Larry Kudlow, the “White House’s top economic adviser said” the other day “that he opposes the federal minimum wage, arguing that the decades-old law is a ‘terrible idea’ that drives up costs for small businesses across the country,” the Washington Post reports. [1] “’Idaho is different than New York. Alabama is different than Nebraska. That’s why the federal minimum wage doesn’t work for me,’ Kudlow said.” He also opposes a minimum wage at the state and local level as well, but he doesn’t think the federal government should try to interfere with states and localities that do so.

That Donald Trump’s chief economic adviser thinks that a minimum wage is counterproductive should surprise no one. What might be surprising is that your humble servant agrees, though, I suspect, not for the same reasons.

First of all, $7.25 per hour, the current federal rate, is a joke. Secondly, even in states where it is higher it isn’t sufficient to keep a family of four out of poverty. The poverty line for a family of four is currently $25,100.00 per year. [2] Based on a 50 week year, for 40 hours a week, that amounts to $12.55 per hour. Only New York City and the District of Columbia exceed that amount, and nowhere else does it reach that amount. [3]

First of all, $7.25 per hour, the current federal rate, is a joke. Secondly, even in states where it is higher it isn’t sufficient to keep a family of four out of poverty. The poverty line for a family of four is currently $25,100.00 per year. [2] Based on a 50 week year, for 40 hours a week, that amounts to $12.55 per hour. Only New York City and the District of Columbia exceed that amount, and nowhere else does it reach that amount. [3]

So pass a law that makes businesses pay more, right? Not really. It is true that there are some businesses that could pay that much, or more. But it is also true that that some businesses would be adversely affected. Specifically, we want to encourage people to start businesses, and the higher the costs we impose on such ventures the fewer will be those who do it.

What we need is a plan that will keep businesses from getting government subsidies in the form of SNAP benefits and welfare for their underpaid employees, and at the same time encourage entrepreneurship. And it just so happens that we have one.

We begin with the idea of a negative income tax, by which I mean this: Every person will be guaranteed an income that is above the poverty line. So a family of four would be guaranteed $25,100.00 per year. If one of the adults in the home is working, in order to encourage working, we will credit the family with an extra person, thus guaranteeing $29,420.00, making up the difference between the worker’s actual wages and the guaranteed amount.

Now, of course we’ll have to do something about free-riders, companies which will, even if they can afford to do otherwise, pay low wages, relying on the taxpayers to pick up the rest of the paycheck. The way this problem could be handled would be to base a business tax rate (and this would be the same for corporations, partnerships, sole proprietorships, or any other business form) based on the difference between the amount received by the highest paid person in the company and the lowest paid.

Now, of course we’ll have to do something about free-riders, companies which will, even if they can afford to do otherwise, pay low wages, relying on the taxpayers to pick up the rest of the paycheck. The way this problem could be handled would be to base a business tax rate (and this would be the same for corporations, partnerships, sole proprietorships, or any other business form) based on the difference between the amount received by the highest paid person in the company and the lowest paid.

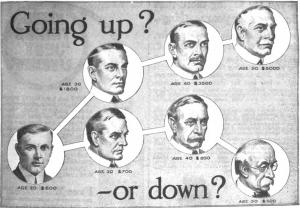

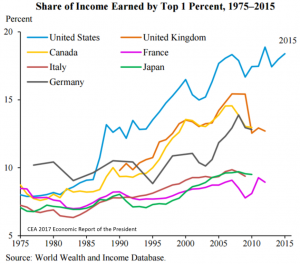

CEO compensation has soared since the 1950s. As Forbes reports in an article appearing in May of this year, “In the 1950s, a typical CEO made 20 times the salary of his or her average worker. Last year, CEO pay at an S&P 500 Index firm soared to an average of 361 times more than the average rank-and-file worker, or pay of $13,940,000 a year, according to an AFL-CIO’s Executive Paywatch news release today.” [4] The result has been that “the average wage-adjusted for inflation—has stagnated for more than 50 years. Meanwhile, CEO’s average pay since the 1950s has grown by 1000%.”

The 1950s were a pretty good time for the United States, economically speaking. Perhaps we should relive some of it, and bring the CEO to worker pay back into line. But to ensure that we’re lifting all boats, we’ll calculate the ratio based on the highest compensated individual in the company versus the lowest paid, and we’ll say that we’re targeting a 40 to 1 ratio between the two. Companies that have that pay structure will pay a tax on 10% of their profits. The tax rate will vary as a company’s pay ratio is less or more, 1% as the firm’s ratio goes up or down by 4. So a firm will pay 20% with an 80 to 1 ratio, 30% with a 120 to 1 ratio, and so on. Businesses will reach a 100% tax rate with a 400 to 1 ratio, which ought to discourage the practice.

The Catechism of the Catholic Church tell us that there “exist…sinful inequalities that affect millions of men and women. These are in open contradiction of the Gospel:

The Catechism of the Catholic Church tell us that there “exist…sinful inequalities that affect millions of men and women. These are in open contradiction of the Gospel:

“Their equal dignity as persons demands that we strive for fairer and more humane conditions. Excessive economic and social disparity between individuals and peoples of the one human race is a source of scandal and militates against social justice, equity, human dignity, as well as social and international peace.” (Id, no. 1938) [5]

None of the foregoing, I should point out, is original with me. But perhaps it will serve as a means of getting these ideas into currency, and make the small part of the world we inhabit a better place.

The icon of St. Joseph the Worker is by Daniel Nichols.

Please go like Christian Democracy on Facebook here. Join the discussion on Catholic social teaching here.