One step up …

Mary Beth Quirk: “California Goes Gangbusters Against Abusive Lending, Passes Sweeping Foreclosure-Protection Law”

Hey, rest of the country that isn’t California! This is how you do it: California legislators went ahead and approved a sweeping bill on Monday that is basically a homeowner bill of rights, including ending abusive practices by mortgage lenders while at the same time helping homeowners evade the abyss of foreclosure. California ain’t kidding around.

While there are other states with similar legislation, this is among the most ambitious of its type in the nation, notes Reuters. It would prevent banks from “dual-tracking” — moving forward on foreclosures during the process of negotiating with homeowners over loan modifications.

As we reported before, lenders who reject a modification would also be required to provide a clear explanation for the denial. And if the process gets to the foreclosure stage, the lender would need to verify all related documents — and provide the homeowners with copies if requested. Filing unverified documents could result in fines up to $7,500 per incident.

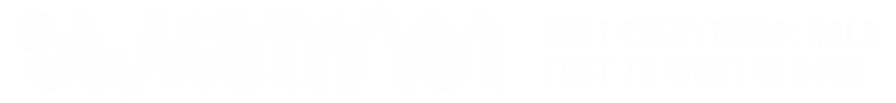

… And two steps back

Ethan Bronner: “Poor Land in Jail as Companies Add Huge Fees for Probation”

Three years ago, Gina Ray, who is now 31 and unemployed, was fined $179 for speeding. She failed to show up at court (she says the ticket bore the wrong date), so her license was revoked.

When she was next pulled over, she was, of course, driving without a license. By then her fees added up to more than $1,500. Unable to pay, she was handed over to a private probation company and jailed — charged an additional fee for each day behind bars.

For that driving offense, Ms. Ray has been locked up three times for a total of 40 days and owes $3,170, much of it to the probation company. Her story, in hardscrabble, rural Alabama, where Krispy Kreme promises that “two can dine for $5.99,” is not about innocence.

It is, rather, about the mushrooming of fines and fees levied by money-starved towns across the country and the for-profit businesses that administer the system. The result is that growing numbers of poor people, like Ms. Ray, are ending up jailed and in debt for minor infractions.

Jeff Tietz: “The Sharp, Sudden Decline of America’s Middle Class”

Prior to the Great Recession, [Janis] Adkins owned and ran a successful plant nursery in Moab, Utah. At its peak, it was grossing $300,000 a year. She had never before been unemployed – she’d worked for 40 years, through three major recessions. During her first year of unemployment, in 2010, she wrote three or four cover letters a day, five days a week. Now, to keep her mind occupied when she’s not looking for work or doing odd jobs, she volunteers at an animal shelter called the Santa Barbara Wildlife Care Network. (“I always ask for the most physically hard jobs just to get out my frustration,” she says.) She has permission to pick fruit directly from the branches of the shelter’s orange and avocado trees. Another benefit is that when she scrambles eggs to hand-feed wounded seabirds, she can surreptitiously make a dish for herself.

By the time Adkins goes to bed – early, because she has to get up soon after sunrise, before parishioners or church employees arrive – the four other people who overnight in the lot have usually settled in: a single mother who lives in a van with her two teenage children and keeps assiduously to herself, and a wrathful, mentally unstable woman in an old Mercedes sedan whom Adkins avoids. By mutual unspoken agreement, the three women park in the same spots every night, keeping a minimum distance from each other. When you live in your car in a parking lot, you value any reliable area of enclosing stillness. “You get very territorial,” Adkins says.

Each evening, 150 people in 113 vehicles spend the night in 23 parking lots in Santa Barbara. …