In this election cycle we’ve heard a lot about the economy. Republicans have made the lack of jobs the center of their campaign strategy. R’s spend much of their time convincing everyone the economy is terrible and the president is to blame. D’s have run on the narrative that the stimulus bill kept America from the Great Depression 2.0, things are steadily getting better, but they need more time to work their plans.

What’s really going on? It’s not a short answer, and one of my chief frustrations is the inability of the normal workaday person to really understand the financial meltdown and all that happened after it. Unless you read the news all along, how do you catch up?

Yesterday I found a concise and informative info-graphic that can tell you the story of the U.S. economy for the past 5 years quickly and easily. If you read this it will help you to understand what really happened and thus not fall for the spin from the left or the right. Reading this could be the best 10 minutes you’ll spend this election season. I’ve done a summary here, but I highly recommend reading the entire infographic at good.is.

THE BOOM

In 2007 the economy was booming and everyone was confident – overconfident as it turns out. Investors and financial gurus were ignoring key data.

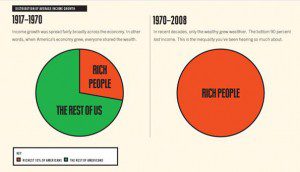

- Growing gap between the rich and the poor

- Financial system was growing beyond control

- Housing prices were inflated

- Healthcare costs were skyrocketing

The gap between the rich and the poor is an especially key problem…

THE BUILDUP

Income grew more slowly in the 2000s than in the previous thirty years. To compensate, people borrowed money – especially on home loans. Banks had so much cash (China was having their long over due industrial revolution & were flush with cash they invested in the American housing market), so those banks loaned to many folks who really shouldn’t have borrowed that much money. Everyone had too much confidence and too much debt.

THE CATALYST

First, there were some pre-existing conditions.

- The dot.com bust of the late 90s

- 9/11 happened

- War in Afghanistan

- War in Iraq

Then the sub-prime mortgage thing happened

- People who shouldn’t get loans got them – millions of them

- Banks sold those loans to investors

- Investors used those risky bundled loans as collateral to borrow more money

- With that borrowed money they bought more of the same risky loans

- Banks bought insurance on the loans

- Housing prices got way over-inflated

- People who never should have gotten a loan in the first place, started to default

- The house of cards fell down

2008

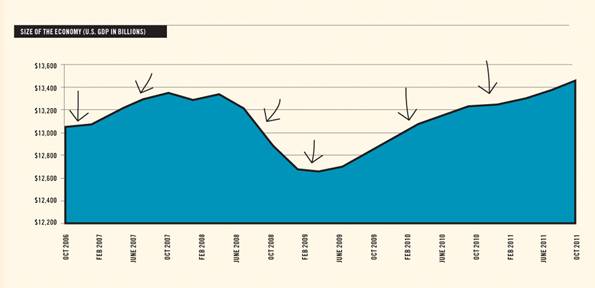

Nobody had money to spend so there wasn’t enough demand for goods and services. People started to lose their jobs, which meant there was less money and less demand, and fewer jobs. Less money > less spending > fewer jobs > less spending… That was the downward spiral.

RECOVERY

The government stepped in, first with the Bush stimulus, which was too small. Then with the Obama stimulus which stopped the freefall. They also began to regulate the bankers – but they have not done nearly enough. Obama must be held accountable for that. If he loses this election, I think this will be why.

Here’s where the politics comes in. Obama wanted another stimulus package in 2010 – a combination of a version of the earlier stimulus money and a jobs bill. Instead the Republicans in congress locked the country in a battle over the debt ceiling that caused a downgrade of the U.S. credit rating. Our credit rating fell not because of our debt, not because of a mistake by Mr. Obama, not because of our struggling economy, but because the Republican controlled congress created a trumped up crisis to win political points.

Then the European markets collapsed and remain in trouble. Even so, over the past few years our economy is growing faster than pretty much everyone except China.

What does all this mean? You’ll have to decide that for yourself. To me, it means that the sky is falling narrative about the economy rings untrue to me. At the key moment when a jobs/stimulus bill could have been the final push toward a healthy economy, the Republicans in congress not only refused to work together with Democrats to get it done, they played a game of Russian Roulette with the debt ceiling and made things worse. Despite all of that the economy is headed in exactly the right direction. Two more years and we’ll be out of the recession and on much more solid financial ground.

Here’s a link to the info-graphic. I highly recommend giving it ten minutes. You’ll know a lot more about our economy after you do.