Practical Spirituality series

I studied economics independently and through MIT. Semiotics gives us an idea of how we use this symbol in our mind.

We equate the value of everything with money. Money is the absolute. All things boil down to money.

“But those who want to get rich fall into temptation and a snare and many foolish and harmful desires which plunge men into ruin and destruction. For the love of money is a root of all sorts of evil, and some by longing for it have wandered away from the faith and pierced themselves with many griefs. But flee from these things, you man of God, and pursue righteousness, godliness, faith, love, perseverance and gentleness.” – 1 Timothy 6:9-11 (NASB)

Money is our object of lust, meaning we have an intense desire for money. Meaning in life becomes attached to money. For comparison, a sex object is in the mind of a person who only perceives others by their sexual attractiveness. I’ve known a lot of people like that. Objectifying is one of the problems with pornography. Porn enables people to objectify the person, meaning turning them into an object rather than a person and relationship. An individual directs their sexual energy towards this object rather than a relationship.

We can turn all of our energy toward money. It can become the only thing that is meaningful.

I independently lack wealth.

What has value?

The word money, or associated words, sums up what in our mind is valuable. Everything has a value or a price.

If we want to buy or do anything, there is a price tag attached. In the marketplace, all things are in competition. The price tag denotes not so much supply and demand, but how much we want the thing. Will that thing satisfy our desires?

An example is a university education. You can learn subjects at a slight cost, but we place a unique value on college. Currently, people without substantial wealth have to get loans to go to college. Pell Grants and scholarships can cover up to 26% of college costs. Work-study programs cover a meager $1800.00.

As a result, students who have aged over 50 are still paying off college loans, depending on their career and that of their spouse. Teachers shouldn’t have this eternal debt hanging around their necks. This practice is more akin to predatory lending (loan sharks) than assistance.

Generation Z is very hesitant to attend college. Of course, trade schools can be more helpful, but Gen. Z looks at the value of a college education compared to the cost. This has its impact on colleges. Many colleges have closed, one per week, and others are suffering because of rapidly rising college prices and lack of attendance. The number of colleges closing in the past 10 years has quadrupled compared to the previous decade. In the decade through 2022, college enrollment declined by 14%. In those colleges that closed, 55% of the students abandoned their college education.

For students, this means that money limits their choices in life. We have in place a system that limits choices, not by interest and talent, but by money. Money makes life goals unattainable.

Wealth transfer

Another aspect of this is wealth transfer. Loans are one way that wealth transfers from the near poor to the very wealthy. The billionaires of the world now hold more wealth than all nations combined, except two. The game is rigged in their favor. (I have nothing against wealth, capitalism, or the wealthy. But understanding there is a problem is key to resolving it.)

People value everything in terms of money. We may not think that we want to do this. But we play the game every time we want to do or buy something. We’re always confronted with the question: “How much is it worth to us, or does money make it impossible?”

Another example is housing. Housing prices have soared, which makes it extremely hard for first time home buyers to get a home. The average age of first-time homebuyers in 2023 was 35 years old. But the average age of mothers having their first child is 27.

Homes are economic decisions, not lifestyle decisions. Right now, it’s slightly less expensive to rent than to buy a home because of high interest rates. But renting hinders people from saving money for a down payment when they could build financial assets through owning a home that increases in value.

The middle and poor financial classes transfer wealth to the very wealthy through home rental and high buyer interest rates.

Consumer goods

Ignoring inflation in food prices for a moment, business decisions aren’t based on public preferences. They aren’t based on minimum profits. They are based on maximizing profits.

In the 1980s, one shampoo and conditioner was at the top of the market. Even Consumer Reports had it at the top of their list. A wealthy individual purchased the product and two years later it was off the market. Why? Consumer preference had nothing to do with it.

Recently a sandwich bread I eat from a local chain disappeared. It was about the only wheat bread I will eat. It had good flavor and from the size of the racks in the store it was a really good seller. In its place is a similar bread but not thin sliced or in as long a package as the sandwich loaf.

I can’t know the reason, but if people have to buy a standard size loaf, they have to purchase more packages for the same amount of slices. They also eat more calories per slice, which is not good.

One manufacturer I worked for designed a new piece of equipment. It was cheaper to manufacture than the previous product, but they charged more for it. Their goal was to double profit over 5 years despite minimal market growth. Another company used product licensing (lease for a year) to maintain annual profit while delivering negligible value to their customers. This is a common occurrence, and in response, some companies choose independently developed software products that are often free.

I can give a huge number of examples of product management and marketing driving business decisions about products. It matters less what customers want and more what can maximize profit. The yearly incremental gains in product capabilities illustrate that, while significant improvements can be made, they don’t lead to annual sales.

Profit is another way wealth is transferred from the middle and lower financial classes to the very wealthy. Investors demand high profit every quarter from businesses. This pushes up stock prices which makes stock more valuable. They put high pressure on businesses with public stock to cut costs and push up prices to maximize profit. To meet expectations, companies will even close product lines that don’t make enough profit to focus on ones that do.

The advantages of regulated capitalism

Capitalism has shown powerful advantages over systems like socialism. Socialist countries like China, Vietnam, and Cuba have adopted some of capitalism’s advantages. Both China and Vietnam have become financial powerhouses.

What advantages does capitalism have? Capitalism encourages individual initiative to create or improve products for the individual’s financial gain. It causes companies to be more competitive in services offered to the public. Historically, monopoly telephone companies took weeks to do repairs or replacement in homes, and innovation was very slow. Today repair and replace are done the same day or within days because monopolies were broken up. Competition also helps lower prices for consumers who are not subject to monopoly pricing.

The original ideas of supply and demand behind capitalism have not been a major feature of capitalism since regulation began in the 1800s. Without regulation, companies drive competition out of business so that consumers face monopolies who charge very high prices. There can only be one company – they consume all others.

Since the 1980s, company mergers have been a major feature of capitalism. With pressure to increase profits every quarter, many resort to buying other companies. This enables them to put the competitive company out of business and take their products for themselves into manufacturing and sales. This Merger Mania is unhealthy for consumers. Regulators have permitted companies to get away with a lot.

Consumerism

Competitive pricing has a disadvantage in lower product quality. Companies want people to buy their products frequently, so product quality goes down. The idea of a quality product that lasts is swiftly fading. Furniture, garden flowers including perennials, potting soil, audio equipment, everything you can think of has a limited life span. One to three years is typical. Only vehicles have improved in longevity over the decades.

Consumerism has a slight advantage of keeping people working, but what it also means is more frequent profits for the company. Quarterly profits make investors wealthier.

The result of a money-based world

Equating the value of everything by money encourages people to think primarily in terms of money. Money becomes the primary consideration in every decision. Much opportunity in the world is lost due to financial inability.

In developing countries, and to some extent the US, money and education exist in private circles which exclude other individuals. With limited educational and job opportunities, many people never achieve the dream of earning wages that enable a living wage. Good news: in the US and developing world, the percentage is increasing.

The horrid fact is that in our current system, for some to be very wealthy, others are forced to be poor. For some that means working multiple jobs just to house and feed their family. It means poor housing conditions for some. It even means living on the streets for some who are employed and for those who lose their jobs.

For the very wealthy, they will become even more wealthy by making money on the money they have. The wealthy don’t spend money to contribute the economy, they simply put it back in the stock market. As the wealthy reinvest their profits in the stock market, they do not pay taxes until they withdraw their money at the end of their time. The stock market doesn’t benefit most industry, it’s just a wealth building mechanism.

Making a money-based world fairer and just

The system is rigged to push money from the middle and poor financial classes to the very wealthy. The system is the problem. How do you make the system work for all? There are a number of ways.

For example, you can place a $1.00 tax on stock market transactions per share worldwide, which is negligible for customers who pay 2 to 3% on each transaction. You can’t do it for just one market because investors might flee to others as a knee-jerk reaction.

In 2023, the average daily volume of the US stock market was 11 billion shares and $515 billion. That would produce $11 billion each day which could assist others by $1 trillion each year. This could also help take the load off government and the taxes we pay. This could enable participatory investment revenue to bring money back to those who it’s taken from.

Looking at educational need, currently 56% of young adults get some kind of postsecondary education (meaning education beyond high school). The number of adults age 18 to 30 getting a postsecondary education is around 16,650,000. The stock market revenue could be used to defray cost and enable many more to attend.

Paying for community college would help. Community colleges are significantly cheaper than four-year institutions, with a cost ratio of approximately 1 to 10. Additionally, living at home is common until the age of 27, reducing the impact of this issue.

If you could assist 16 million people to get a postsecondary education, the stock market could contribute, minus administrative costs, $62,000.00 a year to each for education. Of course, colleges would react to these available funds by raising prices. But loans would go away.

This not only would help individuals, it boosts the economy. Stock market money, instead of being endlessly invested, would go into the economy. And through increased postsecondary education, if you count just half of what those with a bachelor’s degree contribute to the economy, this would mean a lifetime contribution of $130,000.00 going into the economy, while also contributing $22,000 more in local and state taxes, which fund public schools, civil services, infrastructure, and the arts.

The US prides itself on its world leading economy, yet in comparison it lags in many areas, I think because we love money more than people. Education is one example. In many countries, education is free or heavily subsidized. These include Mexico, Panama, Kenya, Norway, Malaysia, Iceland, Germany, Finland, Sweden, France, Denmark, Saudi Arabia, and Iran. Why is it the least able of many countries are better than the US in education?

A more equitable economy helps everyone

Poverty drives crime and drives up healthcare costs, and these are substantial costs we pay. Insecurity drives emotional eating which drives up medical costs and limits life span. A more equitable economy can lessen or eliminate these problems and the associated substantial costs.

More money going into the economy increases consumer purchasing, which drives 60% of business. More educated people also puts more money into the economy. These make us all more prosperous, including the wealthy. There is no downside to making the economy more equitable. It’s just having the will to care about other people.

Conclusion

Economic systems like capitalism don’t occur in nature. They are made by people and are controlled by people. “Pure capitalism” doesn’t exist in an invented system – it is a product of our own creation. It’s up to us to make this system work for all of us, not just for the few who accumulate enormous wealth.

Jesus didn’t favor one economic system or another. In his parables, he simply recognized the system in place in that day and asked people to use it wisely. We need to keep in mind that investing should mean investing in others’ futures, not just investing in more money.

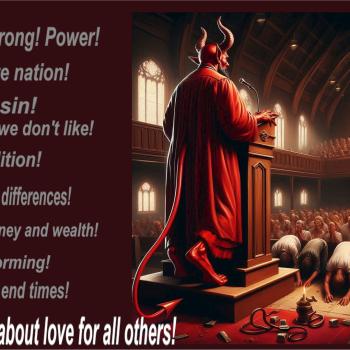

Money and wealth are neither good nor bad. It depends on how we value and use it. When money becomes the measure of everything, then money is our god. Money becomes everything.

In semiotic language, money is a symbol that represents our well-being, values, opportunity, and vehicle for attaining. Nothing else remains. Only the pursuit of money enriches our lives.

We haven’t all bought into this lie. Generation Z is practical and frugal. They want value for their dollar. Value fairly combines quality and cost. Things have no value when their cost is exorbitant, or when their longevity is short. As an example, since the 1980s, college tuition costs have outpaced inflation each year, 5% in just this last year, making college unaffordable for most people. The value isn’t there. 20 Years of Tuition Costs at National Universities.

We can make our economic system work for everyone. Opponents swear that sending money to the poor simply makes everyone poor. But if we devise mechanisms intelligently, we can make the system fair, harming no one but helping everyone. We can improve the system in various ways to benefit everyone without hurting the wealthy. Taxing stock market trades is just one of many ways that have negligible immediate impact and beneficial long-term impact.

Making capital available to marginalized groups through micro-loans is another way, if done cautiously. In developing countries, this has a major impact among the poor. A higher percentage succeed, 99.4%, than the 20% of US Small Business Administration loans that fail in the first two years, and 50% in a decade.

The way the banking system works is each dollar loaned is multiplied several times through redeposits. This benefits the economy and those who receive loans. It hurts no one.

What can you do? Become better informed about economics. Support ways to improve the system for everyone. Write your congressional leaders and tell them to get it done or get out.

We have the ability to make our economic system more fair to everyone without hurting anyone. We just lack the will to do it.

How Equitable Wealth Outcomes Could Create a Resilient and Larger Economy – St. Louis Federal Reserve

From Gaps to Growth: Equity as a Path to Prosperity – San Francisco Federal Reserve

Economic Inequality & Equitable Growth – New York Federal Reserve

MAKING AN EQUITABLE ECONOMY REAL. – We in the World

HOW TO MAKE AMERICA MORE EQUAL – IMF

40 Ways to Build a More Equitable America – Time

INCLUSIVE GROWTH – OECD

Preparing For The Future Of Work, Education, Economy – by Dorian Scott Cole. Two years of research and writing, but I give the ebook away for free.

Solving systemic and intractable problems in inner cities – by Dorian Scott Cole.

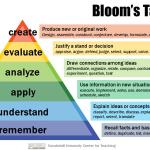

Probability Space

What probability spaces can we open in our minds to focus on how to eliminate the problem of income inequality? Can we think of harmless ways to extract money from the economy, or through investment, enable others and help them and improve the economy?

Potential Space

If you think creatively and allow your mind to wander and explore, how can we make the world more just and fair in the realm of income equality?

The world’s billionaires now hold a combined $14.2 trillion in wealth. This exceeds the GDP of every country in the world except the US and China. Is this a reasonable outcome of economic activity, or an affront to God?

– Dorian

Our answer is God. God’s answer is us. Together we make the world better.