Our friends at Faith in Public Life recently called on the US bishops to “take on Paul Ryan and a Republican Party pursuing a radical agenda that is antithetical to a Catholic vision of the common good”. In response, Msgr. Charles Pope from the archdiocese of Washington wondered if this was a good idea, and asked for input from readers. In his attempt to frame the debate, I think Msgr. Pope gets some things wrong. Still, Msgr. Pope is thoughtful, erudite, and very well-respected in the archdiocese. He asks serious questions and deserves serious answers.

Msgr. Pope lists a number of considerations. I will go through them in order.

“1. Let’s admit that overspending is an American problem“. Well, yes, but this needs nuance. Debt is largely a private sector problem. Indeed, the financial crisis was caused by debt, mainly as the financial sector took risks and leverage to new heights. They were piling up debt to lend to people who were piling up debt to buy houses and consumer goods. Why did this happen? At a root level, it was due to old fashioned greed, and Pope Benedict was very clear in pointing to financial sector greed driving the crisis. But if we believe that positive law is charged with curbing certain behaviors – whether on the level of public or private morality – then the two decades of financial deregulation is surely at fault. Put simply, the financial sector did what it did because it could. This was the key problem. Few of us would argue for the legalization of heroin, given its detrimental personal and social impact. But too many do not follow this argument to its logical conclusion. The libertarian argument that personal freedom trumps the common good is just as dangerous in the economic sphere – and indeed, during the last great global economic crisis, Pope Pius XI was quick to recognize the grave dangers of an overly-large, overly-powerful financial sector.

There is another level to consider. Why did ordinary people borrow so much? Partly because they had bought into one of the myths of the American civic religion – that endless prosperity is their birthright. But social and economic factors also come into play. The rise in personal indebtedness tracks the rise in inequality perfectly. Starting in the 1980s, real median wages stagnated (and actually fell for some groups). The gains from growth and productivity went predominantly to the top. The only way the middle class could keep up was to borrow – and of course, this “borrowing” was on “borrowed” time. But when the party was going on, nobody wanted to turn off the music. Human nature again.

Fast forward to the crisis. We need to make a careful distinction between private sector and government borrowing. I know that comparing government and household spending decisions is popular (“households are tightening their belts, so should governments”). But this analogy is wrong, and quite dangerous. The explanation comes from simple economics. During the crisis, private demand (consumption and investment) fell precipitously. The impact on overall growth and employment was stayed only by a corresponding increase in public demand. Nearly all of this came from the collapse in revenue, not any increase in spending (there was some spending increase on unemployment benefits and some discretionary stimulus). This is what so many people fail to understand. Had the authorities opted to cut spending (or raise taxes) in the middle of the recession, the result could have been catastrophic. We already saw 30 million lost jobs all over the world, and 64 million pushed into extreme poverty – but it could have been far worse. So while private sector debt almost destroyed the global economy, public sector debt arguably saved it.

2. The National Debt is over 14 Trillion Dollars. Msgr. Pope makes the point that “morally speaking we are stealing from future generations”. I think the word stealing is unfortunate, as it connotes a libertarian mindset about the role of government. It would be more correct to speak of taxing future generations. Of course, taxing future generations to avoid paying for our own benefits does indeed raise moral issues, but of a different nature. It is perfectly licit to tax future generations for things that benefit them, such as infrastructure, education, health care etc. The question relates to a fair distribution – but this is a general issue that applies within generations as much as between generations.

Is the overall debt too high? Undoubtedly. But the more pertinent question for economists is whether it is sustainable, and that relates to whether the real growth rate is high than the real interest rate (in other words, if the economy is growing faster than debt costs). If not, the debt/GDP ratio will spiral upwards, and sooner or later, the government will not be able to pay its debts. Despite the rhetoric of John Boehner, that day is not today. There are some dangerous signs, but interests rates are still historically low, telling us that people still want to hold US government debt. The only sensible argument for early action on cutting debt today is that sentiment might change rather quickly, leaving the US in a bind.

So we shouldn’t do nothing. But the scale of the problem doesn’t justify the alarmist rhetoric. And certainly, we should not view the debt as the only economic problem on the horizon. Lest we forget, a more important problem is the 9 percent of the labor force who are unemployed, and the millions of others who have simply dropped out of the labor market altogether, and so are not even being counted. I think ignoring the unemployed is itself a major moral issue, more important that public debt.

So what should be done on the fiscal front? Despite the incessant political huffing and puffing, it isn’t that hard. People have short memories. Remember the fiscal debate immediately before this one? Remember last year’s budget deal? What did Republicans insist on? Two things – the extension of tax cuts for high earners, and a massive estate tax cut. When offered a compromise on thresholds, they would not budge. It was all or nothing, the super-rich or nobody. Today, we could easily halve the deficit over the next decade by doing nothing – letting the Bush tax cuts expire. In other words, restore tax rates to the level of the prosperous Clinton years, already a postwar low. But the Republicans are moving the other way. under the Ryan proposals that are galvanizing Republicans, the Bush tax cuts would stay, and the top rate would actually be cut further – by a whopping 10 percentage points. The ever-widening inequality would be made even worse.

While this is going on, the austerity that is demanded is being borne disproportionately by the poor. It is a true “preferential option for the rich”. To pay for making the rich richer, the Ryan proposals include gutting Medicaid, the safety net health care program for the poor. They include privatizing Medicare, with massive cost shifting onto the individuals themselves – in effect making seniors responsible for 70 percent of their health care costs from their own pockets (note that they actually raise the overall cost of health care, but shift it off the government’s books). Remember, the Ryan budget is not proposing cuts to reduce debt, but to pay for new tax cuts. This is very important, and so often ignored by the commentariat. Just run the numbers – $4.3 trillion in spending cuts over the next decade, matched by $4.2 trillion in tax cuts for the rich. And here’s the punchline – two-thirds of the cuts come from programs that help the poor and people of limited means.

So in sum, if the level of debt is a moral issue, than the distribution of adjustment is an even greater moral issue. As I said, the debt issue could be dealt with simply but fairly, by getting rid of the Bush tax cuts (the single greatest cause of the current fiscal mess after the recession), and by some other common-sense measures such as cutting the bloated military budget. After all, the massive military in the United States is in itself a moral issue – “While extravagant sums are being spent for the furnishing of ever new weapons, an adequate remedy cannot be provided for the multiple miseries afflicting the whole modern world” (Gaudium Et Spes). Remember, almost half of the military spending in the entire world comes from the United States. Also, over the long-term, growing health care costs will continue to strain the budget, but only because overall health care costs are rising (Medicare is much cheaper than private insurance). The Affordable Care Act has some decent efficiency savings on that front, but more will undoubtedly be needed. But this is longer term.

3. But we seem locked into a dependency/entitlement cycle that is hard to break. Here, Msgr. Pope is making a general point, but it is too sweeping. For example, nobody can deny that ethanol subsidies are in place to benefit a particularly strong lobby. But the government bank bailout was designed to avert a second Great Depression, and was totally justified (of course, the quid quo pro of extensive re-regulation has not yet happened). And Catholic social teaching recognizes a role for the state to take over private industry in exceptional circumstances, and the financial crisis was as exceptional as you can yet. Msgr. Pope also talks about subsidies for the arts.

But none of this is directly relevant to the budget issue. Subsidies to the arts are peanuts. Ethanol subsidies are peanuts. And the TARP could very well turn a profit. Of course, society can and should have a debate over what to subsidize and what not to subsidize, what furthers the common good and what merely serves narrow interests. But this is not the issue at hand.

Of course, the concept of a dependency culture is recognized by Catholic social teaching. What it really means is that subsidiarity is being sacrificed to solidarity. But is there really much evidence that this is a pressing concern in the United States today? All the evidence points toward the opposite – a huge push for subsidiarity without solidarity. What else accounts for the turning Medicaid into (vastly reduced) block grants to the states? What else accounts for forcing people to bear and ever-greater share of their health care costs? What else accounts for the calculated attempt to abrogate the promises made during the last century?

Luckily for us, the debate over how to construct a welfare state that respects both solidarity and subsidiarity is not a new one. This was a major Catholic project over the past century, especially after the second world war, and especially under the umbrella of Christian democracy in Europe and elsewhere. It is this model that fits well with Catholic social teaching. The essence is a welfare system that keeps both the state and the market in their place – funded by the state, but managed by subsidiary mediating institutions in a fully autonomous manner. In the economic sphere, there is a strong overlap between Christian democracy and social democracy, and even Pope Benedict has pointed to the compatibility between democratic socialism and Catholic social teaching. Respect subsidiarity, yes, but don’t throw out the baby with the bathwater. Avoid welfare dependency, yes, but do not avoid welfare.

The United States has never had a Christian democratic movement, but – as recognized by the original Faith in Public Life post – the US bishops were strong supporters of a welfare state throughout the 20th century, especially as embodied in the New Deal. It would be no exaggeration to say that this was a very Catholic project. But the achievement was limited, at least relative to comparator countries. Today, the United States today spends far less on social services than does a place like Germany. Getting the welfare state to respect the tenets of Catholic social teaching is not the same thing as cutting social spending or reducing the size of government. This is a major American fallacy.

4. The article above is baiting the Bishops to enter the fray. Msgr Pope sees a carefully circumscribed role for the bishops: “But it would seem they can only enunciate certain general Catholic principles such as care for the poor, an equitable sharing of the burden of cuts in other areas of the budget, and proper balance between subsidiarity and solidarity”. Except that the bishops only do this selectively. They generally offer views on particular issues, with only some exceptions – the licitness of particular wars being an obvious one (and I wish they had the courage to speak out more on this issue).

This is the right approach, as long as we realize that the authority of the bishops diminishes when it moves down from general principles into the application of principles to particular facts and circumstances. The reasons they need to make very specific judgments is simple – sometimes it is patently obvious that the principles do not apply, or that those in question don’t really believe in the principles. Can anyone seriously suggest that the Ryan budget is in accord with the tenor of Catholic social teaching since Rerum Novarum? Can anybody seriously suggest that it takes issues like solidarity and the preferential option for the poor seriously?

The problem is that – despite the window-dressing – the Ryan budget (and indeed, the whole modern Republican economic agenda) stems from a philosophical standpoint that is radically different from a Catholic anthropology. It stems from a kind of liberalism that has always been hostile to Catholic social teaching, one that sees individual liberty and individual rights as paramount (ironically, the left makes the same argument on social issues as the right makes on economic issues). In this worldview, solidarity cannot be imposed, and is confined to the domain of voluntary charity. In the United States in particular, a philosophy that exalts individual freedom is closely entwined with the dominant Calvinist tradition of seeing material success of a sign of virtue and divine favor. Plus, it is no accident that Ryan himself holds Ayn Rand in admiration.

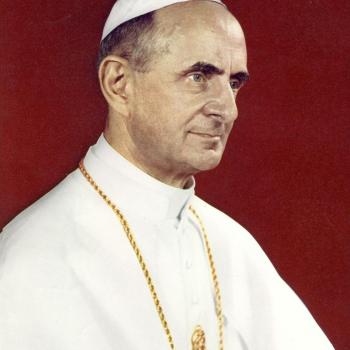

On the other hand, the Church has always insisted that the state had a duty to care for the poor and promote economic justice, and this took on a whole new meaning during the Industrial Revolution. A carefully circumscribed role, but a vigorous role. Successive popes have criticized the idea that the state must take a back seat in economic life, leaving justice to private charity, and acting as a “mere guardian of law and of good order” (Pius XI). They have criticized the “excessive exaltation of liberty” (Pius XII) and the “erroneous affirmation of the autonomy of the individual” (Paul VI). Despite the casual language of the Catholic right, the use of subsidiarity – which is fundamentally about human dignity – to justify a classical liberal view of the state represents a profound misunderstanding of subsidiarity.

Against this background, the Church has a duty to make this teaching loud and clear, especially in a culture besotted with the cult of individual liberty. It has a duty to criticize legislation centered on this flawed philosophy. It has a duty to criticize a fiscal strategy that guts social safety nets of the poor to pay for more upward redistribution toward the rich. In other words, the original post in Faith in Public Life is absolutely right. It is time for the bishops to reclaim their strong moral voice on this issue. It is time for them to recall the strong voice they had a quarter century ago with Economic Justice for All. It is time for them to take the same tone as the Irish bishops, who are not afraid to point the finger at the cult of individualism. I have a funny feeling that they could win back some lost legitimacy if they gained this courage.