Why Income Tax Is the Only Fair Tax

Whenever I make this case, someone jumps to a wrong conclusion. The person obviously does not read my whole essay! (I have written on this subject before and it has been published as a guest column in a local newspaper. Many who responded with letters to the editor made fools of themselves because they clearly didn’t read my whole essay!) I am not advocating adding an income tax to other taxes; I am advocating replacing all taxes for individuals with income tax.

When I was a boy growing up in a Midwestern state’s capital city, some government entity (I don’t know whether city, county or state) had a “tangible personal property tax” (TPP tax). My parents were so poor that the “tax man” came to our house almost every year to look at our furniture and other possessions because the tax office did not believe our possessions were so invaluable.

This “TPP tax” was to be paid on items such as furniture, jewelry, appliances, cars, savings accounts. Individuals and married couples had to file a form detailing their possessions and estimating their worth. Then a tax was imposed. I clearly remember the tax man going through our tiny house, opening drawers to look for jewelry, inspecting our furniture (all of which was bought used at Goodwill), etc. Then he would furrow his brow and say something like “Okay, well, I guess you reported correctly.” My parents struggled to pay that tangible personal property tax, as they struggled to pay for anything.

I don’t know if any government entity in the U.S. still has a “tangible personal property tax” like that—for individuals and families. My assumption is that particular tax was abolished because of its obvious regressive nature. But many, probably all, have a real estate property tax—which can be just as difficult for some people to pay—especially when it increases due to the rising values of houses and land. I have personally known of widows who had to sell their homes because, after their husband’s death, they could no longer pay the county assessed property tax.

The state where I live has no income tax for individuals and families; all taxes on individuals and families are sales tax and property tax. Yes, of course, there are also fees for various things such as automobile registration, etc. But my point is, these taxes are not based solely on ability to pay. Only income tax is based solely on ability to pay.

*Sidebar: The opinions expressed here are my own (or those of the guest writer); I do not speak for any other person, group or organization; nor do I imply that the opinions expressed here reflect those of any other person, group or organization unless I say so specifically. Before commenting read the entire post and the “Note to commenters” at its end.*

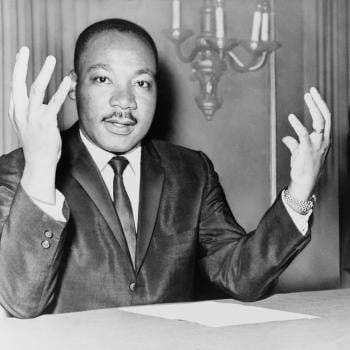

I was surprised recently to discover that none other than Martin Luther agreed with me about this! I’ve been reading books about Luther’s ethics and one of the most interesting and insightful is by German theologian-ethicist Karl Holl (d. 1926). Its English title is The Reconstruction of Morality (Augsburg). In the final chapter Holl, a highly regarded Luther scholar, described Luther’s ideas and attitudes toward secular government and society including economics. According to Holl, Luther believed the only just tax is the Old Testament “tithe”—whether exactly ten percent or slightly more or less—depending on the legitimate needs of the state.

Although I do not know whether Harvard University philosopher John Rawls (d. 2002) believed the income tax is the only fair tax, I believe his theory of “justice as fairness” supports that. (I also recently discovered that Rawls studied theology possibly with the intention of becoming a minister or theologian before switching to philosophy.)

According to Rawls, a public policy is just when it is the one most reasonable (not insane or deranged) people would agree to under the “veil of ignorance”—a hypothetical “original condition” in which people do not know their own, personal advantages and disadvantages. (See his massive book A Theory of Justice.) I believe under the veil of ignorance, in the original condition, all people would choose income tax as the only tax.

And, apparently, income tax (tithe) was the only tax God wanted for his people, so it must be difficult for any Jewish or Christian person to argue against one.

When I meet people who oppose a state income tax to replace all other taxes (for individuals, families) I ask them if they want the federal government to abolish income tax and replace it with sales and property tax. Normally they do not so wish.

Income tax is the only fair tax because it is the only tax based solely on ability to pay. According to Holl, Luther said as much. I may not always want Luther on my side, but in this case I’ll accept his support!

*Note to commenters: This blog is not a discussion board; please respond with a question or comment only to me. If you do not share my evangelical Christian perspective (very broadly defined), feel free to ask a question for clarification, but know that this is not a space for debating incommensurate perspectives/worldviews. In any case, know that there is no guarantee that your question or comment will be posted by the moderator or answered by the writer. If you hope for your question or comment to appear here and be answered or responded to, make sure it is civil, respectful, and “on topic.” Do not comment if you have not read the entire post and do not misrepresent what it says. Keep any comment (including questions) to minimal length; do not post essays, sermons or testimonies here. Do not post links to internet sites here. This is a space for expressions of the blogger’s (or guest writers’) opinions and constructive dialogue among evangelical Christians (very broadly defined).