Taxes are an interesting phenomenon.

Historically, they were imposed on the general population by kings and queens to support wars and lavish lifestyles.

With the advent of democracies—i.e. taxation with representation—the general public accepted taxes as a way to pool resources and work toward the common good.

People agreed to pay a part of the earnings to a government run by the people, for the people, in exchange for roads, harbors, water lines, electricity, airports, education, a legal system, adequate defenses, and more.

As the late US Supreme Court Justice Oliver Wendell Holmes Jr. said:

“Taxes are what we pay for civilized society.”

Ideological Battles

Ever since taxation with representation came into being, there have been ideological battles fought over how much to tax people and for what purpose.

Should people keep most of their earnings and fend for themselves under difficult circumstances or should the government tax more and provide better services for the people?

Those two ideas have been at odds in democratic systems around the world. Tax more and serve more or tax less and serve less (the worst combination being tax more and serve less)?

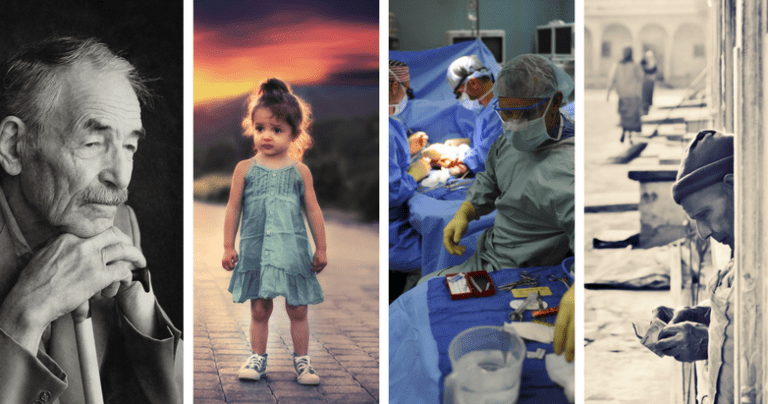

Four Groups of Vulnerable People

In order to answer, we must ask another question.

What makes a civilized society?

One measure is to look at how the society in question treats four groups of vulnerable people.

- The young

- The old

- The sick

- The poor

Are young people sent to work early or are they educated and cared for, even when they don’t have parents who have the means?

Are old people left to die or are they honored, supported, and cared for?

Are sick people treated with the best available care regardless of their income or is there a merit system where only those who have the means get the care they need?

Are poor people taken advantage of at every turn, paid low wages, refused the right to belong to unions, exposed to constant fear of being fired without cause, subject to predatory lending practices, and so on, or do they get both the regulatory support (minimum wage, right to organize) and temporary support (jobless benefits, healthcare subsidies, etc.) that they need in order to rise out of poverty?

These are good questions that should be a part of every election debate.

If a society answers that the most vulnerable among them deserve support, then that same society is voting for an increase in taxes along with increased services.

If a society votes to reduce taxes then, far too often, it has decided to throw the vulnerable off the lifeboat.

This is the moral linchpin of taxation.

Do we keep people in the lifeboat or do we throw them out?

Every election gives answers to that question.

Who Pays?

The other half of the moral equation is the payment side.

Who pays for those who have difficulty fending for themselves?

We can’t all be dependents, can we?

For a system like this to work, we must do two things. Make sure that every able-bodied person is contributing to the system in some way, making it known to all that it is an honorable gesture to pay taxes, and strike a balance where we don’t overtax people and make them resentful.

I was raised in a country (Iceland) where the government tried to fix every problem with systems and programs. Taxes were—and still are—extremely high. In that environment, people are likely to use all means to try and avoid paying them.

I now live in another part of the world (Texas) where I feel like I am not contributing enough to the common good because taxes are relatively low.

I think it is possible to find balance between the two.

What the Money is Spent On

Sociologists have made the case that when the money raised through taxation is spent on services for the people then the people are more likely to participate in the election process. They want to have a say in how the money is spent.

On the other hand, when income from taxes is spent of things such as war machines (under the guise of defense), bureaucracy, and special support for big corporations, people are less likely to participate.

If I compare election participation in Iceland (generally ninety plus percent when I lived there) with election participation in the USA (around fifty percent in presidential elections, but usually less than that), then that gives me a pretty clear indication of where the income from taxes is currently being spent.

Our Moral Compass

We are having a tax debate in this country at the moment (for the record, I am a legal US citizen, have been since 2013). I wish that people would at least consider the moral implications of their actions during that process.

We can’t pay everything for everyone, but we must remember that for every tax cut, someone is being thrown out of the lifeboat (in some cases, literally being sentenced to die) and that for every deferred payment (increase in the deficit) we are taking a loan that our children and their children have to pay.

From a spiritual standpoint (especially the goodness part of that equation), we must do all we can to protect the vulnerable among us while at the same time taking care not to overburden those who so graciously pay part of their earnings to fund the common good.

Gudjon Bergmann

Author & Interfaith Minister

Pictures: Pexels.com