Teaching kids about financial responsibility is a crucial life skill that will benefit them in the long run. One effective way to instill good money habits is by helping your kids save money from an early age. By imparting these valuable lessons, you set the foundation for a secure financial future for your children. Most young children are intrigued by money until they realize it involves math. A nickel is bigger than a dime so to a child, the nickel seems more valuable. Starting small and taking time will help children know the basics.

Why Kids Should Save Money

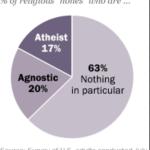

In a world filled with tempting spending opportunities, teaching kids the importance of saving is essential. Kids often receive allowances or gifts, providing the perfect opportunity to introduce the concept of saving. Parents know that saving money allows for future purchases or unexpected expenses. However, fostering a sense of financial security is usually the last thing on a kid’s mind. An article titled “10 Scary Financial Literacy Statistics,” (October 2021, ChooseFiFoundation.Org), shares some concerning financial literacy statistics about teens and children. 1 of the most telling stats is that “4 out 5 parents wish they learned more about money as a kid” (ibid).

Starting Early: The Foundation of Financial Literacy

Early exposure to financial concepts is key. Begin by op

ending a savings account for your child. This practical step not only teaches them the basics of banking but also emphasizes the importance of setting money aside for the future. Make the process engaging by involving them in the decision-making, such as choosing a bank or setting savings goals. 1 advantage today’s kids have over previous generations is the debit card for kids. Seeing their parent use plastic can give a false sense of how money works. A parent-supervised debit card is a great way to fix that.

Making Saving Fun for Kids

Transforming saving into an enjoyable activity encourages kids to embrace this habit. Consider creating a visual savings chart or using a piggy bank where they can watch their money grow—reward milestones with praise or a small treat to reinforce positive behavior. Connecting saving with positive experiences helps kids associate it with a sense of accomplishment. Children of every age respond well to praise and a sense of accomplishment. Likewise, we all appreciate knowing that our parents are proud of us regardless of age.

Teaching Kids

Budgeting Skills

As kids grow older, introduce the concept of budgeting. Help them allocate their allowance or earnings into categories like spending, saving, and sharing. This not only instills discipline but also emphasizes the importance of balancing wants and needs. As a result, kids develop a practical understanding of managing money responsibly. At first, the idea of a budget might seem overwhelming to a child or teen. This article at Medium.com deals with the why and how of budgeting for kids is also very important to be patient with your children when teaching financial concepts. as discussed in the article “Talking To Kids About Money” by Katherine Martinelli (ChildMind.Org).

Credit: kidsmoneylessons.com

Showing Kids Money Lessons in Daily Life

Take advantage of everyday situations to impart money wisdom. While shopping together, explain the difference between needs and wants. Discuss the idea of comparing prices and looking for deals to make their money go further. Real-life examples create lasting impressions and enhance their financial decision-making skills. Many grocery stores have kid’s carts. Allowing small children to follow their parents around the store while shopping can help build life skills that relate to money.

Setting Savings Goals For Kids

Encourage your kids to set savings goals. Whether it’s saving for a toy, a special outing, or even long-term objectives like college, goal-setting teaches them the value of planning and patience. Break down larger goals into smaller, achievable steps, making the process less overwhelming and more rewarding. Another helpful savings or special purchase idea is to participate with your child. For example, for every $2.00 the child saves, the parent will add $1.00 to it. Also, the only real work that many children know is schoolwork. Paying for A’s and B’s is a good way to instill both the idea of a goal/reward and the value of hard work. However, it works best when they have to pay the parent a similar amount for D’s and F’s.

Be a Financial Role Model

Children often learn best by observing their parents. Demonstrate responsible financial behavior by openly discussing budgeting, saving, and spending decisions. Share your experiences, both successes and mistakes, to humanize the learning process. Parents who were raised in poverty might work harder to teach their children the lessons they didn’t get because of trauma. As kids mature, introduce them to basic investment concepts. Explain how investments can grow over time and the role of risk and reward. While this may seem advanced, simplifying these concepts and using relatable examples can make them more accessible. Teaching kids about the potential benefits of investing instills a long-term perspective on finances.

Use Technology to Teach Kids About Money

In today’s digital age, leverage technology to enhance financial education. Explore interactive apps designed to teach kids about money management. These apps often include features like virtual savings jars, goal tracking, and interactive games that make learning about finances engaging and enjoyable. SageVest.Com. offers the following 4 ways to use technology in teaching Tweens (8-12 years).

- Select financially focused websites, online games, and apps for your kids to enjoy.

- Be sure to limit online purchase opportunities, however.

- Choose a family-friendly budgeting and saving app to use together.

- Establish a custodial bank account with basic online functionality.

Involving Kids in Financial Discussions

Include your kids in age-appropriate discussions about family finances. While details can be adjusted based on their age and understanding, involving them in conversations about budgeting, household expenses, and financial goals fosters a sense of responsibility and a better understanding of the family’s financial dynamics. Helping your kids save money is a gift that keeps on giving. By instilling these financial habits early on, you empower them to make informed and responsible decisions about money. From saving for short-term goals to understanding long-term investments, the lessons learned today will shape their financial future. Start the journey toward financial literacy with your kids, setting the stage for a lifetime of financial well-being.