Inflation has reached an annual rate of 8.5%, the highest growth in prices since the Jimmy Carter era.

That is bad enough. But, as Elle Reynolds has pointed out, the cost of everyday items that ordinary Americans have to buy has gone up even more.

According to the Bureau of Labor Statistics (BLS), in the average U.S. city, ground beef is up 14.9 percent since last March, boneless stew beef is up 24.3 percent, bacon is up 23.1 percent, boneless chicken breasts are up 17.6 percent, eggs are up 25.9 percent, milk is up 17 percent, frozen orange juice concentrate is up 18 percent, and ground coffee is up 15.8 percent. Meanwhile, fuel oil has jumped a whopping 71.5 percent, and utility gas is up 23.3 percent. . . .

According to a Redfin analysis, February saw a 15 percent year-over-year increase in asking rent, and a 31 percent jump in the national homebuyers’ median monthly mortgage rate. Americans in the market to buy used vehicles have also seen a far higher price spike than the overall inflation rate in the past year, at a whopping 41.2 percent as reported in March.

As for gasoline, a commodity that is not only a major expense for individual Americans but also impacts the cost of everything that is shipped throughout the country, the average national price for a gallon of gasoline this time last year was $2.87. Last month it was $4.23. That’s an increase of 57%.

In states with high gasoline prices, drivers are paying much more. Californians are paying more than $5, with drivers in Los Angeles paying more than $6.

True, prices have come down a little bit in April, with the latest average I’ve seen being $4.11. But we aren’t even in summer yet, with its peak demands that always sends prices up. Also, more and more countries are slapping embargoes on Russian oil, which will further cut global supplies and send prices even higher.

All of this hurts American families.

Why is this happening? President Biden is blaming Putin’s invasion of Ukraine and supply chain problems caused by the COVID pandemic. Those are factors, but inflation began soaring well before Russia’s invasion and it’s more accurate to say that supply chain problems were caused by the government’s COVID policies, which have contributed in a larger way to today’s inflationary economy. Progressives like Senators Elizabeth Warren and Bernie Sanders are blaming companies for simply charging too much so as to increase their profits, as if pricing had nothing to do with economic conditions.

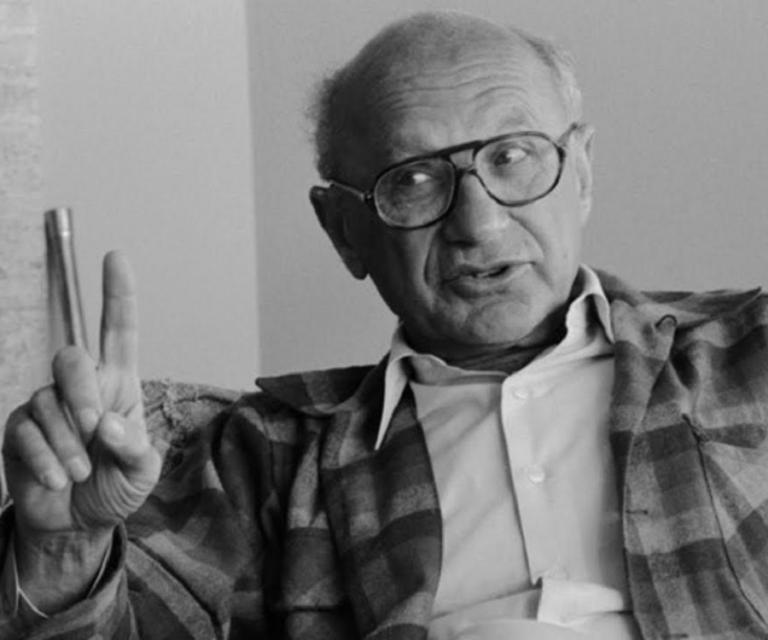

Nobel Prize-winning economist Milton Friedman showed that “inflation is always and everywhere a monetary phenomenon that is produced only by a more rapid increase in the quantity of money than output (goods, services, and/or assets).”

As Andy Kessler has pointed out, “In March 2020 the money supply was $16 trillion, it’s now $21.8 trillion.” Much of increase came from printing money for COVID relief. Shutting down businesses and paying workers not to work cut the supply of goods and services. Giving free money to the public increased demand. Of course this would result in supply chain problems and higher prices. How could it not?

(See Veronique de Rugy’s analysis of what triggered inflation and how even by the terms of non-free-market Keynesian economics, government spending is causing inflation.)

Progressives are wanting to fight inflation by having the government pay subsidies or give tax rebates to help cover expenses for housing, childcare, food, and gasoline. That is to say, by increasing government spending! They would also impose excess profit taxes on companies. That is to say, by decreasing production! Also being considered are price controls, which those of us alive in the 1970s will remember. As Kessler points out, “Price controls don’t work. Never have, never will.”

In 1971 President Richard Nixon announced, “I am today ordering a freeze on all prices and wages throughout the United States.” We got new government entities: a Pay Board and a Price Commission. Americans paid for this mistake for another decade. Farmers drowned chickens rather than send them to market. Store shelves emptied. Price controls contributed to long lines at gasoline stations in 1973 during the Arab oil embargo. It’s pretty simple: When you freeze prices too low, producers stop producing.

What would bring inflation down? Kessler says,

Want to whip inflation now? Forget all the Band-Aids and government controls. Instead, as Friedman suggests, stop printing money. Stop stimulus. Raise interest rates to above the prevailing inflation rate. Prices will adjust naturally. The market works best when it sets prices.

This is how Ronald Reagan and his administration brought us out of the Nixon/Carter economic malaise. That medicine hurt for awhile, but it led to a new era of prosperity.

President Biden said on the campaign trail, “Milton Friedman isn’t running the show anymore.”

But economics is not just a matter of ideology, as if we could implement one economic theory rather than another, like different systems of government or different policy strategies. There are certainly debates among economists and different theories about how facets of the economy work. But economics has to do with economic laws. Principles about the money supply and the relationship between supply, demand, and pricing are operative no matter what political ideology is governing the country.

As George Leef says in response to President Biden and the inflationary consequences of ignoring Friedman’s insights, “This is just economic reality. It doesn’t matter who is ‘running the show.’”

But it would help if those who are “running the show” understood economic reality.

Photo: Milton Friedman, http://www.thefamouspeople.com/profiles/milton-friedman-167.php, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons