After writing the Morning Report for today, I came across two articles I had to share — not because I agree with either in its entirety, but because both offer valuable information and perspectives. The first comes from Joe Nocera, and it’s a lot more even-handed than the title suggests. It’s called “How Democrats Hurt Jobs“:

Boeing’s aircraft assembly has long been done by its unionized labor force in Puget Sound, Wash. Most of the new Dreamliners will be built in Puget Sound as well. But with the plane so far behind schedule, Boeing decided to spend $750 million to open the South Carolina facility. Between the two plants, the company hopes to build 10 Dreamliners a month.

That’s the plan, at least. The Obama administration, however, has a different plan. In April, the National Labor Relations Board filed a complaint against Boeing, accusing it of opening the South Carolina plant to retaliate against the union, which has a history of striking at contract time. The N.L.R.B.’s proposed solution, believe it or not, is to move all the Dreamliner production back to Puget Sound, leaving those 5,000 workers in South Carolina twiddling their thumbs.

Seriously, when has a government agency ever tried to dictate where a company makes its products? I can’t ever remember it happening. Neither can Boeing, which is fighting the complaint. J. Michael Luttig, Boeing’s general counsel, has described the action as “unprecedented.” He has also said that it was a disservice to a country that is “in desperate need of economic growth and the concomitant job creation.” He’s right.

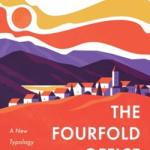

The other article I wanted to share is from the idiosyncratic judge-polymath, Richard Posner. He writes:

The problem is not the level of the debt but its growth. In the seven years between 2000 and 2007 (the last year before the financial crisis that triggered the current depression), the public debt grew in real (that is, inflation-adjusted) terms by 56 percent, the consequence of reckless spending and tax cuts by the Bush administration. Between 2007 and 2012 (the debt in fiscal 2012, which ends September 30 of next year, is of course an estimated number), a shorter period, the nation’s public debt will have grown by another 134 percent. The annual increase from 2009 to 2010 and the (estimated) annual increase from 2010 to 2011 are both 17 percent, and the estimated increase for 2012 is 18 percent. These annual rates of growth vastly exceed the rate of the nation’s economic growth even in prosperous times, and if they continue will bankrupt the federal government.

Posner proposes some possible solutions, and closes with these sobering words:

But it’s not clear that we have enough years. Suppose that the economy recovers by the end of 2012, and in 2013 and subsequent years grows at a 4 percent annual rate. (The long-term growth rate is about 3 percent, but growth is usually more rapid when it starts from a low level.) The public debt won’t continue to grow at 17 or 18 percent a year, but suppose it grows at 7 percent a year. Then the already very large federal deficit will continue to grow, and indeed, to compound: At a 7 percent annual growth rate, our public debt in 2012, estimated at $12.4 trillion, will grow by 40 percent in five years if none of the reforms designed to limit that growth are implemented before the end of that period. Yet if they are implemented while the economy is still struggling, the result may actually be to increase the deficit by driving tax revenues down (because incomes will be depressed) despite the elimination of loopholes, and by increasing transfer payments to the unemployed and others hard hit by the economic crisis.

The result is a quandary. I don’t see a way out of it. I hope others do.