![https://commons.wikimedia.org/wiki/File%3ARobertaylorhome.jpg; By The original uploader was Kaffeeringe.de at English Wikipedia (Transferred from en.wikipedia to Commons.) [CC BY-SA 2.5 (http://creativecommons.org/licenses/by-sa/2.5)], via Wikimedia Commons](https://wp-media.patheos.com/blogs/sites/533/2016/05/Robertaylorhome.jpg)

So the Chicago Tribune reported on a new report on affordable housing the other day, “The Gap,” by the National Low Income Housing Coalition.

As many of these types of reports do, it sets a marker for the proportion of income that one “should” be spending on housing (or another type of expense, such as childcare), and then measures states and metro areas to see how far they fall short of (or, rather, exceed) this metric.

Here’s the executive summary:

The Gap documents a shortage of 7.2 million affordable and available rental units for the nation’s 10.4 million extremely low income (ELI) renter households, those with income at or below 30% of their area median (AMI). Three-quarters of ELI renters are severely cost-burdened, spending more than half of their income on rent and utilities.

The report calls for greater federal investment in ELI rental housing through the National Housing Trust Fund (NHTF) and other housing programs. New rental housing affordable to ELI households is nearly impossible to produce without subsidies, and today’s major federal affordable housing production programs allow rents that are too high for ELI renters to afford.

Millions of ELI renters live in housing unaffordable to them. Expanding the affordable rental supply to which these cost-burdened ELI households could move would free up their current units for other households further up the income ladder.

Now, the reality is this: there are parts of the country where housing costs are out of balance due to high demand and low supply, and where the short supply is due to zoning regulations which limit the number of units which can be built, or which require units of a given size or amenity level, boosting costs, especially in areas which have relatively quickly become extremely popular. There are also issues around bubbles, and a public policy that has prodded Americans to “buy as much house as you can possibly afford” and nonsense where policymakers worry about the cost of housing but nonetheless cheer on rises in property values; and, depending on local funding of schools, property tax issues.

Authors such as Reihan Salam have written about the idea of “filtering” (see this piece, found via google, though I know I’ve seen more recent items on the topic) — the concept that the key to reducing the cost of housing is not necessarily to purposefully build less-expensive/subsidized housing, but just to build housing of any kind, because, over time, whatever type of housing is relatively less expensive will become affordable as supply and demand even out, and as the housing stock ages.

But this report addresses “filtering,” and says it won’t work, because, quite simply, the poorest households can’t afford to pay even that minimal amount of rent necessary to fund the basic costs of old units — repairs, taxes, utilities (which the report includes in housing costs). Accordingly, even in the Detroit area, where there are endless numbers of houses being sold for the price of back tax payments, they identify deficits in “affordable housing.”

Is this really an issue of “affordable housing”?

To begin with, the 30% marker that this report, and pretty much universally used, is pretty arbitrary, along with the 30% for food. Given that this 30% includes utilities as well, it’s well-nigh impossible for a poverty-level family to afford much of anything. Even at $20,000 annually, or 1,667 per month, that’s only $500 per month for rent, and, subtracting out utility costs, there’s not a heck of a lot left.

But what does this really mean?

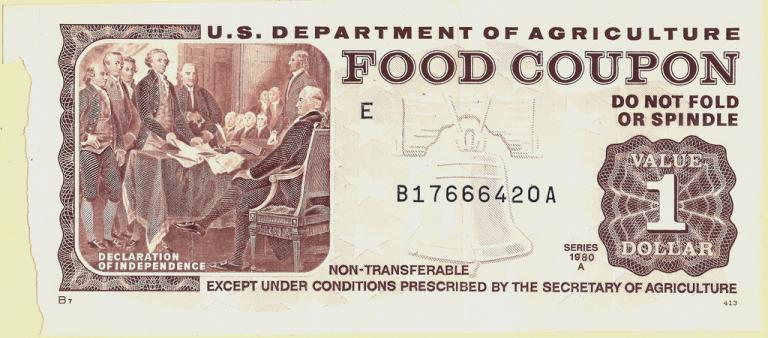

We have generally settled on a system of providing for the poor via vouchers/allowances rather than cash benefits because it alleviates concerns that the poor will misspend the money. Hence, food stamps, housing subsidies, utility subsidies, daycare vouchers, etc.– and of these, the most accessible are food stamps. But no one talks about “affordable food” in making the case for the benefit. And in the same way, we should be able to have a conversation about whether we provide housing vouchers for the poor, as a means of providing for their needs without giving out cash, without using labels like “affordable housing.”

What’s more, the concept of “cost-burdenedness” for poor households is purely based on this 30% metric, or an alternate 50% level. What does it mean to have a shortage of “affordable housing”? One would expect it to be a question of how many people are, in fact, homeless, or doubled-up (that is, not living with a roommate in a mutual and voluntary manner, but dependent on the charity of friends or relatives), or living in overcrowded conditions, or in units that are not fit for occupation. But the report doesn’t try to measure this and instead simply says, more generically, that spending “too much” on housing leads to forgoing needed medical care, or eating insufficient or insufficiently nutritious food.

All of which means that the report’s recommendation, that the government increase the amount it spends on housing vouchers and on government-owned public housing, pretty much misses the point.

Image: Robert Taylor Home(s); from Wikipedia: https://commons.wikimedia.org/wiki/File%3ARobertaylorhome.jpg; By The original uploader was Kaffeeringe.de at English Wikipedia (Transferred from en.wikipedia to Commons.) [CC BY-SA 2.5 (http://creativecommons.org/licenses/by-sa/2.5)], via Wikimedia Commons