It may be hard to believe, but 2013 is almost here. And with a new year approaching, most of us take this time to reflect on what we’ve done this past year, as well as think about what we’d like to accomplish next year.

For many of us, part of what we’d like to do next year is improve our financial lives. Does that describe you?

Do you want to be in a better position in December 2013 than you are in December 2012? If so, here are five ways to get your finances in better shape.

Get Out of Debt

Getting dragged down by debt can lead to heartache, pain, stress, and relational tension. In order to relieve yourself of these burdens, and before you can build wealth and increase your net worth, you’ve got to get out of the financial bondage of debt.

Dave Ramsey popularized an extremely effective way to free yourself from debt, and that method is called the Debt Snowball. To learn more about the Snowball, check out this post on how to accelerate your Snowball.

Max Out Your 401k

If you work for a company, you probably have access to a 401k plan as part of your benefits package. For most employees, this is the best, most effective way to build long-term wealth.

As Tim mentioned in this post, you can contribute up to $17,500 to your 401k in 2013. The good thing about this amount is that it doesn’t include any employer match.

So any money that your company matches can be thought of as a bonus. It’s free money that’ll help you improve your finances even faster.

Max Out Your Roth IRA

If you’re really committed to becoming financially fit, you may already have planned out your budget to max out your 401k, and yet still have money left over to invest. If so, another great wealth-building tool you can take advantage of is the Roth IRA.

In the same post mentioned above, Tim noted that you can contribute up to $5,500 to your IRA in 2013.

Do you know how much wealth can you expect to build by maxing out both your 401k and Roth IRA? Let’s say you invest $23,000 every year, for the next twenty years.

Using the historical stock market average return of 8 percent, and ignoring taxes for the moment, this is how much wealth you’ll have accumulated at the end of those twenty years: $1,052,525. This demonstrates the incredible power of disciplined investing.

Earn More

While you should definitely seek to cut unnecessary expenses, it’s impossible to spend less than nothing. Cutting costs will only take you so far on your journey to become financially fit. But on the other hand, there’s no upper limit on how much you can earn.

Tim has great ideas on how you can earn more money on the side – so there’s no need to quit your day job. You’ll definitely find something you can do to bring in extra money. Once you start bringing in extra income, you can use it to pay off your debts faster, or invest it to build even more wealth.

Give More

It’s nice to be able to get your finances in order and build wealth. But I think it’s even better to be in a position to bless others with that wealth you accumulate.

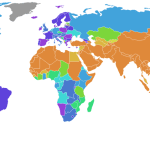

Kiva is a site that allows you to do exactly that. By making a small loan, you can play a part in fighting poverty by helping entrepreneurs create better opportunities for themselves.

Best of all, with an over 98 percent repayment rate, you’ll most likely get all your money back. Then you can make another loan to help yet another entrepreneur. It’s truly a gift that keeps on giving.

What are you going to do to become more financially fit in 2013?