How to BUDGET

Luke 14:28-33

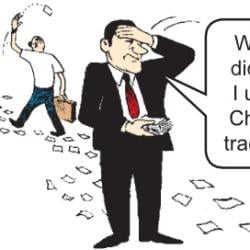

I learned long ago about planning with the following phrase: Prior proper planning prevents pitiful poor performance. That rule is illustrated with this story about money.

This is the story of a man who did not budget properly. In this mini-parable, Jesus teaches us about budgeting. In the immediate context, this is about how a man spends his money. In the larger context, this idea of budgeting affects how I live as a follower of Jesus. Therefore, budgeting is biblical. Budgeting should be a skill that every Christian should use. It is the first fundamental skill of financial management. Every Christian should know how to manage their money. A budget is an essential tool — a plan that is used in a process to manage money.

SIX ELEMENTS OF A BUDGET

Here, we see six elements of a budget described, outlined, and lived out in this story.

B – Begin to evaluate what I spend (Luke 14:28) “sit down”

Jesus describes a man who decides to build a tower. His first step is evaluate what he will have to spend. He sits down and calculates. He determines what he needs to spend.

“Know well the condition of your flock, and pay attention to your herds,” (Proverbs 27:23, CSB)

You have to know what you have to work with. The best way to do that is to sit down and start to develop a budget. Both the husband and wife need to sit down and talk about their finances. Dave Ramsey in his book Dave Ramsey’s Complete Guide to Money and seminar on Financial Peace talks about this process. He says that there are savers, known as the “nerds” and there are spenders known as the “free spirits.” He says that they both have to sit down and work out a budget. They need to have the budget meeting once a week. Just as the man in the parable sat down to calculate the cost, you need to do the same thing.

U – Understand the expenses (Luke 14:28) “calculate the cost”

Once you sit down and see what you have, you need to calculate what you are spending. The cost of something are the expenses. What you make is your income. What you spend are your expenses. You have to look at what you are spending and where.

“Complete your outdoor work, and prepare your field; afterward, build your house.” (Proverbs 24:27, CSB)

You can’t have a handle on your finances until you know where your money is going. Believe me, your money slips in and out of your hands. You have to make the effort to tell your money where it needs to go.

Your checkbook is a window into your priorities. You have to see where you spend your money. Where you spend is what you care about. If you are married, then you will have conversations, good and bad, about your priorities. You both have to come together and agree where you are going to spend your money. You have to reign in your money. You have to control it or it will control you. We have a simple rule in our marriage: we don’t spend more than fifty dollars without talking with one another about it. You have to spend time and calculate the cost.

D – Determine my assets and income (Luke 14:28) “if he has enough”

You sit down and see how much things cost, you also look at how much you have coming in. Your income has to match or exceed your expenses. Do you have enough for what you want to do? If not, what do you have to do to make ends meet?

You have to see if you have enough to spend money on what you need and want. You need to determine what you have in cash and income. From this you decide what to spend.

G – Guard against spending too much (Luke 14:29) “Otherwise”

Here, the man decides to start his building project and it seems that he ran out of money. He laid the foundation, but couldn’t finish the building. He left his project unfinished. He spent money and did not have enough capital to finish the job.

Many times we have to also guard against spending too much money. This problem sometimes occurs because we spend on our “wants” and not just our “needs.”

We spend too much money too early and we can’t finish it. This is why budgeting is important. A budget will tell you if you have enough money to finish something because you made a plan. You force yourself to set money aside for a purpose. A budget will help you do this.

However, this takes discipline.

E – Escape the danger of debt (Luke 14:29) “cannot finish it”

“The rich rule over the poor, and the borrower is a slave to the lender.” (Proverbs 22:7, CSB)

“Take his garment, for he has put up security for a stranger; get collateral if it is for foreigners.” (Proverbs 27:13, CSB)

People who don’t have discipline in their budget revert to getting into debt, and live that way. In this scenario, the king will have to get extra money to finish this project. In order for him to finish, he will have to go into debt.

The Bible does not prohibit getting into debt. It only warns about the danger of using debt. There are many examples in the Bible of people who were indebted to others financially. Two stories come to mind. Jacob was indebted to his uncle Laban for fourteen years. Of course, he was cheated and had to work fourteen years and not seven years. It does illustrate the danger of getting into debt.

Another example is when Nehemiah chastises the people of Israel for getting their fellow Israelis indebted to them by charging too much interest on loans.

We have the same problem today. Instead of individuals charging one another, we have entire companies that make money off of putting people into debt. Credit card companies charge outrageous rates. Payday loan companies charge rates that should be criminal.

So there is a real danger in getting in debt. While the Bible warns against putting others into debt, this passage warns an individual about getting into a debt that they cannot repay back. In this illustration, the construction project cannot be completed. He needs more money. Jesus warns us that we need to be prepared to have the resources to finish what we start.

If you get into debt, then you need to make whatever effort you to need to get out of that debt. Work longer hours. Get a second job. Cut back on what you spend. Sell some stuff. You were responsible for getting into debt. You alone are responsible for getting out of debt.

“The end of a matter is better than its beginning; a patient spirit is better than a proud spirit.” (Ecclesiastes 7:8, CSB)

People today want to spend money now, instead of waiting until they have enough money for what they want. People are very short-term and short-sighted with their money. When it comes to budgeting, you have to deal with short-term planning and long-term planning. Many people want to start something, but it feels better to end something. Especially that may take some time to finish. This is where a budget is critical. A budget will help you make it through the long haul.

T – Take care of my finances for my future

(Luke 14:29-32) “they will begin to ridicule him, saying,” “if not.”

Budgets allow me to plan, execute, and finish projects. Budgets also allow me to plan how to spend for my present and prepare for my future.

In this little parable, Jesus warns that the person who does not prepare for the future will receive ridicule. In the second mini-parable, the king has an unexpected cost. He can’t plan to go to war. He is invaded and needs to fight. He needs to have his resources available and ready for use. He can only do that if he has saved up and is prepared for the unexpected.

A budget helps me prepares for the unexpected, including the future. One modern example of unexpected challenges include a death. We see many people use GoFundMe as a means to raise money to pay for funeral expenses. Here is the problem with that approach. You didn’t plan for the future and so you are caught unprepared for an unexpected expense. It is fine for someone to donate to help others. At the same time, it shows my financial maturity for me to be prepared for the unexpected.

There is something called the 70/10/10/10 Rule

10% – Give to God

10% – Give to Yourself Now (Savings)

10% – Give to Yourself Future (Retirement)

70% – Spend

“Honor the Lord with your possessions and with the first produce of your entire harvest;” (Proverbs 3:9, CSB)

When I plan and stick to a budget, I won’t end up like the man in this parable.

“Wealth obtained by fraud will dwindle, but whoever earns it through labor will multiply it.” (Proverbs 13:11, CSB)

I won’t become rich overnight. It takes time and work (labor) to build true wealth. Budgeting is the most basic skill and tool to use to build wealth. Budgeting is a form of financial discipleship as Jesus pointed out in His conclusion to these parables.

“In the same way, therefore, every one of you who does not renounce all his possessions cannot be my disciple.” (Luke 14:33, CSB)

I don’t believe that Jesus means that you should abandon possessions in general. Jesus is making the point that possessions or materialism, or the love of money, can control me. Budgeting is the tool that prevents me from having my money and possessions rule me.

One of the goals of a disciples of Jesus is to have enough control over my money so that I can make it do what God wants me to with my money. That takes discipline. That takes obedience to Jesus as my Master. My finances affect me. It also impacts others. My finances affect my family and friends. People see how I spend my money. People can tell if my lifestyle matches what I make. God wants me to have some dollars and sense and act my wage, not just my age.

Other Posts:

The Path to Positive Money Management