You guys know me and money. It makes me so stressed and my instincts are to hang on tight to money and never spend any. I know how to penny pinch and I coupon at the grocery store. Even if we have money in the bank account, I’m never sure if we really have enough and so I make my husband not buy the potato chips he wants. I’m very stingy. My default answer to can we go to the movies is no because I just don’t spend. Ever.

But I just found out about a budgeting software that can actually make me relax and know exactly how much I have to spend on each thing we need or want. I had to share it with you guys even if it’s a little off topic!

Before I found it the problem with my budgeting was I create a budget based on what I think I’ll get paid and we inevitably go over somewhere and I feel panicked. I also have inconsistent income, so it’s really hard to plan.

YNAB (You Need A Budget) is a brilliant program that’s been around for a little while, yet I’d never heard of it before.

It does two things differently that are extremely helpful to me: It clearly connects your spending and your income so it’s easy to compensate if you go over budget in one area, and it transitions you to working from last month’s income, so you’re paying this month’s bills with money you already earned last month and is already in your account.

Even before you get to that point, it’s really easy to see where each paycheck is going and exactly how much you have.

I love it! It’s making me so much more relaxed because I know exactly how much we have in the account for the electric bill, which means that when Brad wants to buy work clothes, I know that we have enough for that!

It’s kind of like the envelope system except you don’t have to do it in piles of cash. You have the “envelopes” on the software and you can watch savings grow in each category. It’s easy to plan for once a year bills too.

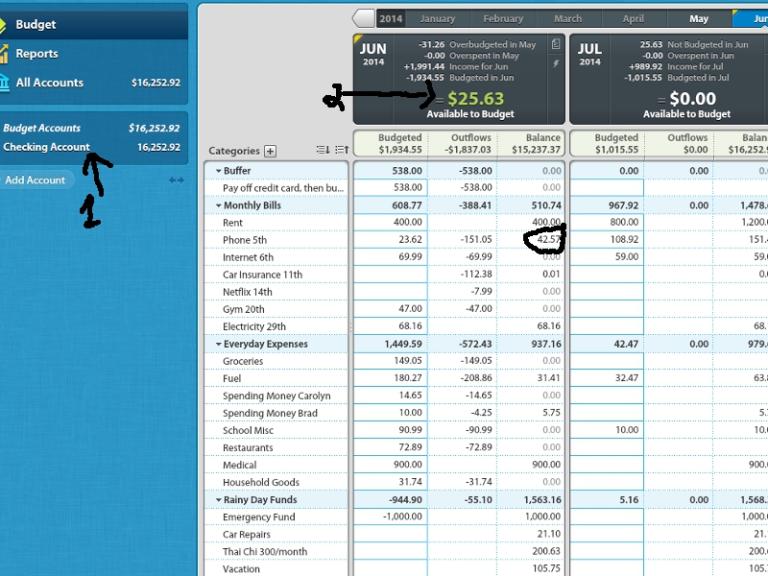

Here’s what it looks like (yes, you can get a little peek at our finances. The large balance amount includes a chunk of money in long term savings towards a house down payment):

So what happens is you put the amount of money you have in your account page (number 1 above) and then it shows up as “available to budget” (number 2 above). You add all that money to your categories (in the first column) until “available to budget” is empty. That way every single penny of your money is accounted for and doing something! Notice how with my categories, I’ve put the day of the month when that bill comes so I know I need money for the beginning of the month bills first and prioritize that. (This picture is for the second half of June, so the rent has already come out as well as some of the other bills and I’ve started putting more money into those accounts for next month).

When you spend money you put that transaction on the account page (number 1 above) and it shows up in the second column. Then you can see in the third column how much you have left. The third column is the “envelope” and whatever money you don’t spend one month carries over to the next (see the circled above).

Eventually you get to a point where you’re putting the money coming in this month into the “available to budget” for next month. That way you’ll be spending money that you already have and you won’t have to speculate or guess. I haven’t reached that point yet!

Their software really helps you save up for what you want too because you can clearly see where your money is going and you can make choices based on what’s most important to you.

There’s a thirty day free trial and I highly recommend giving it a try. Also, watch the getting started video and sign up for the free classes. I’ve taken two of them so far.

Once you’re ready to buy the full version, come back here and buy through my referral link. You’ll get $6 off the one time $60 fee and I’ll get $6 for referring you! I bought it through someone else’s link because I love saving money, even when it’s just $6! (I’m not sure but I think it is still downloadable for people outside the U.S. and those prices should adjust for your currency).