“Viral” hardly describes what happened to this recent article in The Atlantic. It’s called “The Secret Shame of the Middle Class”.

“Viral” hardly describes what happened to this recent article in The Atlantic. It’s called “The Secret Shame of the Middle Class”.

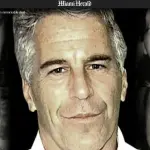

The author, Neal Gabler, is a well-known and well-respected writer. With naked vulnerability, he describes his own family’s descent into the “I can’t even find $400 to meet an emergency” situation.

Gabler doesn’t make excuses about some of the financial decisions he and his wife made (like expensive private schools and exclusive universities for their children) that ended up accelerating the decline. He also makes clear that what he did is pretty well what the rest of the middle class has done: spent with the historical understanding of rising incomes to support a middle class life style.

The whole article is worth reading, but for those in church work, where the sustenance of the churches comes primarily from the faithful giving of the middle class, this paragraph is particularly telling:

Wolff [researcher with the Russell Sage Foundation] also examined the number of months that a family headed by someone of “prime working age,” between 24 and 55 years old, could continue to self-fund its current consumption, presuming the liquidation of all financial assets except home equity, if the family were to lose its income—a different way of looking at the emergency question. He found that in 2013, prime-working-age families in the bottom two income quintiles had no net worth at all and thus nothing to spend. A family in the middle quintile, with an average income of roughly $50,000, could continue its spending for … six days. Even in the second-highest quintile, a family could maintain its normal consumption for only 5.3 months. Granted, those numbers do not include home equity. But, as Wolff says, “it’s much harder now to get a second mortgage or a home-equity loan or to refinance.” So remove that home equity, which in any case plummeted during the Great Recession, and a lot of people are basically wiped out. “Families have been using their savings to finance their consumption,” Wolff notes. In his assessment, the typical American family is in “desperate straits.”

Read that again: “the typical American family is in ‘desperate straits.'”

Three Options

The church faces three options here.

One, rely upon the very rich to keep the church going. Certainly, many of the wealthy are exceedingly generous, thanks be to God. But what happens when they die off, or have to go into assisted care and their children take over their finances, or when they do die or . . . what if they become unhappy with the direction the church is going and decide to go elsewhere and their giving along with it?

Two, dramatically reduce expenses. And for most churches, their major expense comes from payroll. Reducing payroll means fewer support staff and far fewer full-time clergy.

Two is the more likely outcome right now across the board. More than anything else, this financial malaise may become the major force in reshaping the church of the future.

But there is a third option: regain our Wesleyan heritage and begin aggressive teaching about the use of money in a way that is holy and freeing.

Take the lead in education about basic financial principles. There are good programs out there for churches to use. For those who have never sat down and actually listed all expenses and obligations and sought to match them to income, any program that insists on such an inventory can be a giant, often distressing but ultimately freeing, wake up call.

Remember, John Wesley assumed that part of the job of the church was to help people with health, family and financial issues. He preached a sermon called “The Use of Money” that is as relevant now as it was then. In many ways, Wesley was a meddler into the most intimate parts of human experience.

Again, notice the title of the article referenced above: “The Secret Shame. . . ” People are more embarrassed to talk about money than they are about their sex lives. Let’s change that.

The church at its best becomes a place of openness and vulnerability. This is an area where the church can and should have a powerful impact on this increasingly fragile and very afraid middle class: show a better way.

Clergy and lay leaders should all model basic financial responsibility. Share your stories with your own struggles and victories from the pulpit. Discuss what it means to give generously and how it has impacted you. Explain when it is right not to give money. Even better, work on becoming employment centers. Teach job skills. Open day-care centers. Start community gardens and kitchens. Consider partnering with local schools on an edible schoolyard project.

Let’s get this shame out of the “secret” stage and see how the church can turn shame into glory. That’s our job.