Matt Stoller: “Mortgage Servicers: Getting Away with the Perfect Crime?“

The bad behavior is so rampant that banks think nothing of a contractor programming fraud into the software. This is shocking behavior and has led to untold numbers of foreclosures, as well as the theft of huge sums of money from mortgage-backed securities investors.

Here’s how the fraud works: Mortgage loan notes are very clear on the schedule of how payments are to be applied. First, the money goes to interest, then principal, then all other fees. That means that investors get paid first and servicers, who collect late fees for themselves, get paid either when they collect the late fee from the debtor or from the liquidation of the foreclosure. And fees are supposed to be capitalized into the overall mortgage amount. If you are late one month, it isn’t supposed to push you into being late on all subsequent months.

The software, however, prioritizes servicer fees above the contractually required interest and principal to investors. This isn’t a one-off; it’s programmed. It’s the very definition of a conspiracy! Who knows how many people paid late and then were pushed into a spiral of fees that led into a foreclosure? It’s the perfect crime, and many of the victims had paid every single mortgage payment.

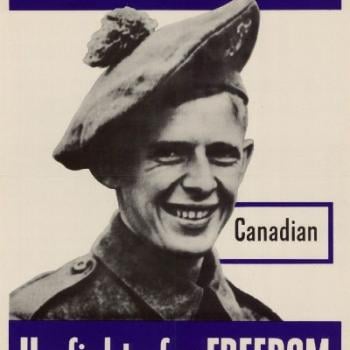

Pat Garofolo: “Banks May Have Illegally Foreclosed on 5,000 Members of the Military“

For months, major banks have been dealing with the fallout of the “robo-signing” scandal, following reports that the banks were improperly foreclosing on homeowners and, in many instances, falsifying paperwork that they were submitting to courts. Banks have been forced to go back and re-examine foreclosures to ensure that homeowners did not lose their homes unlawfully.

In the latest episode of this mess, the Office of the Comptroller of the Currency has found that banks — including Bank of America, Wells Fargo, and Citigroup — may have improperly foreclosed on up to 5,000 active members of the military. …

Yves Smith: “Federal Judge Refuses to Dismiss Bank Break-In Case Against JP Morgan, Lender Processing Services“

One case that got national attention was that of Nancy Jacobini. A company hired by JP Morgan to manage properties broke into her home while she was inside even though the property was not in foreclosure:

And to add insult to injury, the bank broke in a second time, after Jacobini had filed suit in Federal court. The lame excuses made, that she was not paying her utilities and had abandoned the house, were simply untrue. …

JP Morgan had no legal relationship to Jacobini at the time of the break ins. It has filed a robo-signed assignment of mortgage that post-dates the break-in. The practical implication is that random financial institutions are being allowed to barge into people’s properties, and the only recourse they have is a slow, costly adjudication.

Mike Konczal: “The Fed Scrambles to Save Banks, Stalls on Unemployment“

If we were to replace the FRB with a group of monkeys armed with darts, one would imagine that they would make at least a few projections above the actual rate of unemployment. It’s funny — the FRB tried to revise how bad unemployment is but doesn’t revise it anywhere near enough to lower it to where the economy actually is.

So to recap: Lehman Brothers goes worse than the Federal Reserve’s projection and the Fed goes to the most extreme lengths it can find to extend emergency lending. Every single unemployment number turns out to be worse than all of the Federal Reserve’s projections, and it finds every excuse to look the other way.

Nick Kristof: “A Banker Speaks, With Regret“

One memory particularly troubles [former Chase Home Finance vice president James] Theckston. He says that some account executives earned a commission seven times higher from subprime loans, rather than prime mortgages. So they looked for less savvy borrowers — those with less education, without previous mortgage experience, or without fluent English — and nudged them toward subprime loans.

These less savvy borrowers were disproportionately blacks and Latinos, he said, and they ended up paying a higher rate so that they were more likely to lose their homes. Senior executives seemed aware of this racial mismatch, he recalled, and frantically tried to cover it up.

Bryce Covert: “Dealing With Credit Card Companies Is a 99% Problem“

The newly operational Consumer Financial Protection Bureau established a Consumer Response office and a system for addressing consumer complaints [about credit card companies] when it launched in July. … Between then and October, consumers submitted 5,074 credit card complaints, which amounts to over 50 a day.

Only 50 a day? I guess they’re just getting started. …

Robert Johnson on “The bias toward creditors“

But the thing that surprises me most right now is why the big banks and bondholders aren’t much more aggressive in favor of fiscal stimulus. I mean things like 10-year infrastructure programs. I understand there are different philosophies of government between the right and the left, but I’m surprised more bankers aren’t saying we need to get people back to work. Austerity is never the endgame. It never works in the long run.

Merrill Knox: “While Reporting on Mortgage Fraud for KLAS, George Knapp Discovers He Was a Victim“

KLAS chief investigative reporter George Knapp made a disturbing discovery while reporting on Nevada mortgage fraud for “Desert Underwater,” the station’s series for sweeps: he was a victim of the very mortgage fraud he investigated.

As part of his reporting, Knapp interviewed a foreclosure attorney who told him that many people who purchase homes out of foreclosure have fraudulent paperwork associated with their chain of title.

“I gave her my address, because I bought a home out of foreclosure three years ago this month,” Knapp said in his report. “It took her all of about five minutes to call up the documents and identify the problem in the chain of title. The Attorney General’s office confirmed to me that I don’t own my home because of bogus signatures and improper filings.”

Brad DeLong: “Yes, the U.S. Government Ought to Own the Banks Now“

Without the Fed and the Treasury, the shareholders of every single money-center bank and shadow bank in the United States would have gone bust. …

When you contribute equity capital, and when things turn out well, you deserve an equity return. When you don’t take equity — when you accept the risks but give the return to somebody else –y ou aren’t acting as a good agent for your principals, the taxpayers.

Thus I do not understand why officials from the Fed and the Treasury keep telling me that the U.S. couldn’t or shouldn’t have profited immensely from its TARP and other loans to banks. Somebody owns that equity value right now. It’s not the government. But when the chips were down it was the government that bore the risk.

David Cay Johnston: “Closing Wall Street’s casino“

Credit default swaps that are just bets on which one party wins and which one loses would vanish if we restored the ancient, time-tested and therefore profoundly conservative rule that government will not enforce the collection of gambling debts.

Making gambling debts unenforceable produced its own problems. For one, it created work for people like the late Harry Coloduros, who sat in my kitchen 25 years ago, bouncing my little Molly on his knee as I made coffee, and told me about gamblers he beat up to make them pay up.

I cannot imagine Goldman Sachs hiring the likes of Harry to collect on bets when the losing party fails to pay up. So, unless taxpayers cover the bets, as they were forced to at 100 cents on the dollar in the AIG wagers, Goldman would likely get out of speculative bets and stick to actual hedging.

And that shows the immense value of restoring the sound policy of making losing bettors suffer their losses without any help from government.

It’s a good idea, although I don’t share Johnston’s confidence that Goldman Sachs wouldn’t “hire the likes of Harry.” Or simply hire Bloomberg’s “army” to act like the likes of Harry.