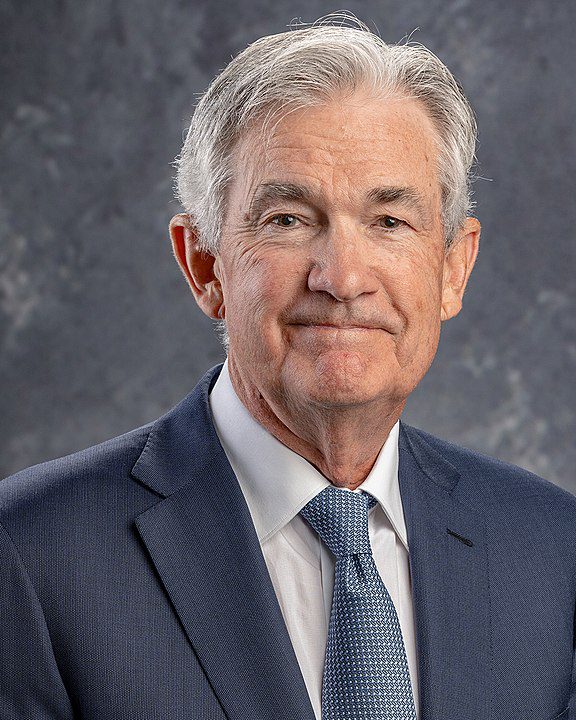

Federal Reserve chairman Jerome Powell has said that he is going to get tough on inflation, raising interest rates like his Reagan-era predecessor Paul Volcker did in the 1980s, even though that might mean “pain” in unemployment and recession. What he didn’t say is that he and his institution played a big part in making the mess that he is now trying to clean up.

Business reporter Christopher Leonard explains what happened in an article for Politico, which is emphatically not a conservative site. Read it all, but I’ll give you an excerpt, including the most lucid explanation of “quantitative easing” that I have come across.

Leonard notes that in Volcker’s day, when we last had to battle soaring inflation, the government’s debt was $907 billion, which came to 30% of the entire economy, which was considered bad enough. Now the debt is $28 trillion, which comes to 125% of the entire economy. That is to say, our government owes 25% more than the nation’s entire economic output.

It was the Fed’s own experiments that helped create all this national debt in the first place. The Fed did so through an experimental program called quantitative easing, or QE. The importance of QE can’t be overstated. Under this program, the Fed created about 9 trillion new dollars between 2008 and today. (To put that in perspective, the Fed created only about $1 trillion in its first 95 years of existence. So it has printed 900 years’ worth of money in a little over 10 years, when measured against its historic rate.) All that money was injected straight into the Wall Street banking system, pumping up the very markets, like stocks and bonds, that are now threatened by the Fed’s tightening.

Here’s how it worked: The Fed would call up a banker at a place like J.P. Morgan and ask to buy $8 billion in Treasury Bonds from the government. Only about 24 banks — including J.P. Morgan — can sell Treasury Bonds directly to the Fed because those banks had a special designation as a “primary dealer.” When the Fed buys $8 billion in Treasury Bonds from a primary dealer, it does so by creating 8 billion new dollars out of thin air. The dollars instantly appear inside a special account the banks have inside the Fed, called reserve accounts. The Fed repeated this transaction over and over again until it had created the trillions of new dollars inside Wall Street’s reserve accounts.

And here are the consequences (in addition, I would add, to inflation as more and more money chased fewer and fewer goods thanks to the pandemic and supply line crisis):

This buying spree had the secondary impact of pumping up the market for U.S. debt because it made it cheaper for the U.S. government to borrow money. It was simple supply and demand. Every time the United States went to market to sell bonds and raise money, the Fed was there as a buyer. In the year or so after the Covid pandemic began, there were periods when the Fed was buying the vast majority of U.S. debt being sold. This meant that the government didn’t have to offer to pay high interest rates to entice people to buy its debt; the Fed was always there to buy. This kept 10-year-Treasury interest rates historically low since 2009. During 2020, when the Fed was buying trillions in Treasurys, the rate was almost zero. It’s hard to overstate what a huge effect this had on the ability of the U.S. government to borrow money. By May of this year, the Fed owned 25 percent of all outstanding U.S. Treasury bonds. It owned 38 percent of all long-term Treasury bonds that mature in 10 or 30 years.

The abundance of cheap debt has helped Washington borrow record amounts of money to pull off a seemingly impossible fiscal trick: increasing spending each year while also cutting taxes. This means that the government has borrowed about as much money as it actually raised in taxes this year, making annual deficits a normal part of the budget rather than something done in times of emergency.

Now that the Fed is raising interest rates, government borrowing gets more and more expensive. “All of this means the fastest growing part of the U.S. budget could be the line item to pay interest costs,” Leonard concludes. He quotes the president of the Committee for a Responsible Federal Budget: “’Whether you’re a big government person who wants to spend a lot more, or a small government person who wants spending to come down, neither of those gets first claim to the dollar. The first claim on dollars is always interest payments,’ MacGuineas said. ‘It’s absolutely going to crowd out other priorities.’”

Already our interest payments come to $590 billion, which is about what we pay for national defense. And it’s going to get much, much worse. How, for example, will we be able to pay more for national defense in order to replace all of the military equipment we abandoned in Afghanistan and have given to Ukraine? Let alone invest in the upgrades and new technology necessary to hold our own with China? Add in other priorities that you think the government should be spending on.

Can’t we keep borrowing our way out of the problem? Leonard says that without the Fed buying the treasuries, the government is having a harder time selling them. He cites recent auctions that had a record low number of participants bidding for them, with foreigners not wanting to buy American debt as they used to. Can’t we just keep raising the rates we pay until they do? Well, that would raise interest rates even more for the entire economy. The point is, the entire global financial system is now at risk, thanks to the Fed’s “experiment,” and there may not be anyone to bail us out.

Taxes will have to be raised dramatically. And/or government spending will have to be cut dramatically. Perhaps that second alternative would be a happy ending, leading to the smaller government that conservatives have been calling for.

Yes, Jerome Powell was appointed by President Trump, who benefited from his ability to cut taxes while presiding over a flush economy, and President Biden was happy to reappoint him to help finance his gargantuan spending sprees. But Powell wasn’t the first to practice Quantitative Easing, which began under George W. Bush, continued through the Obama Administration, and became an accepted tool in the course of dealing with the financial crises of the 2008 housing market collapse and the COVID shutdown.

But the day of reckoning approacheth.

Do you know of any politicians who have a plan to set our financial house back in order?

Photo by Federalreserve – Official portrait of Jerome H. Powell, Chair: Powell_Jerome_Aug_16_22-674_8x10, Public Domain, https://commons.wikimedia.org/w/index.php?curid=122785274