This exchange, between President Obama and George Stephanopoulos, should echo throughout the presidential race:

OBAMA: My critics say everything is a tax increase. My critics say that I’m taking over every sector of the economy. You know that. Look, we can have a legitimate debate about whether or not we’re going to have an individual mandate or not, but…

STEPHANOPOULOS: But you reject that it’s a tax increase?

OBAMA: I absolutely reject that notion.

Here’s the video:

Yet today we learned that Obamacare could only be constitutionally salvaged as a tax, an expensive and complex new burden on the middle class that will only escalate with time. Here’s how this tax works (taken from our ACLJ complaint challenging Obamacare):

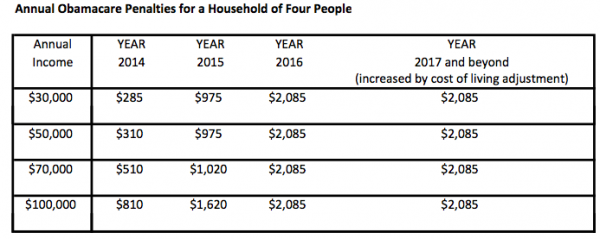

Under the Act’s complicated shared responsibility payment structure, the minimum shared responsibility payment amount per year for each adult who lacks minimum essential coverage will be $95 for 2014, $325 for 2015, $695 for 2016, and $695 or more for 2017 or later, increased due to cost-of-living adjustments . . .

The above-mentioned shared responsibility payment calculation is disregarded when a certain percentage of the taxpayer’s household income that exceeds the applicable threshold for filing a tax return is greater than the amounts listed above for the taxable year. The applicable percentages are 1 percent of the excess amount in 2014, 2.0 percent of the excess in 2015, and 2.5 percent in 2016 or later.

When the percentage of the excess over the filing threshold is greater than the specific amounts listed above for the taxable year-which will often be the case for Plaintiffs and many other Americans-the taxpayer must pay the amount of the excess with no specific dollar cap. For example, where a taxpayer’s household income (minus the amount of the applicable threshold for filing a tax return) is $50,000, the shared responsibility payment amount per year would be, at a minimum, $500 for 2014, $1,000 for 2015, and $1,250 for 2016 or later.

Here’s the family tax consequence in chart form:

While I’m profoundly disappointed by the outcome of the case, I’m also deeply disturbed by an administration that would deceive Americans so brazenly. Let’s not forget, almost immediately after Obamacare was challenged, the administration sallied into court arguing just what the Supreme Court ultimately held: the mandate wasn’t a penalty, but a tax. The administration tells the citizens one story, the Court another, and ultimately gets what it wants — a health plan that permits and indeed requires state micromanagement of an immense and vital segment of our economy and lives.

A shorter version of this article appeared on National Review Online.