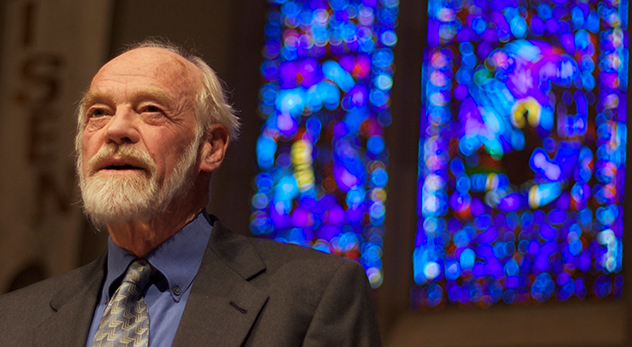

A conversation with Ben Zoba, Part 1 of 5

The post-holiday season stands as a stark reminder to a majority of Americans of the raw force of being in debt and the panic that is often associated with that.

In this series of five podcasts, in conversation with Benjamin Zoba,  I will be exploring the unsettled, sometimes hostile relationship between persons and their money. Ben is an organic farmer and community activist in a small town north of Boston who, in addition to farming and managing a food co-op, in his off-season time has spent several years studying the current money system and how it works. As a result of his studies, Ben is seeking to advance positive and alternative ways to creatively engage citizens under a new paradigm of economic exchange.

I will be exploring the unsettled, sometimes hostile relationship between persons and their money. Ben is an organic farmer and community activist in a small town north of Boston who, in addition to farming and managing a food co-op, in his off-season time has spent several years studying the current money system and how it works. As a result of his studies, Ben is seeking to advance positive and alternative ways to creatively engage citizens under a new paradigm of economic exchange.

As a matter of full disclosure, Ben is my son, which is how I have been exposed to his ideas and have become intrigued by them. Notwithstanding, his ideas are compelling and worthy be explored in the marketplace of ideas. While he does not presume to be an expert on the intricacies of these matters, he speaks smartly and with the passion of a man under conviction. He believes that what is at stake under the current money system –which often adversely affects so many — is a gospel issue affecting the spiritual and cultural development of societies and their citizens.

This discussion will span a series of five podcasts posted weekly on Poets & Lunatics, covering topics such as the difference between interest and usury; the role of the Federal Reserve; and thoughts toward forging a new paradigm for how we view and exchange goods and services.

Through these conversations, Ben hopes to open up a conversation, and explore and consider a new way toward creative possibilities for the way we “do” money.

Listen to Part 2 here.