The old complaint was that big corporate retailers like Wal-Mart and Borders were putting the local mom ‘n’ pop stores out of business. But now buying on the internet is making even the big box stores obsolete, as people from every corner of the nation are buying what they need online without the need of any local stores.

Not only that, the online retailers have a big price advantage. Part of that comes from not having to charge sales tax, which can add upwards of 10% to the cost of a product. Local stores report how they are being reduced to showrooms for online companies, as customers go to actual stores to check out the merchandise and then buy it online. Sometimes they do so on their smart phones while they are still in the store.

Now states, desperate for revenue, and local businesses are pushing for internet operations to charge sales tax. More and more states are passing laws to this effect. Now the federal government is getting into the act. A bill before Congress, with lots of bipartisan approach, would make it easier for collecting sales tax to become routine across the internet.

The latest federal proposal — the Marketplace Fairness Act — has strong bipartisan support and appears to be moving forward. . . .

The bill proposes that a state can decide whether to enforce collection of its sales tax. If the state chooses to, then it should simplify its tax system according to conditions outlined in the bill.

Sales tax rates generally range from 5 to 10 percent, depending on the type of product as well as the jurisdiction (cities and counties can impose their own taxes on top of state rates). In Maryland and the District, many items are taxed at 6 percent, while in Virginia, the sales tax generally hovers around 5 percent.

Traditional retailers with an online presence, such as Barnes & Noble, Wal-Mart and Target, also support the bill, as do groups such as the National Retail Federation and the Retail Industry Leaders Association.

On the other side is NetChoice, the trade association of e-commerce companies. NetChoice has opposed sales tax collection and overturning the physical-presence ruling by the Supreme Court. Its argument, which Amazon has used in the past, is that tax calculation for thousands of jurisdictions countrywide is an impossibly complicated task.

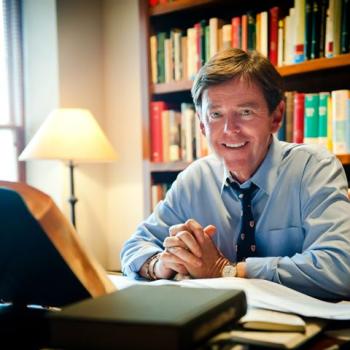

“The burden falls disproportionately on a small business,” said Steve DelBianco, executive director of NetChoice. “It has no accounting or IT staff to keep track of tax rules and holidays.”

The new bill exempts online businesses making less than $500,000 a year from collecting sales tax. NetChoice says that threshold is too low. It also notes that the amount states will gain from online sales taxes is less than 1 percent of total state tax revenue.

The measure, sponsored by Sens. Mike Enzi (R-Wyo.), Richard J. Durbin (D-Ill.) and 12 others, was introduced in November. The House Judiciary Committee is set to hold a hearing on it July 24.

via States, Congress rallying for an e-sales tax – The Washington Post.

What do you think about this? Can you formulate an argument why this is not a good idea on grounds other than just not wanting to pay more?