More from George Will on the debacle in Greece:

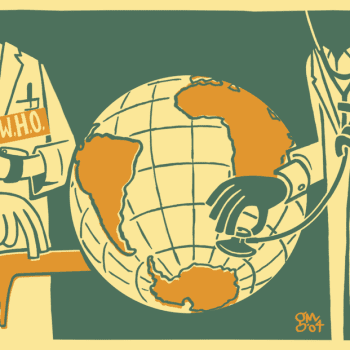

Greece, whose gross domestic product is below that of the Dallas-Fort Worth metropolitan area, is “too big to fail,” meaning too inconveniently connected to too many big banks. Bailing out Greece really rescues European banks that improvidently bought Greek bonds. Visit http://tinyurl.com/2dzaul2 for a useful New York Times graphic illustrating how European nations borrow from one another. For example, Italy owes France French banks $511 billion, a sum nearly equal to 20 percent of France’s GDP. About one-third of Portugal's debt is held by Spain, which has $238 billion of its debt held by Germany and $220 billion by France. Russell Roberts of George Mason University notes that this “discourages prudence and wariness” because when “everyone has financed everyone else, you can justify bailing everyone out.”

At the Parthenon last week, the Greek Communist Party, which got 8 percent of the vote in the last national election, draped banners emblazoned with the hammer and sickle: “Peoples of Europe Rise Up.” Of course. “Arise ye prisoners of starvation” exhorts “The Internationale,” the left’s ancient anthem. But who is to arise against whom?

Time was, the European left said it spoke for horny-handed sons of toil oppressed in dark Satanic mills. But Athens’ “anti-government mobs” have been composed mostly of government employees going berserk about threats to their entitlements. Even Greek air force pilots went on strike. The government, unable to say how many employees it has, promises to count them. It cannot fire many of them because Article 103, Paragraph 4 of the Greek constitution says: “Civil servants holding posts provided by law shall be permanent so long as these posts exist.”

America’s projected $9.7 trillion in budget deficits in this decade will drive the nation’s debt to 90 percent of GDP Greece’s is 124 percent. So some people say that to avoid a Greek-style crisis, America should adopt a value-added tax VAT. But Europe’s most troubled nations — the PIIGS: Portugal, Ireland, Italy, Greece and Spain — have VATs of 20 percent, 21 percent, 20 percent, 21 percent and 16 percent, respectively. As part of its austerity penance, the Greek government is going to give itself more money by raising its VAT to 23 percent. . . .

Greece now knows the terrific strength of weakness. Beware of Greeks — or any other people — receiving gifts.

via George F. Will – Greece and GM: Too weak to fail.