Last week, David French discussed how college — with its sky-rocketing costs — may not be the right answer for everyone. This week, we talk to those high school students (and their parents) who want to pursue higher education about how to do college right… without debt!

Zac Bissonnette, author of the new book Debt-Free U: How I Paid for an Outstanding College Education Without Loans, Scholarships, or Mooching Off My Parents is starting a new trend that Adam Daniels of the Huffington Post is calling “Debt Sexy:”

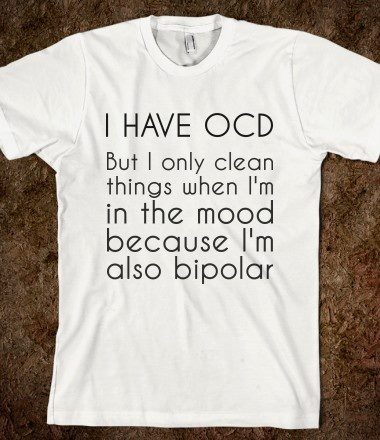

“I think there’s a problem in thinking that college has to be the best four years of your life,” Bissonnette said. “Well, if the best four years of your life puts you in so much debt that you can’t pursue the career that you want, you can’t have a family, you can’t buy a house, then that’s the worst four years of your life.”

Okay, so he’s got your attention. Don’t hold it against him that he’s a senior at the University of Massachusetts, Amherst majoring in art history. Somebody has to study art history, after all.

So why listen to him?

He’s living proof that you can get a good college education without going into years of debt — creating those “golden handcuffs” many of you are bound with as you trudge to the office to pay off those student loans. He argues that the diploma eventually hanging on your kid’s wall might potentially sabotage their entire financial futures.

Another reason to listen to this 22 year old is that he’s also a personal finance expert (at Daily Finance) who’s researched this subject for years. (Yes, even in high school. Investment expert Andrew Tobias called him “Doogie Howser meets the boys of Facebook.”) Though the book is written in a fun, conversational tone, he also includes hard data that’ll help you make better decisions about your kids’ futures by debunking certain myths:

1. “Student loans are NOT a necessary evil. Ordinary middle class families can- and must-find ways to avoid them, even without scholarships.”

2. “College “rankings” are useless-designed to sell magazines and generate hype. If you trust one of the major guides when picking a college, you face a potential financial disaster.”

3. “The elite graduate programs accept lots of people with non-elite bachelors degrees. So do America’s most selective employers. The name on a diploma ultimately won’t help your child have a more successful career or earn more money.”

He says parents shouldn’t take out student loans to pay for their children’s college, but goes further to say students shouldn’t either. In fact, it’s one of the worst things a student can do. Why does he make this claim, when 2/3 of college students today have borrowed to get there?

He writes:

“A 1998 Nellie Mae study found that 38 percent of student loan borrowers reported that their debt had prevented them from pursuing grad school. With the bachelor’s degree opening far fewer doors than it once did, graduate school will be a necessity for an increasing percentage of students: save your borrowing capacity for grad school.

“Also according to that Nellie Mae survey, “In 1997, 40 percent of borrowers said that their debt had caused them to delay buying a home. . . 22 percent said that their student loans had caused them to delay having children.” And remember: That was in 1998, when students were borrowing far less to pay for college than they are now.

“A 2007 study published by the National Bureau of Economic Research found that “debt causes graduates to choose substantially higher-salary jobs and reduces the probability that students choose low-paid “public interest” jobs.”

“And remember: Those are outcomes related to the sacrifices borrowers must make when they do make their loan payments. Borrowers who fail to make their payments can have their financial lives literally permanently ruined by the consequences of default.”

So what’s a parent to do? His book’s main theme is that “if you pick an affordable school, live within your means and work during college, college without loans, financial aid or parents looting home equity or retirement accounts is within reach.”

Don’t believe him? He broke down the calculations at Daily Finance in an article called “Yes, College Without Loans is Possible.”

However, this plan is not for the weak-willed as it requires diligence, short-term sacrifice and tight budgeting. Bissonnette encourages students that the long-term goal — of graduating debt free — is worth it, even if the journey is tough. “Whether this plan will work for your family depends on your character: are you willing to buck the culture of self-indulgent consumerism and short-sightedness and put your child’s best interest ahead of your desire to see them go to a fancy college and impress the neighbors? If you will make that commitment now, I promise you one thing: Debt-free graduates have much better lives.”

By: Zac Bissonnette

Buy it: here