By now, you’re probably aware that Donald Trump gave a speech on economics yesterday. You may be less familiar with a particular piece of his speech—the bit where he addressed making childcare more affordable. As you may remember, affordable childcare played an important part in his daughter Ivanka’s speech at the Republican National Convention. How does Trump propose to fix the high costs of childcare, which often price women out of the job market entirely? Like this:

My plan will also help reduce the cost of childcare by allowing parents to fully deduct the average cost of childcare spending from their taxes.

If you’re familiar with how taxes work, you’ll recognize that this is a terrible solution. Here is how twitter user and self-described econ wonk Michael Linden explained it:

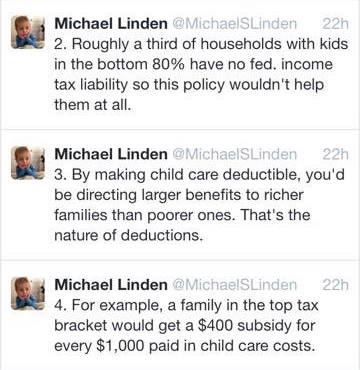

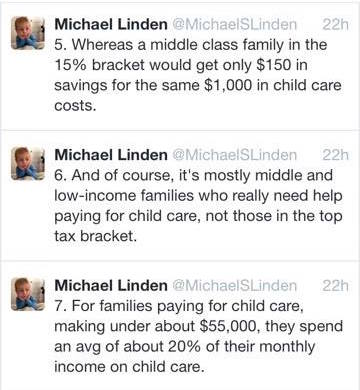

Here is the text of Linden’s tweets, which he helpfully numbered:

1. Making child care fully tax deductible is just about the worst possible way to help subsidize the cost of child care.

2. Roughly a third of households with kids in the bottom 80% have no fed. income tax liability so this policy wouldn’t help them at all.

3. By making child care deductible you’d be directing larger benefits to richer families than to poorer ones. That’s the nature of deductions.

4. For example, a family in the top tax bracket would get a $400 subsidy for every $1,000 paid in child care costs.

5. Whereas a middle class family in the 15% bracket would get only $150 in savings for the same $1,000 in child care costs.

6. And of course, it’s mostly middle and low-income families who really need help paying of child care, not those in the top tax bracket.

7. For families paying for childcare, making under $55,000, they spend an average of about 20% of their monthly income on child care.

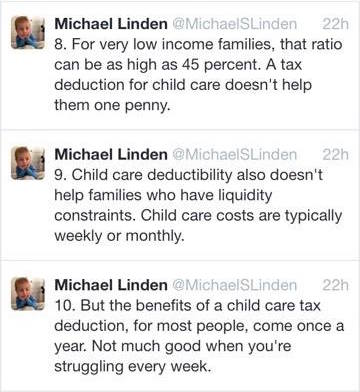

8. For very low income families, that ratio can be as high as 45 percent. A tax deduction for child care doesn’t help them one penny.

9. Child care deductibility also doesn’t help families who have liquidity constraints. Child care costs are typically weekly or monthly.

10. But the benefits of a child care tax deduction, for most people, come once a year. Not much good when you’re struggling every week.

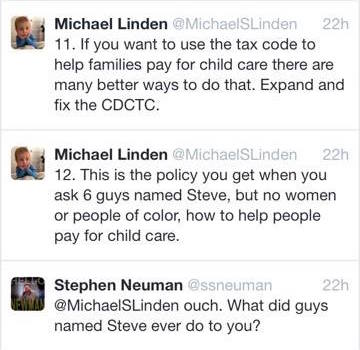

11. If you want to use the tax code to help families pay for child care there are better ways to do that. Expand and fix the CDCTC.

12. This is the policy you get when you ask 6 guys named Steve, but no women or people of color, how to help people pay for child care.

A tax deduction exempts a certain amount of your income from income tax. The mortgage tax deduction is an example of this—any money you spend on mortgage interest is deducted from your income for the purposes of federal income tax. Unfortunately, tax deductions tend to benefit the wealthy more than they do the middle class (who have lower tax brackets) or the poor (who may not have any federal income tax liability to begin with). This is a rich man’s solution to the problem of childcare costs. Given that it was a very rich man giving this speech, this is perhaps not surprising. It should, though, be soundly troubling. We need childcare solutions that center the needs of the poor and middle class.

Let’s be real here: According to Linden’s numbers, Trump’s proposal would do nothing at all for one third of families with kids in the bottom 80%. That’s an awful lot of poor families who would gain nothing at all—no increased ability to pay for childcare, no nothing. Many states do offer childcare subsidies for the poor, but those subsidies can be difficult to obtain and often have long waiting lists. I had a friend several years back who couldn’t get on the waiting list because she didn’t have a job, but couldn’t get a job because she didn’t have childcare.

What is the CDCTC Linden mentions? It’s the Child and Dependent Care Tax Credit included in our tax code. A tax credit works differently from a tax deduction. A tax credit is money the federal government hands you. It either cancels out part of the taxes you would have had to pay or is simply handed to you. If your credit is $3000 and you are on the hook to pay $2000 in federal income tax, you will be handed $1000. If your credit is $3000 and you are on the hook to pay $8000 in federal income tax, you will have to pay $5000. The problem with the CDCTC is that it is limited to $3000 per child, up to a total of $6000. If you (like I have) have two children in daycare for a combined cost of $17,000 for the year, the most you can receive is a credit for $6,000. If you (like I have) have one child in daycare for a total of $8000 for the year, the most you can receive is a credit of $3000.

It’s probably pretty easy to see, at this point, why Linden thinks improving the existing childcare tax credit would be superior to creating a childcare tax deduction. I’m unsure of why Trump couldn’t see this too. I’m curious whether his policy proposal came from advisors who were apparently not thinking this through or whether the idea was his own—as someone who has always been very rich (though also laden with debt), Trump is probably much more focused on deductions than on credits.

The importance of reigning in childcare costs cannot be overestimated. I cannot tell you how many friends I have who have delayed having children because of the high cost of childcare. When we put our first in daycare, my husband had to find a second source of income so that we could afford it. When we had a second child in daycare, I found a second source of income. Even today, our childbearing decisions involve the cost of childcare—if we had a third child, we’d be out at least $80,000 in childcare costs over five years. This doesn’t take into account before and after school care, as well as summer childcare, once the children are in school. Those costs are a big part of the reason we’re not planning to have a third child.

What is Clinton’s plan for reigning in costs? According to an article from last May:

Hillary Clinton this week unveiled her vision for more quality child care in the United States, a lofty plan that includes raising pay for the industry’s workers. But the boldest idea targets parents, who now face day-care costs that rival college tuition. Clinton wants to cap that expense at 10 percent of a household’s income.

…

Clinton intends to accomplish the 10 percent cap with tax credits and subsidized child care, according to her campaign. Details on how the plan would be funded and executed will come later this year, aides said.

A proposal last year from the Center for American Progress, a policy idea wellspring for Democrats, could offer a clue. Carmel Martin, CAP’s vice president of policy, said she has advised the Clinton campaign on child-care issues.

CAP recommended creating a new child-care tax credit, worth up to $14,000 per child. Under the plan, which would target low- and middle-income families, the tax credit would be advanced to parents on a monthly basis and paid directly to child-care provider. The centers, meanwhile, would qualify to receive federal money only if they complied with the state’s quality standards.

Be still my heart.