Vietnam veteran

1980s-2000 – older African American men, poor minorities

Present – working class people

Non-causes

→ Supply? Cartels, smugglers, dealers?

→ Demand? Addicts, users?

→ Gateway? Trying marijuana = death from heroin overdose (this is a thoroughly debunked theory by several disciplines)

Fact: Studies reveal that D.A.R.E. programs actually encourage students to try drugs.

Actual causes

→ Opioids are indeed addictive. Heroin is a form of morphine and if you take too much it can suppress your metabolism, cause you to fall asleep, and die. Bayer developed it as a non-addictive substitute for morphine. As evidence mounted, Bayer took it off the market and replaced it with aspirin. Shortly after, in 1914, the Harrison Narcotics Act prohibited heroin.

→ Government intervention. The pain and trauma associated with war is an enormous cause of addiction. The systemic effect of artificially suppressing economic opportunities creates underclasses and people on the outside of society who develop a need for escape which drugs provide

→ Iron Law of Prohibition. Prohibition makes drugs more potent, more addictive, and more dangerous (and this was the case with alcohol prohibition: 140-160 proof bathtub whisky during prohibition versus 80 proof whisky in the free-market). During prohibition, it makes more economic sense and involves less risk to smuggle and sell more potent, higher dose drugs.

→ AMA and drug companies recently changed the prescription process for opioids. Big Pharma encouraged these new guidelines. Physicians are encouraged to follow these guidelines, particularly as they know that they’re being scrutinized and observed by the DEA. 15,000 people died in 2015 from legal opiates alone. Once the 30-60 day prescription is over, a doctor will not refill the prescription, but too often the addiction has already set in. It is dangerous and difficult to quit cold turkey, drug treatment centers are incredibly costly, and this pushes ordinary people into black market heroin, which is cheaper and easier to access than black market Oxycontin and other prescriptions. Black market heroin is very impure and has a highly variably potency, particularly among the stuff that mimics pharmaceutical drugs.

Solutions?

→ Locking people up clearly doesn’t work. Temporary drug treatment often fails.

→ Thornton recommends the legalization of drugs. Cannabis is an effective tool for treating pain and gradually curing individual opioid addiction. Thornton cited the Portugal experiment, where drug decriminalization was instituted in 2001 with positive effects. He wasn’t able to go into much detail in this section due to time constraints.

Lecture 4 – Fake Economic News by Walter Block

Single-payer healthcare

→ Single-payer healthcare, very simply, means demand will always be greater than supply because consumers aren’t paying.

→ Shortages and surgery delays are part and parcel of single-payer systems. Animals typically get quicker surgeries than human beings in single-payer countries (some data or studies would have been nice, which Block did not provide, though this was a passing comment).

→ Why is healthcare linked to your job? Maximum-wage laws which were established during WW2. Employers used health-insurance options to attract talent and circumvent these laws.

→ 40 million Americans with no health insurance? They don’t have oil change insurance, either. So why do we worry about it? Because it’s so damned expensive. Why is it so expensive? It’s not because of medical technology. It’s because of restricted entry in the medical field – we have fewer doctors than there should be and this is largely because of the AMA which dictates how many students are permitted to enter medical schools. Immigrant doctors are discriminated against on the basis of language.

Financial crises

→ This was mostly a discussion of the Austrian Theory of the Business Cycle: artificially low interest rates leads to malinvestments which leads to economic corrections.

→ Block compared the typical government response to recession (that is, pushing interest rates down even further, bailouts, and New Deal-style interventions) with drinking to cure a hangover.

Minimum wage laws

→ Minimum wage laws are not a wage floor. Minimum wage laws are a barrier over which people have to jump, and people with a marginal product of labor below the minimum wage will find themselves unemployed.

→ Unemployment caused by minimum wage laws don’t show up immediately. However, over time, with higher and higher minimum wage laws, automation becomes more cost effective and hiring people less so.

→ Why give foreign aid to poor countries? If minimum wage policies are an effective tool of pulling people out of poverty, why not just have these countries raise their minimum wage?

→ The left understands that, for example, lowering the cost of college would expand access and raising the cost of college would restrict access. Why does this logic not hold for the cost of labor? The minimum wage law increases the cost of employment and restricts access.

→ Employment is an act between consenting adults – the employer and the employee.

Lecture 5 – Hayek and Keynes: Head to Head by Roger Garrison

We’re back with Roger Garrison. Much of this will dovetail with his previous lecture.

Competing visions

→ Keynes vision of the economy suggests a circular flow framework in which earning and spending are brought into balance by changes in the level of employment

→ Hayek’s vision suggests a means-end framework in which means are changed over time into consumable output.

Keynes’s circular flow

→ Very simply, in the Keynesian model, consumption plus investment contribute to the circular flow of the economy, with consumer expenditures moving out of households and into firms and wages moving out of firms and back into households. In this model, income is equal to expenditures. Consumption and investment are portrayed as additive components of total spending. According to Keynes, a collapse of investment of activity and with it a collapse in consumption is the primary cause of economic downturns. In response to reduced investment and thus reduced employment opportunities, the economy spirals downward into recession and possibly into depression. This chain of events is caused by the “waning of animal spirits.” Keynes eliminated the interest rate from consideration in his model. Interest rates, of course, are a crucial element of the Austrian explanation.

Hayek’s means-ends capital-based framework

Hayek’s means-ends capital-based framework

→ Garrison spent the first 40 minutes on explaining Keynes, which didn’t leave much time for Hayek (about 5 minutes, if that). I’ve added the video of his lecture if you’d like to check that out.

Lecture 6 – Minimum Wage by Mark Thornton

Thornton notes that this is a very ideologically-driven issue. He jokes that he does, in fact, hate the poor. Empirical studies have created some confusion about this issue, but Thornton believes that the unique Austrian approach brings clarity.

Austrians do not believe that minimum wage laws create unemployment, full stop. Ceteris paribus requirements throw a wrench in quantitative predictions.

What is the minimum wage?

→ The minimum wage law sets a “floor” on payments to labor.

→ You can pay higher but not lower.

→ The current federal floor is $7.25 per hour.

→ 31 states have a higher floor than the federal law, and numerous cities have higher floors than the various states. 5 states have no minimum wage law, though they still have to pay the federal minimum. Poor states, including Alabama, do not usually have a minimum wage. According to Thornton, this is because of the destruction it can bring about.

What does the minimum wage do?

→ Some economists believe that the minimum wage doesn’t cause a loss of employment

→ Other economists believe that higher minimum wage laws reduce the quantity of labor demanded and lead to unemployment. The price of labor isn’t exempt from the law of supply of demand and the price cannot be artificially raised without side-effects.

→ Hilariously, Thornton quoted Paul Krugman to defend both positions.

Seattle: a tale of two studies

→ Thornton cited two studies, one from the University of California-Berkeley, the other from the University of Washington. The UW study showed that the minimum wage hurt low-wage workers in Seattle, reducing monthly pay and work hours (in addition to helping higher-skilled workers by increasing the demand for their labor).

→ Thornton notes that despite reports, the UC study showed similar results. Both studies showed a substitution of high-skilled workers for low-skilled workers. These workers found more jobs and kept their hours. Both showed that low-skilled workers lost pay and hours (note: this doesn’t necessarily mean immediate unemployment).

I’ve added the full lecture here:

Austrian view

→ Minimum wage law will cause some combination of the following:

1) fewer hours worked overall

→ fewer jobs, disproportionate harm to small businesses without corporate HQs able to guide them through, fewer employers

2) decrease in job benefits

→ sick days, vacation days, and even clean uniforms

3) decrease in job desirability

→ messier workplaces, reduced lighting and air conditioning

4) increased demand for high-skilled workers (which both of the aforementioned studies showed)

5) increase in job automation (McDonald’s is a case-study in this)

6) increase in instances of discrimination

→ rate of middle-class and upper-class teenagers in the workforce rises

→ competition on the basis of low-wages is eliminated

→ opens up the opportunity for employers to exploit their bias by choosing higher-skilled people and/or people they’d prefer to work around

→ results in discrimination towards minorities, people without experience, and people with lower-productivity

→ unemployment rate in the US is 4.2%

→ total teenage unemployment rate is 16.4

→ white teenage unemployment rate is 14.7

→ black teenage unemployment rate is 27.8

→ Hispanic teenage unemployment rate is 19.0

→ young people are blocked from gaining very basic job experience (like showing up on time) and this results in negative long-term outcomes

Austrian conclusions

→Wage rates are determined by market conditions and the relative scarcity of human and non-human resources

→There is no unemployment in a free-market economy

→ Wage rate increases are driven by increases in capital and productivity. The way to make a country more wealthy is through savings and investment. You make Hayek’s structure of production larger.

→ Early experience in the job market is vital

→ Minimum wage laws hurt their intended beneficiary and others who have disadvantages in the job market

→ How to help the poor? (This was a very brief section – an entire lecture on this subject would be well worthwhile)

1) Eliminate minimum wage laws and compulsory education (given the state of public education in certain areas, many young people would be better off learning basic job skills)

2) Eliminate monopoly grants by governments in certain professions to expand opportunity

3) Eliminate taxes on labor

4) Eliminate the welfare-trap

Countries with and without minimum wages

→ 20% of EU countries have no minimum wage

→ Denmark has no minimum wage for teenagers, but once you turn 18, a minimum wage kicks in and an enormous amount of people on their 18th birthday lose their job (I may have misheard this).

→ Here are some of Thornton’s slides. It’s obvious the story they tell.