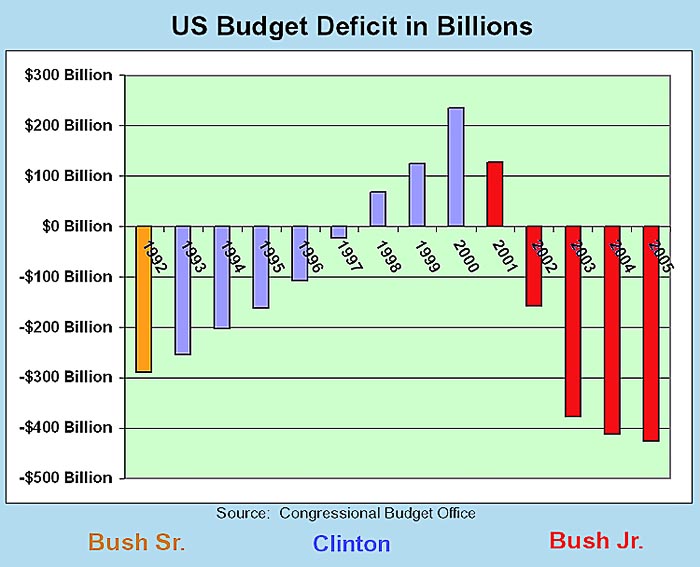

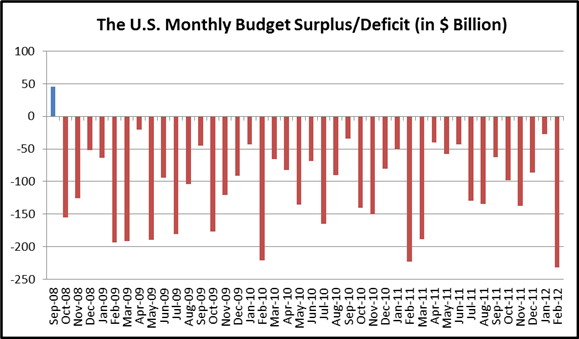

We all mostly agree that running deficits of over a trillion dollars each year can’t be good. Even the more liberal amongst us aren’t thrilled about it. And I know our kids aren’t going to be happy once they find out about it.

Maybe you agree with me and Senate Minority Leader Mitch McConnell that we have a spending addiction. Or maybe you agree with President Obama that we need to raise taxes more. Maybe both.

But seriously, if it were up to you, what would you do about it. Maybe it would help to think in terms of this scenario:

If you bumped into your congressperson today at the grocery store and he asked for your input on the national budget deficit, what would you say? You’d only have few minutes, so it would have to be concise and memorable because she didn’t bring any paper to jot down your remarks. And the cashier is waiting.

Call it crowd-sourcing, if you will, but I find I learn best when in conversation with others. Maybe you do to. Even if we don’t always agree.

So, if you only had a minute or two, what would you tell your congressperson when he or she asked, “What do you think we should do about our national budget deficit?”