Here’s the context:

I spent a fair bit of time writing on the issue of the working poor and the minimum wage back in April, e.g., “When did the idea of the “working poor” become a bad thing?” and ““The [working] poor you will always have with you”: more on minimum and “living” wages” on the fact that proponents of a high minimum wage are losing sight of the fact that welfare benefits for the working poor were originally meant to promote work over welfare dependency with gradual phase-outs. Fundamentally, I believe that meeting the Left’s demand that the minimum wage be set high enough to support not just a single individual but entire families, would result in far more people unable to find work of any kind — which, admittedly, to some on the Left is a feature, not a bug, as they’d just extend welfare benefits more permanently and generously to these people. (I also wrote about this, in “Minimum wage and the dignity of work.”)

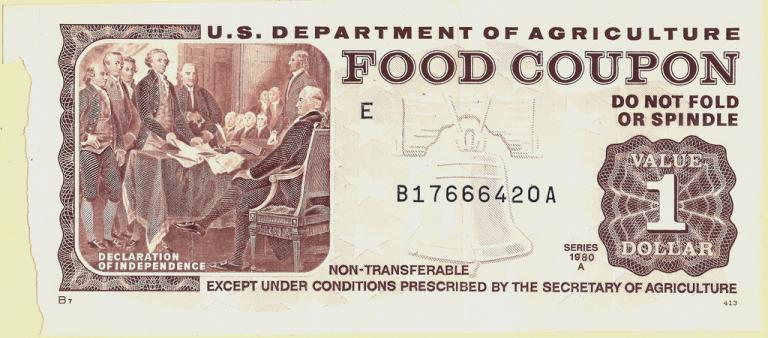

But here’s an article from yesterday’s Chicago Tribune, “Report: Taxpayers cover the costs of low wages.” The bulk of the article is a profile of three poor women: a 61-year old grandmother supporting her (presumably adult but non-working) daughter and granddaughter with a $12.20/hr job and a Section 8 housing voucher; a 29-year-old single mother of one earning $10.50/hour and receiving food stamps and Medicaid; and a 28-year-old mother of three earning a hypothetical $10/hr (that is, including tips that don’t often arrive) and receiving $400 in food stamps.

And the argument, which you’ve likely see before, is that companies benefit from low wages but taxpayers foot the bill in the form of government spending for food stamps and other welfare benefits for the working poor.

Authors of the NPA [National People’s Action] report point out that while paying lower salaries benefits corporations, it penalizes taxpayers who have to offset the cost of living for workers. Typically, the authors say, those low-paid employees must turn to public assistance in the form of housing vouchers, food stamps, discounted day care or child care programs.

According to the NPA study, 60 percent of the cost of public assistance in Illinois goes to families headed by someone who works. In addition, nearly 1 million people in Cook County live in poverty and either collect public assistance or qualify for it, the report shows. County taxpayers end up covering the cost of nearly $150 million in health care for the working poor. They pay millions more for child care and other expenses, Murray said.

Here’s the full report, as found on the group’s website.

This is nothing new — except, I suppose, that now at the same time we’ve got two parallel arguments being made by our politicians: we’ve got organizations demanding a minimum wage sufficient to eliminate daycare subsidies for the poor, and at the same time, we’ve got other groups saying that daycare is fundamentally unaffordable by anyone, so that it needs to be provided by the federal government for everyone (not just the poor) on a free or heavily-subsidized basis.

But what did strike me, the “brief observation” that I had in mind when I started typing this up, is this: the above-mentioned mother of three is eligible for up to $522/month in Earned Income Tax Credit, which can be paid out as additional amounts in her paycheck. One hopes this already is the case. For the mother of one, it’s $281. The grandmother may not be but that’s another story, if she’s obliged to support an adult daughter.

Is this, too, a “taxpayer subsidy of low-wage paying employers”? The NPA thinks so, at least to make their numbers more dramatic in their report. But it doesn’t ever seem to make its way into news reporting, presumably because of a recognition that the public at large doesn’t think so. It’s either simply not known or understood by the reporters writing these articles, or because it’s perceived of as coming through the “tax system” it’s simply viewed differently, as something owed to low-income individuals just as much as high-income individuals owe money to the government.

So my question is this: what would the public conversation look like, and what would the effects be, both good and bad, if both of these benefits, the food stamps and the EITC, were replaced by an equivalent cash assistance benefit that phases out as income grows?