“All economic news is bad,” said George Will, “especially good economic news, because it gives rise to bad behavior.” He was referring to the way the current prosperity has brought about a dangerous decline in savings rate. His words might also apply to yesterday’s stock market performance, when the Dow Jones Industrial Average plummeted by 1,175 points.

This was the biggest point drop in stock market history. What happened? Good news. There are more jobs and wages are up.

Higher wages raise fears of inflation. The prospect of higher prices sends bond prices up. With greater yields in bonds, investors sell off their stocks to buy bonds. Interest rates go up. Which means investors sell off their stocks to put their money in the bank.

Higher interest rates would also mean that companies that want to expand will spend more to borrow money. Lower stock prices means the companies are worth less. Eventually, that could mean job layoffs and lower wages. So in the vast cycle of the economy, lots of jobs could come to mean fewer jobs, and higher wages could mean lower wages.

So all economic news is bad, especially good news. But maybe the stock market dropping off a cliff is not as bad as it sounds.

The drop was the highest numerically, but it only amounted to 4.6% of the total valuation. The market is now about the same as it was in December. Another factor: computer-driven selling.

The fundamentals of the economy remain strong. Says economist Paul Donovan of the drop, “Economics has no part to play in this.” “Economically,” he says, “the world is doing fine – on track for trend-like growth.”

Besides, the meteoric rise of stock prices since Donald Trump became president–up 21% –just could not be sustained. We’ve had a bull market since 2009, the second longest in history. Nearly everyone has been saying a “correction” of 10%-20% is inevitable and necessary. Normally those corrections come on the average of every two years, so we shouldn’t be surprised if we finally have one, though this will require the market to fall even further. (We would be half-way or a quarter-of-the-way to a correction after today.)

Says fund manager Adrian Lowcock , a sell-off was “long overdue.”

Investors need to keep perspective, markets don’t go up in a straight line and falls of 5 per cent to 10 per cent are not as uncommon as the last 18 months may have led some to believe. The economic outlook is still positive. The tax reform in the US is supportive of corporate profitability and earnings are still expected to grow which supports market valuations.

This puts the best construction on what happened. And yet others have warned of a catastrophic “stock bubble” that is bound to burst, with disastrous consequences.

What do you make of all of this? Are there other factors at work? Television did its familiar split screen with one side showing President Trump giving a speech bragging on the the state of the economy and the other side showing a graph of the plunging stock exchange numbers. What will be the political fall-out, if any? Do you see any solutions, or do we just need to let it all ride?

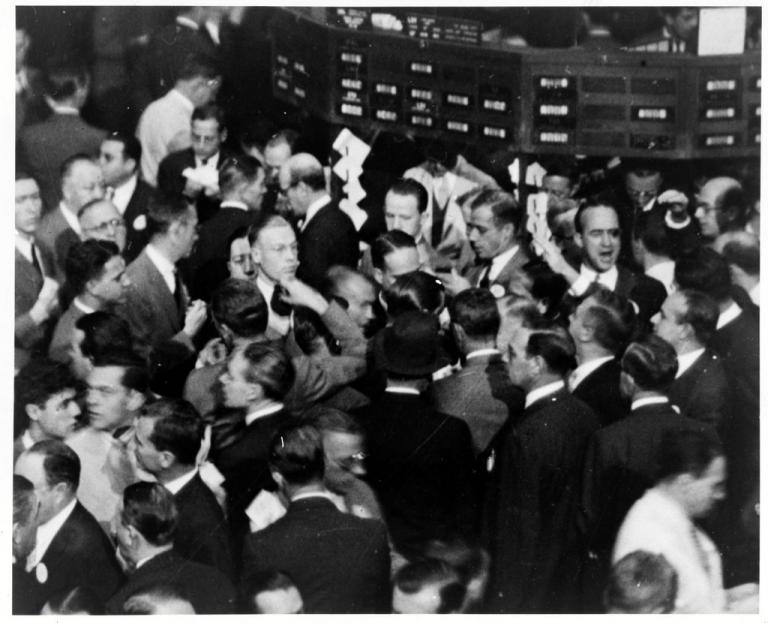

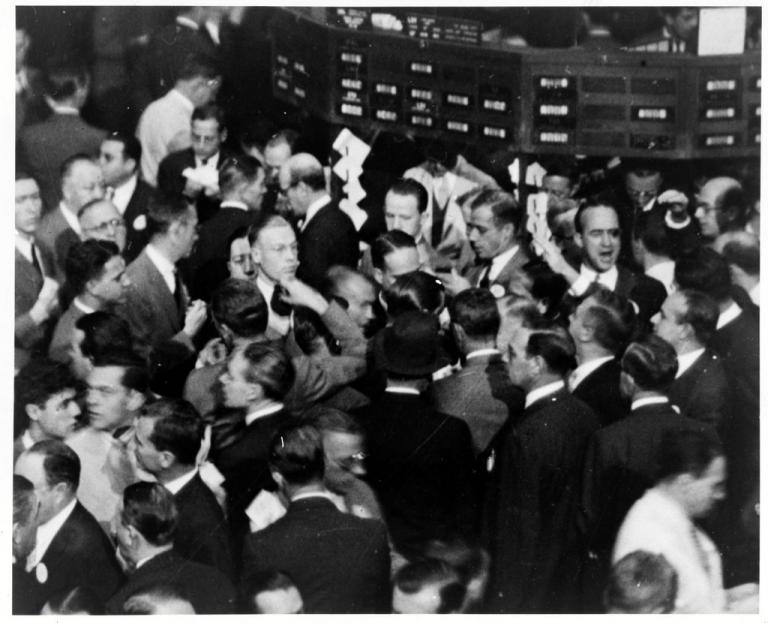

Photo: Traders on the Floor of the New York Stock Exchange, 1936, Library of Congress, Public Domain, via Flickr