Many of you by now have seen this video:

(click here to watch it with Spanish subtitles)

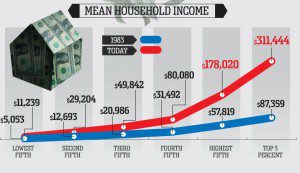

It is a few months old, but thanks to Upworthy and a few similar sites has made a big resurgence in recent weeks on social media. Today, a larger infographic was created, telling a bit more about what has changed in the last 30 years. Interestingly, if we look at the chart embedded on mean household income, the picture from 1983 looks a lot like what 9 out of 10 Americans (Democrats, Republicans, and the rest) see an IDEAL wealth distribution in America:

On the down-side, by breaking into 20% portions, the real inequality is masked (the top quarter of the lowest 20% pulls the rest up) and the extraordinarily high income of the top 1 or 2% is masked by the lower portions of the top 20%. Interestingly, the video points out that:

- People (again, 9 out of 10) have an ideal of some inequality, but it is a minimal inequalty which allows for social support for those who need it and rewards for those who work hard or (as is often the case) are just lucky.

- People believe wealth inquality is too great, but

- what they believe is the current state of wealth inequality isn’t even close to the actual state of affairs.

And for everyone else, the full “Life in America, 1983 vs Today” infograph:

And for Buddhist content, here is the Buddha recounting his advice to a king in a past life. Note: the context is one where the king wants to make a ‘great sacrifice’ because he’s so filthy rich. The Buddha convinces him of some better ideas and what the ‘best sacrifice’ is.

SPOILER: the best sacrifice is to renounce household life, go forth as a monk, and seek awakening, but that all comes later. first:

Your Majesty’s country is beset by thieves, it is ravaged, villages and towns are being destroyed, the countryside is infested with brigands. If Your Majesty were to tax this region, that would be the wrong thing to do. Suppose Your Majesty were to think: ‘I will get rid of this plague of robbers by executions and imprisonment, or by confiscation, threats and banishment’, the plague would not be properly ended. Those who survived would later harm Your Majesty’s realm. However, with this plan you can completely eliminate the plague. To those in the kingdom who are engaged in cultivating crops and raising cattle, let Your Majesty distribute grain and fodder; to those in trade, give capital; to those in government service assign proper living wages. Then those people, being intent on their own occupations, will not harm the kingdom. Your Majesty’s revenues will be great, the land will be tranquil and not beset by thieves, and the people, with joy in their hearts, will play with their children, and will dwell in open houses.

Kutadanta Sutta (DN 5) translated by Maurice Walshe

We could perhaps replace ‘king’ with corporate CEO if we are to talk about who controls the wealth, but most likely we would think of the Buddha instead talking to the President. Or we might look at it and say “yes, this is happening now, too – but the ‘theives’ ARE the CEOs.” However you see it, the Buddha’s advice of distributing grain to those raising crops (family farmers, not the corporate industrial operations), giving capital (low interest loans?) to those in trade, and to those in service (again think here of the lowest paid, not the fat-cats inside the beltway), assign proper living wages sounds like good and much-needed advice in our day.